Summary

Summary Highlights

- Unemployment remains below 4% at 3.6%; non-farm employment was up 2.8% month-to-month, with employment rising by 209,000 jobs in June

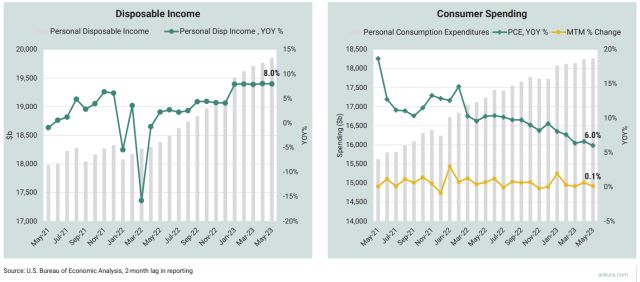

- Personal disposable income rose 8.0% in May 2023; consumer expenditures increased 6% YOY and were flat compared to previous month

- Revolving credit debt continues to rise – up 12.9% over 2022, with total consumer credit increasing 6.2%

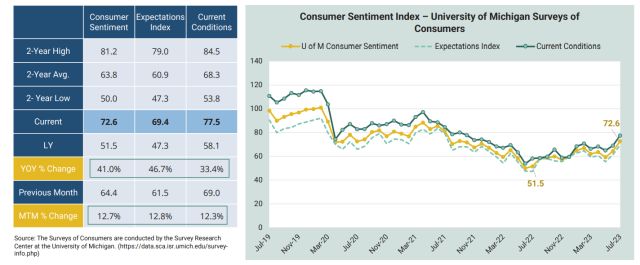

- Consumer Sentiment rose again, with gains for all demographic groups except lower-income consumers; the overall increase was attributed to the continued slowdown in inflation along with stability in labor markets

- June retail sales (excl. motor vehicles and

gas stations) increased 3.9% over 2022 – MTM sales increased

just 0.3%

- Several key segments in sporting goods, building materials, garden, electronics and department stores continued to show YOY declines

- Food Services and Dining increased 8.4% as consumers

continue to spend on experiences

- The Consumer Price Index increased 3.0% YOY,

with Core CPI up 4.8%

- Shelter was a large contributor to the monthly total increase, as was price inflation for food at and away from home

- Retail gas prices remain stable, down 23% YOY at $3.66 /

gallon nationally through early July vs. $4.75 last year

- Air travel continues to increase among U.S.

travelers; year-to-date, TSA checkpoint numbers are up 11%

- The price of air travel declined 8.1% MTM, and was nearly

19% lower than last year

- The price of air travel declined 8.1% MTM, and was nearly

19% lower than last year

- Bank Prime Loan Rate rose slightly to 8.25%; Federal Funds Rate increased to 5.08% through June

- 30-year FRM rate of 6.96%, above last year's rate of 5.51%; 15-year rate now 6.3%

- New home sales increased 20% over last year

– boosted still by low inventory of available homes

- The median U.S. home price in May 2023 declined 7.6% YOY

but increased 3.5% MTM

- The median U.S. home price in May 2023 declined 7.6% YOY

but increased 3.5% MTM

- The Global Supply Chain Pressure Index (GSCPI)

rose to -1.2 from a revised value of -1.56 in May, due to

significant upward contributions from Great Britain and Euro Area

backlogs as well as U.S. and Taiwan delivery times

- General freight trucking cost is down 8.7% over last year and 3.4% lower than previous month

- Retail Inventories increased 7% above

2022; companies continue to face challenges as retail sales

slow

- While we are in the heat of summer with consumers shopping for Back-to-School, we anticipate a fairly robust bump in sales short term, as most of these product categories need to be replaced YOY as either out-used or out-grown

- Longer term we see potential challenges, due in large part to the heavy weight of consumer debt that continues to climb, which could squeeze shoppers to limit spending to essentials like food and health & beauty, pushing off other necessities and durable goods

- A key concern for retailers in the back end of 2023 is the fresh arrivals of inventory planned for the 2nd half and how deep promotions will need to be to sell thru the merchandise

Key Consumer Metrics

Consumer Sentiment Index

Consumer sentiment rose again, with gains for all demographic groups except lower-income consumers; the overall increase was attributed to the continued slowdown in inflation along with stability in labor markets

Consumer Income and Spending

Personal disposable income rose 8.0% in May 2023; consumer expenditures increased 6% YOY and was flat compared to previous month

Personal Savings & Consumer Credit

Personal savings rate rose again in May to 4.6%; revolving credit debt continues to rise – up 12.9% over 2022, with total consumer credit increasing 6.2%

To view the full article, click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.