Please find attached the monitoring report for the period 1 February 2023 to 27 February 2023. This monthly report aims to provide you with a summary analysis of the potential impact of new developments on your business.

Starting on 1 January 2023 we are limiting the monthly report to developments that we have identified as having a potentially medium or high risk impact (with all lower risk developments intentionally omitted). This change is intended to make the report shorter and more easily comprehensible. Should you however wish a full report – including all developments and all risks, and including direct hyperlinks and filtering/data extracting possibilities – please do not hesitate to contact us.

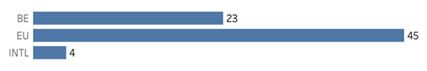

What is the origin of the documents reviewed?

What are the important tendencies?

What are the important documents of the month in review?

|

Date |

What is this about? |

⠀ |

What is the title of the document? |

What do you need to know? |

Risk |

|

|

20/02/2023 |

Digitalisation |

BE |

Besluit van de Vlaamse Regering tot wijziging van artikel 14 van het besluit van de Vlaamse Regering van 17 december 2021 tot vaststelling van de regels voor de toekenning van projectfinanciering voor digibanken |

This decision by the Flemish Government aims to extend the entire digibank project operation by 19 months until the end date of 31 July 2026 to strengthen existing and new initiatives for sustainable service delivery. |

Medium |

|

|

17/02/2023 |

SFDR |

EU |

Commission Delegated Regulation (EU) 2023/363 of 31 October 2022 amending and correcting the regulatory technical standards laid down in Delegated Regulation (EU) 2022/1288 as regards the content and presentation of information in relation to disclosures in pre-contractual documents and periodic reports for financial products investing in environmentally sustainable economic activities |

This Delegated Regulation makes amendments to Delegated Regulation (EU) 2022/1288 in relation to the information to be provided in pre-contractual documents, on websites, and in periodic reports about the exposure of financial products to investments in fossil gas and nuclear energy activities. Such information should also be included in the website disclosures. These amendments were deemed to be necessary to increase transparency and thereby to help financial markets participants and investors to identify environmentally sustainable fossil gas and nuclear related activities invested in by financial products. The provision of more detailed information on investments in those activities is also intended to improve comparability of the information disclosed to investors. |

High |

|

|

14/02/2023 |

Sustainability |

BE |

Wetsvoorstel tot wijziging van het Wetboek van vennootschappen en verenigingen wat de bekendmaking van niet-financiële informatie door bepaalde grote vennootschappen en groepen betreft |

A proposal for a law amending the Belgian Code for Companies and Associations as regards the publication of non-financial information by certain large companies and groups has been introduced in the Belgian Parliament. More specifically, the draft law expands the obligation of certain large companies to include in the statement of non-financial information (included in or accompanying the annual report) also information about their policies and their impact (positive or negative) on human trafficking. Currently, this statement only contains information on how they deal with environmental issues, social and personnel matters, respect for human rights and the fight against corruption and bribery. To reinforce this reporting obligation, the companies in scope will also be required to publish the statement on their websites from now on. |

Medium |

|

|

08/02/2023 |

Consumer protection |

BE |

Wetsontwerp houdende invoeging van boek XIX "Schulden van de consument" in het Wetboek van economisch recht. |

This draft law seeks to insert a new Book XIX "Consumer debts" into the Code of Economic Law. On the one hand, this new Book provides frameworks for certain consequences of the late payment of a consumer's debts towards businesses. On the other hand, it deals with (and updates) the amicable recovery of consumer debts by the creditor or by a third party. Book XIX consists of the following sections. More specifically, the first title of this Book deals with the payment of consumer debts to businesses in general (with, in case of late payment, the principle of the first free reminder and the limitation of damages clauses). Title 2 then deals with the amicable recovery of debts: the Law of 20 December 2002 on the amicable recovery of consumer debts is included here in an adapted version. Book XV "Law Enforcement" is further amended to include the applicable penalties in Book XIX and to define the powers of the Economic Inspection in it. |

Medium |

|

|

06/02/2023 |

Prospectus requirements |

EU |

Q&A on the Prospectus Regulation |

According to ESMA, the purchase of securities by a joint account can be considered as "one investor". This would mean that, in the context of an offer, a purchase for EUR 100,000 from a joint account held by spouses, still complies with the "at least EUR 100,000 per investor" condition. It can be noted that this position of ESMA goes beyond the more prudent view typically taken by at least some Belgian scholars (including our advisory practice by the FinReg Team) to consider that, for the purposes of the private placement exemptions, investments made from a joint account should be considered as investments made by each joint account holder (meaning that, if a joint account of spouses is used for an investment, the private placement exemption requires 2x 100,000 EUR). |

Medium |

|

|

03/02/2023 |

Corporate Governance |

EU |

Directive (EU) 2022/2381 of the European Parliament and of the Council of 23 November 2022 on improving the gender balance among directors of listed companies and related measures |

This Directive is aimed at ensuring the application of the principle of equal opportunities between women and men and achieving a gender-balanced representation among top management positions by establishing a set of procedural requirements concerning the selection of candidates for appointment or election to director positions based on transparency and merit. |

High |

|

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.