Please find attached the monitoring report for the period 1 July 2023 to 30 September 2023. This report aims to provide you with a summary analysis of the potential impact of new developments on your business. We are limiting the monthly report to developments that we have identified as having a potentially medium or high risk impact (with all lower risk developments intentionally omitted). This change is intended to make the report shorter and more easily comprehensible. Should you however wish a full report – including all developments and all risks, and including direct hyperlinks and filtering/data extracting possibilities – please do not hesitate to contact us.

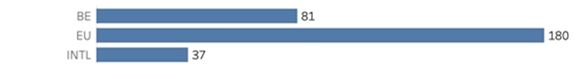

What is the origin of the documents reviewed?

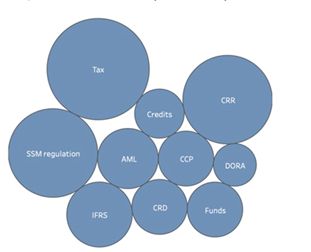

What are the important tendencies?

|

Date |

What is this about? |

⠀ |

What is the title of the document? |

What do you need to know? |

Risk |

|

|

29/09/2023 |

AML |

BE |

Richtsnoeren inzake beleid en controles voor een doeltreffend beheer van ML/TF risicofactoren |

The FSMA has confirmed that it will integrate the EBA guidelines on policies and controls for the effective management of ML/TF risks when providing access to financial services: § The guidelines concern de-risking and explain that a customer can only be refused services on grounds of ML/TF risk factors after various other options have first been considered. § They also set out the steps that institutions must take when considering refusing or terminating a business relationship with a customer on grounds of ML/TF risk factors and clarify the interaction between access to financial services and compliance with the AML/CFT obligations in situations where customers have justifiable reasons for not being able to meet the traditional requirements of customer due diligence. |

High |

|

|

29/09/2023 |

Credits |

EU |

Commission Implementing Regulation (EU) 2023/2083 of 26/09/23 laying down implementing technical standards for the application of Article 16(1) of Directive (EU) 2021/2167 of the European Parliament and of the Council with regard to the templates to be used by credit institutions for the provision to buyers of information on their credit exposures in the banking book |

The European Commission adopted a regulation implementing technical standards specifying the requirements for the information that credit institutions selling non-performing credit agreements shall provide to prospective buyers. The technical standards would, by means of common templates, data fields, definitions, and characteristics, facilitate the sale of non-performing credit agreements on secondary markets and should reduce entry barriers for small credit institutions and smaller investors wishing to conclude transactions in respect of non-performing credit agreements. |

Medium |

|

|

29/09/2023 |

DORA |

EU |

Joint European Supervisory Authorities' Technical Advice to the European Commission's December 2022 Call for Advice on two delegated acts specifying further criteria for critical ICT thirdparty service providers (CTPPs) and determining oversight fees levied on such providers |

In light of the two delegated acts envisaged in the DORA regulation, the European Commission had requested the ESAs' technical advice to further specify the criteria for critical ICT third-party service providers (CTPPs) and determine the fees levied on such providers to which they responded with this report. These are some key takeaways: § The first part of the report suggests various quantitative and qualitative indicators to evaluate critical ICT third-party service providers (CTPPs). § It also outlines the necessary information to use these indicators and proposes minimum relevance thresholds for some quantitative measures. These thresholds are not criticality triggers but minimum requirements for conducting criticality assessments. § Detailed designation procedures and methodologies will be developed later, within six months of the Commission's delegated act adoption, as part of the oversight framework. § The second part of the report focuses on oversight fees for CTPPs, specifying the types of expenditures covered, methods for determining turnover, fee calculation methods, and practical payment considerations. |

Medium |

|

|

29/09/2023 |

MiCa |

EU |

EBA's Technical Advice in response to the European Commission's December 2022 Call for Advice on two delegated acts under MiCAR concerning certain criteria for the classification of ARTs and EMTs as significant and the fees that are to be charged by EBA to issuers of significant ARTs and EMTs |

The EBA has responded to the European Commission's request for advice on two delegated acts related to the Markets in Crypto-assets Regulation (MiCAR). These acts concern the criteria for determining the significance of asset-referenced tokens (ARTs) and electronic money tokens (EMTs), as well as the supervisory fees that the EBA may impose on issuers of significant ARTs and significant EMTs. In its response, the EBA has proposed a set of core and ancillary indicators for each significance criterion, focusing on financial sector interconnectedness and international-scale activities. These indicators cover various aspects of interconnectedness and international transactions while considering data availability. Regarding supervisory fees, the EBA has put forth criteria for distributing costs among issuers as defined in MiCAR. This approach ensures that all costs incurred by the EBA in carrying out its supervisory duties, including establishing supervisory colleges and delegating tasks to national competent authorities, can be recovered from issuers of significant ARTs and significant EMTs, aligning with MiCAR's full cost-recovery approach. |

Mediium |

|

|

29/09/2023 |

SFDR |

EU |

2023 Joint ESAs Report on the extent of voluntary disclosure of principal adverse impacts under SFDR. Annual Report to the Commission under Article 18 of Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector |

The ESAs published their second annual Report on the extent of voluntary disclosure of principal adverse impacts under the Article 18 of the Sustainable Finance Disclosure Regulation (SFDR). § Similar to the approach adopted for 2022 Report, the ESAs launched a survey of National Competent Authorities to assess the current state of entity-level and product-level voluntary principal adverse impact (PAI) disclosures under the SFDR, and have developed a preliminary, indicative and non-exhaustive overview of good practices and areas that need improvement. § The results show an overall improvement compared to the previous year, although there is still significant variation in the extent of compliance with the requirements and in the quality of the disclosures both across financial market participants and jurisdictions. § Disclosures appear easier to find on websites compared to the previous year. § When financial market participants do not consider principal adverse impacts, they should better explain the reasons for not doing so. Even though they are encouraged to do so under the SFDR, financial market participants are generally not disclosing to what extent their investments align with the Paris Agreement. § The Report also includes a set of recommendations for the European Commission to consider ahead of the next comprehensive assessment of the SFDR. |

Medium |

|

|

28/09/2023 |

Deposit protection schemes |

BE |

Wetsontwerp betreffende het garantiefonds voor financiële diensten |

This draft law adapts, modernises and simplifies the legislation on the Guarantee Fund for Financial Services in several areas. The main changes compared to the existing legislation relate mainly to the deposit guarantee scheme where, in line with international recommendations and the urgent requirements of the European Commission, the draft provides for the creation of a segregated fund. |

Medium |

|

|

19/09/2023 |

Payments |

BE |

Wetsvoorstel tot wijziging van het Wetboek van economisch recht en van de wet van 18 september 2017 tot voorkoming van het witwassen van geld en de financiering van terrorisme en tot beperking van het gebruik van contanten, teneinde bankuitsluiting tegen te gaan |

In order to manage bank exclusion, an increasingly common phenomenon affecting NPOs, the self-employed and Belgians who are residing abroad, this draft law provides for three measures. § First, banks will have to make their decision to refuse or cancel a bank account known, in detail and in writing, to the FPS Economy, which will then assess the merits of the reason or reasons invoked. If those reasons are not sufficient according to the FPS Economy, the bank would be obliged to open a bank account or maintain a bank account. § Secondly, a company would be able to claim to enjoy the basic banking service once it can demonstrate that at least two credit institutions have refused to open a bank account. § Third, the aim is to end any discrimination regarding access to banking services on the basis of place of residence. |

Medium |

|

|

08/09/2023 |

AML |

EU |

Guidance for EU operators: Implementing enhanced due diligence to shield against Russia sanctions circumvention |

The EU Commission published a guidance note addressed to European operators to help them identify, assess, and understand the possible risks of Russia sanctions circumvention – and how to avoid it. Here are the key takeaways: § EU operators have an obligation to carry out due diligence when trading with third countries to ensure that their business partners are not circumventing EU sanctions. § The guidance note is intended as a practical guide outlining the successive steps to be applied by EU operators when conducting strategic risk assessments. This should mitigate as much as possible their exposure to sanctions circumvention schemes. § In addition, the document sets out guidelines for implementing enhanced due diligence, including by providing best practices with regard to the assessment of business partners, transactions and goods. § Finally, the guidance provides a list of circumvention red flags. |

High |

|

|

01/09/2023 |

CRD |

BE |

Driemaandelijkse beslissing van de Nationale Bank van België inzake het contracyclische bufferpercentage voor 2023K4: 1,0 % |

The NBB has decided to activate the countercyclical capital buffer (CCyB). This buffer will be created in two steps from 1 April 2024. At the same time, the NBB will reduce the sectoral systemic risk buffer for Belgian mortgage loans. In this way, the NBB will increase the banking sector's overall resilience to unexpected losses. |

Medium |

|

|

01/09/2023 |

Monetary policy |

EU |

Regulation (EU) 2023/1679 of the European Central Bank of 25 August 2023 amending Regulation (EU) 2021/378 on the application of minimum reserve requirements (ECB/2021/1) (ECB/2023/21) |

The ECB Regulation sets out the Governing Council decision to set the remuneration of minimum reserves at 0%. The decision of the Governing Council to reduce the remuneration on minimum reserves ensures the continued effectiveness of monetary policy by preserving the DFR's anchoring function for money market rates and thereby maintains the current degree of control over the monetary policy stance. |

Medium |

|

|

16/08/2023 |

Credits |

BE |

Wet tot wijziging van de artikelen VII.2, VII.3, VII.100, VII.148, VII.150, VII.153 en VII.154 van het Wetboek van economisch recht |

The Law amends certain provisions of the CEL in respect to consumer credits. § Amongst others the Law provides that Articles VII.148, § 1, first paragraph, 2° and 3°, second paragraph, and §§ 2 and 3, VII.149, § 2, and VII.150 to VII.155 apply to credit agreements where none of the consumers involved have their ordinary residence in Belgium on the date of the conclusion of the credit agreement, with a creditor who carries out his professional activity in Belgium, or such activities with any means are aimed at Belgium or several countries, including Belgium, and the agreement falls under those activities. § In the case of an unauthorized debit balance that occurs within the framework of a credit facility, only the expressly agreed and authorized default interest and costs provided for in the CEL may be requested. The default interest is calculated on the amount of the unauthorized debit balance. § In addition, specific rules are included with respect to debit balance within the framework of a payment account, in particular the amount of default interest and costs. |

Medium |

|

|

01/08/2023 |

Sustainability |

EU |

Commission delegated regulation (EU) of 31 July 2023 supplementing Directive 2013/34/EU of the European Parliament and of the Council as regards sustainability reporting standards |

The EU Commission has adopted a proposal for a Delegated Regulation laying down the European Sustainability Reporting Standards (ESRS) for use by all companies subject to the Corporate Sustainability Reporting Directive (CSRD). § This marks another step forward in the transition to a sustainable EU economy. The standards cover the full range of environmental, social, and governance issues, including climate change, biodiversity and human rights. § The standards provide information for investors to understand the sustainability impact of the companies in which they invest. § They also take account of discussions with the International Sustainability Standards Board (ISSB) and the Global Reporting Initiative (GRI) in order to ensure a very high degree of interoperability between EU and global standards and to prevent unnecessary double reporting by companies. |

High |

|

|

01/08/2023 |

EU |

Questions and Answers on the Adoption of European Sustainability Reporting Standards |

In line with the Corporate Sustainability Reporting Directive, the Commission has adopted common standards which will help companies to communicate and manage their sustainability performance more efficiently and therefore to have better access to sustainable finance. The European Sustainability Reporting Standards (ESRS) will be mandatory for use by companies that are obliged by the Accounting Directive to report certain sustainability information. The EU Commission has published a Q&A containing more information on the ESRS. |

High |

||

|

24/07/2023 |

Funds |

EU |

Capital markets union: provisional agreement reached on alternative investment fund managers directive and plain-vanilla EU investment funds |

The Council and the European Parliament reached a provisional agreement on the review of the AIFMD and the UCITS Directive. § Under the provisional agreement, it was decided to enhance the availability of liquidity management tools, with new requirements for managers to provide for the activation of these instruments. § The Parliament and the Council also reached a provisional agreement on an EU framework for funds originating loans. § Negotiators also agreed on enhanced rules for delegation by investment managers to third parties. § Other key components of the agreement include enhanced data sharing and cooperation between authorities, and new measures to identify undue costs that could be charged to funds, and hence their investors, as well as on preventing possible misleading names to better protect investors. |

Medium |

|

|

17/07/2023 |

Competition |

BE |

Wet tot regeling van het taalgebruik met betrekking tot het screeningsmechanisme ingesteld bij het samenwerkingsakkoord van 30 november 2022 tot het invoeren van een mechanisme voor de screening van buitenlandse directe investeringen |

The Law regulates the use of language applicable to the screening mechanism established by the cooperation agreement of 30 November 2022 establishing a mechanism for screening foreign direct investments. Under penalty of nullity, the notification of the cooperation agreement shall be made in Dutch or in French. The Law provides for detailed rules in this respect. |

Medium |

|

|

17/07/2023 |

Insurance |

BE |

Koninklijk besluit tot wijziging van het koninklijk besluit van 26 mei 2019 tot vaststelling van een referentierooster met betrekking tot het recht om vergeten te worden in het kader van bepaalde persoonsverzekeringen bedoeld in artikel 61/3 van de wet van 4 april 2014 betreffende de verzekeringen |

In the Royal Decree of 26 May 2019 establishing a reference grid regarding the right to be forgotten in the context of certain personal insurance policies referred to in Article 61/3 of the Law of April 4, 2014 on insurance, the Annex 1 is replaced by the Annex attached to the Royal Decree. |

Medium |

|

|

14/07/2023 |

Tax |

BE |

Voorafgaande beslissing nr. 2023.0137 d.d. 23.05.2023 |

In this decision, the Ruling Commission ruled, among other things, that: § the investors in the Fund, in the Feeder and in CarryCo who are subject to corporate income tax can enjoy the deduction for definitively taxed income (DBI deduction), regardless of the size or duration of their participation in the Fund, the Feeder or CarryCo; § the Fund can enjoy DBI deduction for the income referred to in Article 202 Income Tax Code that it receives from the Taxed Portfolio Companies, regardless of the size or duration of its participation in these companies; § the Fund may benefit from the exemption of capital gains on the shares of Taxed Portfolio Companies, regardless of the size or duration of its participation in these companies; § the investors in the Feeder subject to corporate income tax may benefit from FDI deduction, pursuant to Articles 203, §2(3) jo. 192, §3, 2° Income Tax Code; § the receipt of dividends from the Feeder and the realization of capital gains on the shares of the Feeder by a foreign company-investor resident in the EEA does not have a negative impact on the determination of the taxable basis of this foreign company. The decision further deals with cases where withholding tax is completely waived and with the tax treatment of carried interest. |

Medium |

|

|

12/07/2023 |

MiFID II |

EU |

Review of the technical standards under Article 34 of MiFID II – Final report |

This Final Report contains draft technical standards (i) specifying the information to be notified by, inter alia, investment firms wishing to provide cross-border services without the establishment of a branch and (ii) establishing standard forms, templates and procedures for the transmission of information in this respect. |

Medium |

|

|

11/07/2023 |

MiFID II |

EU |

Supervisory briefing on understanding the definition of advice under MiFID II |

ESMA has published an update to the content of the CESR document "Understanding the definition of advice under MiFID", in particular in light of the evolution of business models and technology (for example, increased use of social medial and mobile apps by firms). ESMA has also deemed useful to transform the Q&As in a supervisory briefing for NCAs to use in their supervisory activities. This document is also intended to continue providing guidance to firms in this important area. The content of the above-mentioned CESR document remains largely unchanged but is supplemented or further specified on certain aspects by this briefing. |

High |

|

|

11/07/2023 |

Sustainability |

EU |

Public Statement |

ESMA has issued a Public Statement on the sustainability disclosure expected to be included in prospectuses. § The statement sets out ESMA's expectations on how the specific disclosure requirements of the Prospectus Regulation in relation to sustainability-related matters in equity and non-equity prospectuses should be satisfied considering the ESG-transition. § ESMA emphasises the importance of an issuer's non-financial reporting under the NFRD and the future sustainability reporting under the CSRD, especially because such disclosure may be material under the Prospectus Regulation and included in an issuer's prospectus. § In addition, regarding non-equity securities advertised as taking into account a specific ESG component or pursuing ESG objectives, the statement clarifies the disclosure required in relation to 'use of proceeds' bonds and 'sustainability-linked' bonds. § The Public Statement also notes that sustainability-related disclosure is sometimes included in advertisements but not in prospectuses themselves and highlights that this disclosure should be included in prospectuses if it is material under the Prospectus Regulation. |

High |

|

|

07/07/2023 |

Basic banking service |

BE |

Wetsvoorstel tot instelling van een volksspaarrekening |

This draft law seeks to establish a people's savings account that guarantees a relatively high interest rate for savings of up to 22,000 euros per adult. The people's savings account would be intended for small savers and have the same terms and conditions as the basic banking service. Every financial institution in Belgium would be required to offer this savings account offer it to its customers. |

Medium |

|

|

07/07/2023 |

Consumer protection |

BE |

Wetsvoorstel tot wijziging van het Wetboek van economisch recht, teneinde direct marketing nader te reguleren en strenger te bestraffen |

This draft law proposes to allow direct marketing practices only from Monday to Friday, between 10 a.m. and 1 p.m., and between 2 p.m. and 7 p.m. The intent is to prohibit them on Saturdays, Sundays and holidays. In addition, consumers will be allowed to be contacted by phone for marketing purposes by the same professional or by people acting on his behalf a maximum of four times per month (30 calendar days). This bill also seeks to tighten penalties in case of violations. |

High |

|

|

07/07/2023 |

Insolvency |

BE |

Wet tot omzetting van Richtlijn (EU) 2019/1023 betreffende preventieve herstructureringsstelsels, betreffende kwijtschelding van schuld en beroepsverboden, en betreffende maatregelen ter verhoging van de efficiëntie van procedures inzake herstructurering, insolventie en kwijtschelding van schuld, en tot wijziging van Richtlijn (EU) 2017/1132 en houdende diverse bepalingen inzake insolvabiliteit |

This draft law aims to transpose European Directive (EU) 2019/1023 into Belgian insolvency law. In addition, the Book XX of the Code of Economic Law will also be adapted to the requirements set by the Court of Justice of the European Union in the Plessers rulings of 16 May 2019 and Heiploeg of 28 April 2022 that impose certain changes to the reorganisation by transfer of companies. Furthermore, bankruptcy laws are being amended and it will become easier to liquidate companies in certain circumstances. Post-bankruptcy debt discharge will be relaxed and brought in line with Constitutional Court case law. The second-chance policy, which encourages entrepreneurship and enables a fresh start, is central to this. Finally, some purely formal amendments are also made to Book XX. |

High |

|

|

03/07/2023 |

Capital buffer |

BE |

Driemaandelijkse beslissing van de Nationale Bank van

België inzake het contracyclische |

In 2022 and the first half of 2023, against a backdrop of high uncertainty caused by a potential energy crisis, the downturn in the credit and real estate cycles, and turbulence in the US and Swiss banking sectors, the NBB decided to maintain the countercyclical capital buffer at 0% to ensure that Belgian banks could use their ample free capital resources with full flexibility to proactively increase their loan loss provisions and support the real economy. This uncertainty has since largely dissipated. What's more, the slowdown in Belgium's credit and real estate cycles has been relatively orderly so far, not least due to the moderate extension (welcomed by the NBB) of maturities for new mortgages, which has helped to offset the negative impact of rising interest rates on affordability. |

Medium |

|

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.