INTRODUCTION

A U.S. L.L.C. is usually treated as a partnership for U.S. Federal income tax purposes.1

Generally, a partnership is treated as an aggregation of its partners, meaning a flow-through treatment applies as to the partnership's income. However, for certain purposes, a partnership is treated as a separate entity from its partners, treated as if it were a corporation.

As a result of this inconsistency, various complicated and somewhat counterintuitive tax consequences may arise from the acquisition or the disposition of interests in a U.S. L.L.C. by a foreign member.

As a result of this inconsistency, various complicated and somewhat counterintuitive tax consequences may arise from the acquisition or the disposition of interests in a U.S. L.L.C. by a foreign member.

- The first relates to withholding tax exposure when a foreign person sells an interest in a U.S. partnership or L.L.C. and encounters Code §1446(f) withholding tax. For various reasons, the withholding tax may have no connection to the ultimate tax on the gain.

- The second involves U.S. tax accounting for partnerships that take in additional members after operations have been conducted for several years. The new members may invest directly in the partnership or they may acquire a partnership interest by purchase from an existing member.

The second involves U.S. tax accounting for partnerships that take in additional members after operations have been conducted for several years. The new members may invest directly in the partnership or they may acquire a partnership interest by purchase from an existing member.

In the balance of this article, we will assume that the form of the entity is a U.S. L.L.C. which defaults to a partnership for U.S. income tax purposes.

WITHHOLDING TAX ON A SALE OF AN L.L.C. INTEREST BY A FOREIGN MEMBER

It is not unusual for a non-U.S. investor to own units in a U.S. L.L.C. For purposes of the discussion in this section, assume two foreign corporations, A and B, and that each is owned by individuals who are neither tax resident the U.S. nor citizens of the U.S. ("N.R.N.C.").

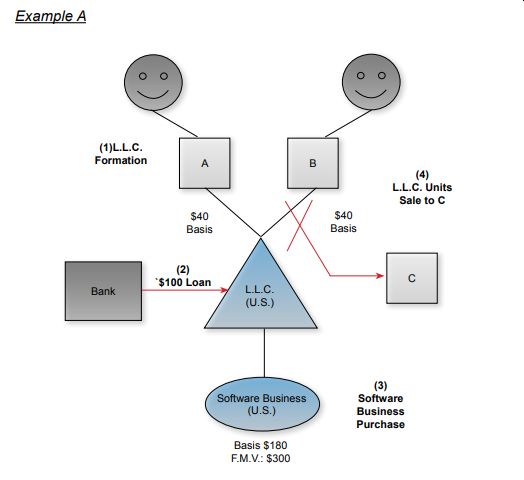

A and B form a U.S. L.L.C. ("L.L.C."), with each contributing $40 in return for a 50% interest in capital, profits and losses. See item (1) in Example A below. The L.L.C. then borrows $100 from a bank under terms that provide no recourse to the members in the event of a default and are not guaranteed by any of the members.2 See item (2) in Example A below. Pursuant to the contribution and the loan, the L.L.C. holds cash in the amount of $180.

The L.L.C. uses its cash to purchase a U.S. software engineering business for $180. See item (3) in the Example A below. When the fair market value ("F.M.V.") of the software business reaches $300, B sells its units in the L.L.C. to U.S. investor "C" for $150. See item (4) in the Example A below. The L.L.C. has no other assets, the L.L.C. has no losses, all profits are distributed in full to A and B, and 0% Branch Profits Tax is imposed by reason of an applicable income tax treaty.

B's Basis in the Units of the L.L.C.

Even though B invested only $40 in the L.L.C., B's basis in the units is $90. For U.S. income tax purposes, B's basis is comprised of the investment of $40 made at the time of the formation of the L.L.C. plus B's share of the L.L.C.'s liability arising from the $100 bank loan ($100 x 50% = $50) loan.3

Exposure to U.S. Income Tax on Gain From the Sale of a Partnership Interest

The U.S. tax system generally provides that foreign corporations and N.R.N.C. individuals generally are subject to tax only on income and certain gains derived from sources within the U.S.4

The key questions are (i) whether gain arising from B's sale of L.L.C.'s units is U.S. source income, and if so, (ii) whether the gain should be treated as effectively connected income ("E.C.I."). E.C.I. is the domestic law equivalent of "business profits" when applying an income tax treaty.

The general source of income rules under Code §865(a) provides that income and gain arising from the sale of personal property by a foreign corporation or N.R.N.C. individual will be treated as foreign-source income. Under the general rule, the sale of L.L.C's units by B, an N.R.N.C. individual, should give rise to foreign source income.5 This was the holding in Grecian Magnesite v. Commr. 6 The holding in the case was legislatively reversed on a go-forward basis by the Tax Cuts and Jobs Act, which enacted Code §864(c)(8).7

Code 864(c)(8) provides that all or a portion of the gain recognized in connection with a sale of an interest in an L.L.C. is treated E.C.I. when the L.L.C. is engaged in a trade or business in the U.S. The portion of the gain treated as E.C.I. is equal to the selling member's distributive share of the amount of gain that would have been E.C.I. had the L.L.C. sold all of its assets at fair market value as of the date of the sale or exchange of the interest in the L.L.C.8

To view the full article click here

Footnotes

1. Nonetheless, each may elect to be as an entity for U.S. income tax purposes that is separate from its owners.

2. If the L.L.C. is debt-financed, the allocation of portions of the debt to the members of the L.L.C. depends on the particular facts related to the partnership and the loan. The allocation of debt amongst the members of an L.L.C. or partnership is beyond the scope of this article.

3. Code §§ 722 and 752(a).

4. Code §§871, 872, 881, 882. As an exception, limited categories of foreign source income can be treated as income that is effectively connected with the conduct of trade or business in the U.S. Foreign source income may be categorized as E.C.I. if a business is conducted in the U.S. through a fixed place of business and the income arises from one of three categories of activity, including (i) rents or royalties for the use of intangible property, (ii) dividends, interest, guarantee fees derived in the active conduct of a banking or financing business, and (iii) sales of inventory where a U.S. office materially participates in arranging the sale. See Code §864(c)(4).

5. Treating the units of the L.L.C as a separate asset reflects the theoretical approach that an L.L.C. is an entity separate from its partners. It can sign contracts, own property, sue, and be sued, doing each in its name.

6. Grecian Magnesite Mining v. Commr., 149 T.C. 63, (2017), aff'd, 926 F.3d 819 (D.C. Cir. 2019).

7. Pub. L. No. 115-97, §13501. See also Rev. Rul. 91-32.

8. General guidance appears in Treas. Reg. §1.864(c)(8)-1.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.