"Those who do not remember history are doomed to repeat it."

We've all heard this cliché before—and tech companies now more than ever must heed its wisdom to learn from their mistakes.

Over the past decade, the tech industry adopted a dangerous mindset due to favorable conditions like high total addressable markets (TAMs) and easy access to capital funding (e.g., low-interest-rate-fueled VC investment and debt financing). Profitability, they believed, would come as a byproduct of topline growth and economies of scale. 'Growth at all costs' served as a de facto slogan for major industry players that raced to snap up top talent at the expense of competitors.

For those old enough to remember the dotcom boom of the late 1990s, this feels awfully familiar. While the conditions and models were different and the damage far worse back then, the behavior was essentially the same. The pendulum swung too far in one direction.

Just as before, the tech landscape is again transforming, and the pendulum is swinging back. Cash has become more expensive as the Federal Reserve (Fed) raises interest rates to combat high inflation. Tech companies that once enjoyed massive growth rates now find themselves struggling to turn a profit. Faced with these unfavorable conditions, companies must confront a harsh reality: their growth patterns might not be sustainable.

CURRENT MARKET TRENDS ARE FORCING TECH COMPANIES TO REEVALUATE THEIR STRATEGIES

Shifting markets and investor expectations are now forcing tech companies to focus on profitability while still delivering on growth. It's a completely different model. The strategies that defined past success and drove rapid growth will be ill-suited to meet this profitability challenge. Imagine a world-class sprinter suddenly being forced to run a marathon. For many companies, it may feel like a daunting and completely different paradigm. But you better not stop running.

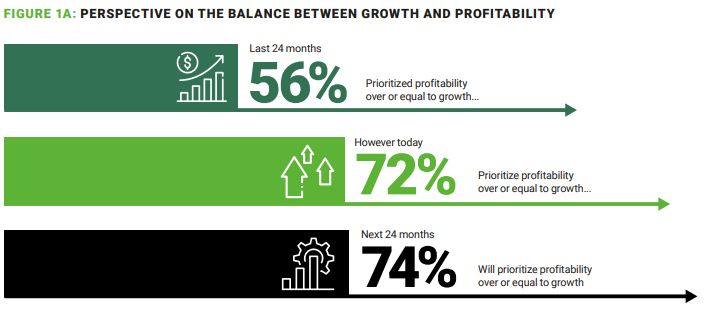

AlixPartners surveyed more than 140 tech executives to study how industry leaders are confronting the profitability versus growth challenge. Not surprisingly, our research shows a pronounced shift in focus toward profitability. 72% of respondents prioritize profitability over or equal to growth today—up from 56% over the last 24 months. Further, 74% of tech leaders say this will be the case over the next 24 months (see Figure 1A).

Please rate the impact of growth versus profitability on the business. N=146

Please rate the impact of growth versus profitability on

the business over the past 24 months

Please rate the expected impact of growth versus

profitability on the business in 2024. N=146

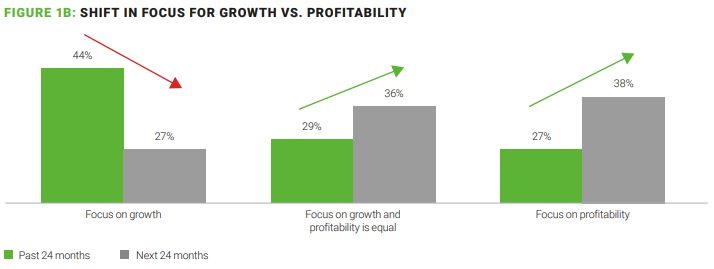

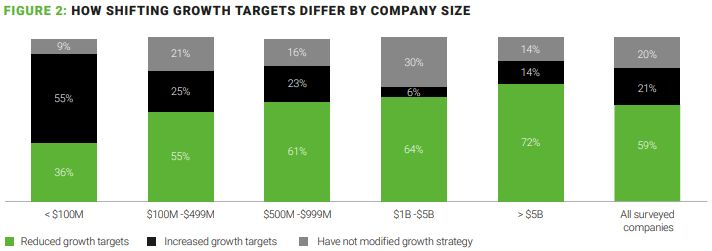

While a combined measure of growth and profitability is not new to the tech industry, there has been an evident shift in mindset regarding the tradeoffs between growth and profit. Nearly two in five respondents (38%) said their strategy over the next 24 months focuses on profitability gains over growth (see Figure 1B). Perhaps even more significant, 88% of respondents expect to accelerate profitability improvements and cost-management strategies due to the shifting market. The majority of companies (especially those earning more than $1 billion in revenue) are reducing growth targets for the same reason (see Figure 2).

Have you adjusted your growth strategy and targets as a result of the shifting market conditions?

Meanwhile, year-over-year growth consensus for public tech companies has fallen by more than 2x since 2021, from an average of 27% then to just 13% and 12% anticipated for 2023 and 2024, respectively—the lowest growth targets since 2015. At the same time, median EBITDA dollar expectations have increased by 13% for 2023 and 14% for 2024, according to company data.1

WHY DID THE PENDULUM SWING?

For those in this space, the above data is probably not a surprise—it's already being felt and seen across the industry. Tech players must look deeper into why this shift is underway and more importantly, what they can do to thrive in the face of this challenge.

These factors combined into a perfect storm that left a trail of squeezed profits and missed growth targets in its wake. As the market reacted to the changing conditions, equity valuations began to plummet. All of a sudden, tech companies were forced to scramble to assess the damage to their profits through closer scrutiny of operating costs.

Unfortunately, we fear this storm isn't yet over. The macro environment hasn't turned and likely won't for some time. Interest rates continue to pressure valuations and limit access to capital. Bank failures like SVB and First Republic haven't helped and, despite inflation softening from recent 40-year highs, it remains well above the Fed's 2% long-term goal. While it's unclear whether the U.S. or global economy will dip into a recession, this uncertainty will have prolonged impacts on both consumer and enterprise spending on technology.

THE 'COST' OF MONEY

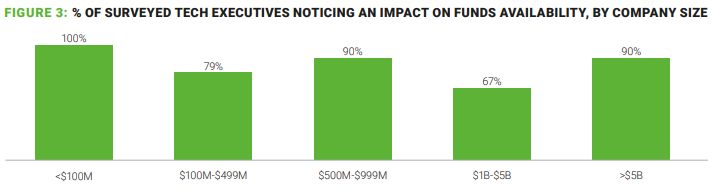

Our study found 82% of tech companies have noticed a change in credit and financing availability due to higher interest rates and unfavorable market conditions (see Figure 3).

Interest rate hikes have driven up the cost of debt and pressured cash reserves. The former has made it difficult to raise additional funding. On average, public tech companies have taken on the burden of a 14% increase in cash interest paid when comparing the last 12 months (as of Q2 2023) to the fiscal year-end 2022 (or an 8% CAGR versus fiscal 2021).1

As cash is more expensive and difficult to access, tech companies of all sizes must fund most of their operations and growth using their own reserves. To do so, this requires the ability to generate positive cash flows. Maintaining positive free cash flow (FCF) has become a critical factor for all industry players. However, for small- and mid-cap tech companies with less scalable operations, this has been extremely difficult.

Elevated funding costs have emphasized the need to simplify business processes and optimize operating models. This not only helps turn a profit and improve cash positions, but also de-leverages the balance sheet. While it might be a bit of an oversimplification (this topic could be worthy of an entirely separate article), the point remains that companies will be forced to forge ahead using the money already in their coffers.

Have you noticed a change on credit and financing availability due to higher interest rates and/or market conditions? N=146

ECONOMIC UNCERTAINTY STIFLES DEMAND

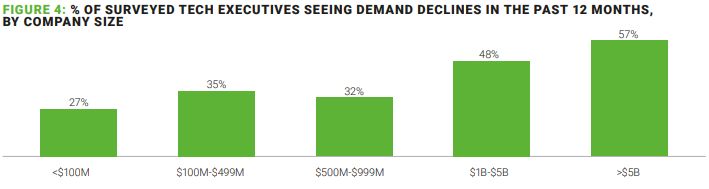

This murky economic future has also caused a pullback in demand from pandemic-era highs, as the pinch from inflation and the rising cost of capital forces companies to reduce IT and enterprise spending.

Growth for B2B and B2C tech companies during 2020 and 2021 was fueled by accelerating digital trends that shifted consumer and enterprise behavior. Pandemic-era enterprise demand for tech reached new heights as companies sped up digital transformation and scrambled to equip themselves with the necessary hardware and software to support remote and hybrid work.

However, this wave of digital transformation that supported surging demand and rapid growth for tech was soon disrupted by rising inflation.

Today, tech companies grapple with a new reality. Enterprise customers are consolidating IT and cloud costs through increased scrutiny on consumption. They are integrating platforms and eliminating excess license spending where they see an opportunity for improved efficiency. As a direct result, many hyperscalers and B2B SaaS players have reported lower demand during recent earnings calls. Further, tech companies have cited a pullback in demand for some areas of hardware products (e.g. PCs, wearables, servers, and peripherals) and robotics due to worsening economic conditions.

In the past 12 months, have you experienced changes in market conditions and/or demand volumes? N=146

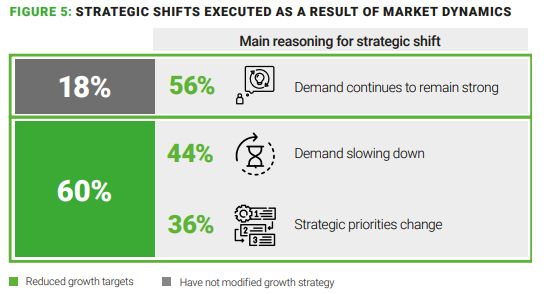

Nearly three in five (57%) senior executives from tech companies with revenues of more than $5 billion reported a drop in demand in the past 12 months (see Figure 4). Our study found that 60% of executives from all companies have modified their growth targets or shifted strategy, and 44% of that segment are doing so primarily because demand for their products and services has slowed down (see Figure 5).

Have you adjusted your growth strategy and targets as a

result of the shifting market conditions?

What is the primary reason you have taken current

actions to change your strategy?

What is the primary reason you have not taken current

actions to change your strategy?

CORRECTING COURSE FROM PANDEMIC-ERA OVERHIRING

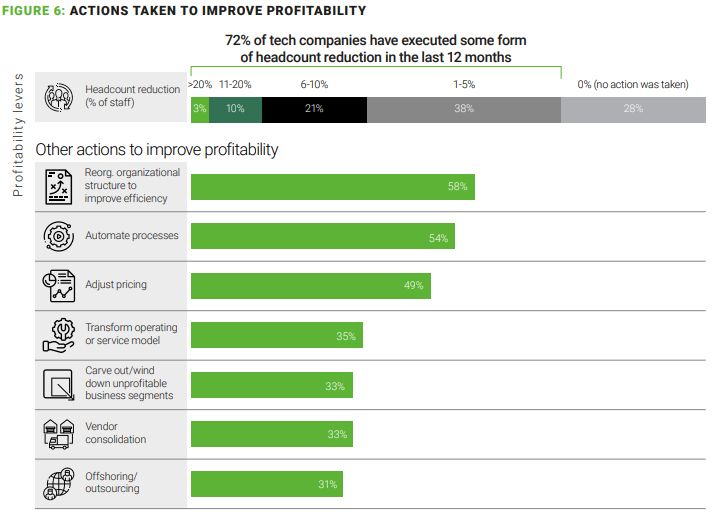

As is customary during most slowdowns, headcount reductions have been the main cost-saving lever tech companies have pulled. This is unfortunate, but also predictable as it tends to be the easiest to execute; rearranging elements of operational strategy can be complex, time-consuming, and slow to pay off. Since the beginning of 2022, over 350,000 jobs (and counting) have been lost in the tech sector, with more than 50% of those layoffs occurring thus far in 2023.2

Our study found that 72% of tech companies have executed some form of headcount reduction in the last 12 months, with more than one-third (34%) cutting more than 5% of their staff (see Figure 6).

Have you undergone a headcount reduction in the past 12

months? If so, what was the scale of the reduction?

Are there any other actions you have taken or expect to take to

improve profitability? N=146

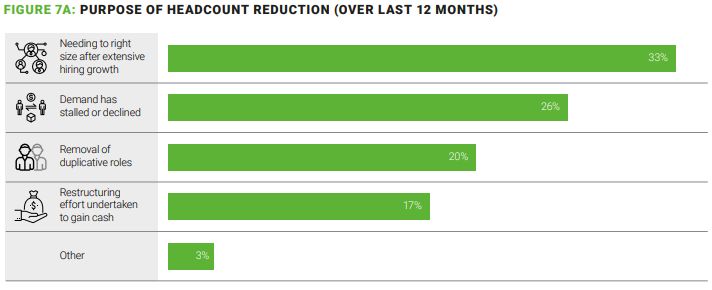

Large tech players that hired at high rates during the pandemic to support growth and demand—Meta and Amazon are two notable examples—are now forced to course correct to rebalance operating profits. On average, public tech companies increased headcount growth at a 17%1 CAGR from 2019 to 2021. 60% of study respondents who implemented layoffs said the action was either to right-size after extensive hiring or as a result of stalled demand (see Figure 7A).

What was the primary reason you had to lay off xx%? N=99

How do you expect your headcount to change in the next 12 months? N=146

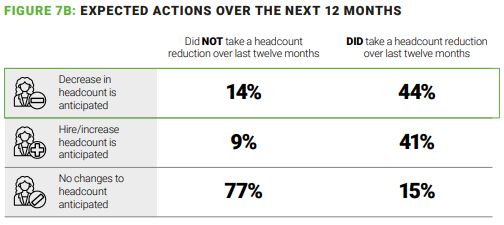

Despite these staggering numbers, our survey found that these efforts alone are not enough to right-size the scale of many operations. Nearly half (44%) of those who have already reduced their workforce are planning future reductions over the next 12 months (see Figure 7B).

But what if that still isn't enough? Headcount reductions may provide a near-term uptick in profitability, yet companies can only cut so much. They must simultaneously look to improve their operating models to provide sustainable, meaningful profitability boosts.

FIXING THE PROFITABILITY ENGINE

It feels no tech industry article today can be complete without a mention of generative AI. Some companies are now looking at gen AI solutions as a sort of 'silver bullet' to unlock profit potential. While we agree it should be part of a sound operational strategy, we believe it's only one piece of the puzzle.

To achieve meaningful, sustainable cost reduction without sacrificing future growth potential, tech companies will need to embrace transformational operational change. But at the same time, they must be careful not to harm their core profitable businesses or hamstring innovation capabilities that serve to future-proof their portfolio. We believe developing a portfolio of initiatives that can drive more than 20 to 30% improvement in the cost base is quite achievable, even if it may initially sound intimidating.

Building focused and structured collaboration among all key facets of your business is critical during leaner times. Orchestrating sales, marketing, customer success, and product functions provides visibility into marketing efficacy, pricing effectiveness, and customer retention challenges. Formalizing this approach helps keep all relevant teams and employees abreast of success metrics and opportunities for improvement. This enables you to keep the engine running despite having to do so more efficiently.

Let's look at a few ways to capture the improvement potential and strike a growth-profitability balance, addressing current headwinds while also preparing for what comes next:

Optimize your product management and R&D strategy

For many of our clients, product rationalization becomes a key component to driving adoption and continued consumption. But strategic shifts like this are impossible if your 'agile approach' isn't truly agile. Pivots in product strategy as well as development organizations require efficient product management processes. Is your product strategy and planning process effective enough? Are product roadmaps detailed, connecting customers and development teams? Are your development teams efficient with planned backlogs with measurable sprint velocity?

- We recently worked with a leading global provider of employment background screening and workforce solutions to optimize the product management and software development operating model. Analysis identified significant organization and process inefficiencies impacting product time to market, quality, and cost. Through a series of leadership interviews, as well as process and data analysis, root causes were determined to stem from a lack of strategic product roadmaps, ineffective development processes, and a high degree of development dependency management. By implementing standard agile processes, improved tooling, and streamlining organization structure and roles, the revised operating model achieved a 47% reduction in coordination overhead and a 27% increase in development capacity.

Turn AI and automation hype into real return on investment

AI-enabled chatbots in customer care and support, especially for lower-level cases, free resources to deal with more profitable customers and more complex problems. They can also automate customer service in any language, onboard new employees, identify knowledge gaps in current workforces, and suggest resources to fill those gaps effectively. Robotic process automation (RPA) is a related form of process transformation that allows companies to streamline routine, high-volume transactional activities like accounts payable, accounts receivable, and invoicing. Leveraging large language models (LLMs) can boost performance and adaptability.

- We are helping one of the largest data and information services companies worldwide as it integrates automation and AI across its strategy and operations. We developed a prioritized roadmap to integrate these capabilities while ensuring the client understood the productivity enhancements each change would bring. At the same time, we're working to redefine the client's corporate and go-to-market (GTM) strategy based on new products, new customer segments, and new customer engagement models that leverage both analytical and generative AI. These strategies are delivering cost savings in the 20 to 25% range across the organization, while enabling the client to reach a much larger market, improve sales productivity, and increase its enterprise value.

Emphasize return on invested capital (ROIC)

Return to basics. Make sure you're investing in the right activities and entrusting the right people in the right places with execution. Emphasizing ROIC means prioritizing the efficiency and effectiveness of capital allocation with an eye toward generating outsized returns. Scarce investment dollars should go to the services, products, and projects that have the highest potential for long-term growth, provide outsized economic profit, engender the most durable competitive advantage, and align best with your organization's strategic direction.

- At a global fintech company, we identified more than 10% savings on impacted functional headcount through underutilized offshore capabilities across several areas— including R&D, infrastructure operations, and services.

- On a related point around inefficient spend, you must pay close attention to cloud costs, which can quickly increase exponentially. We recently worked with a leading cloud data platform solutions client to lower cloud spend by nearly 12% by reducing demand and introducing a rigorous governance process.

Carefully measure hiring initiatives

Leveraging tools such as AlixPartners' Radial Organization Analyzer allows companies to take a more holistic view of their labor expenses and enables a rigorous, methodical, and sustainable approach to hiring for both new and backfill positions.

- Leveraging the Radial tool and a controlled hiring approach allowed a data platform client to avoid hiring more than $30 million of run-rate labor and ensured that only roles that met business-critical needs were filled.

Enhance your GTM effectiveness

Focus on select product and market opportunities that you best believe can drive short- and long-term profitability and quickly recoup GTM costs. Properly allocate resources— sales reps, business development, customer success, sales engineers, specialists, and more—by customer tier to make sure you're serving each level of customer appropriately.

- We helped a multibillion-dollar global enterprise storage

provider build an integrated approach to a realigned GTM strategy,

a new sales renewal and churn reduction process, and an optimized

product roadmap which combined to yield a $600 million impact,

improving EBITDA by 22% year-over-year. To optimize their GTM

model, we implemented several steps including:

- Simplifying field seller roles from several different hybrid positions to two seller roles focused on hunting and farming.

- Optimizing the account coverage model, aligning field sellers to high-value customer segments, and deploying inside sales teams to hunt, farm, and service low-value accounts.

- Reducing field sales admin activities by streamlining sales enablement processes and strengthening operational functions.

- Aligning field sellers' incentives to drive growth of high-value accounts.

BE READY—THE PENDULUM ALWAYS SWINGS BACK WITH TIME

Thankfully we're old enough to remember history. While the fallout from the dotcom era was challenging, let's not forget what followed. The subsequent years saw advancements in technology and innovation that brought a sustained period of evolutionary growth, modernizing just about every element of how businesses transact.

The pendulum swung back, as it will again. While we believe the current focus on profitability is critical, growth efforts should not be completely abandoned. Tech companies should prepare to not only weather the storm but emerge better equipped to efficiently capitalize on the inevitable swing back.

We're still bullish on the future and you should be too.

Footnotes

1. Source: Company data, CapitalIQ, AlixPartners analysis (based on analysis of 101 public tech companies >$500M in revenue)

2. Source: Layoffs.fyi, AlixPartners analysis

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.