INTRODUCTION

At a certain point in the life of a corporation that operates more than one business, management may wish to separate the different businesses into two or more separate corporate entities. Reasons may vary, but they often include resolving operating conflicts, creating a locally based more-effective style of management, improving borrowing capacity, complying with regulatory restrictions, and reducing exposure to liability

The corporate division can take many forms.1 In most cases, demergers are structured based on the requirements of the corporate law in the country of the demerged corporation. Typically, a demerger that follows the corporate law provisions would also be exempt from tax in the relevant country.

If any of the shareholders is a U.S. individual or corporation, U.S. Federal tax considerations should be taken into account to prevent unexpected U.S. tax for a U.S. investor.

DEMERGERS UNDER U.S. FEDERAL TAX LAW - OVERVIEW

Under the Code,2 a corporation must recognize gain on the disposition of appreciated property,3 whether such disposition is made by way of a sale,4 a distribution5 or otherwise, including a constructive disposition.

However, if certain conditions are met under Code §355,6 a corporation may distribute shares of stock in a subsidiary corporation to shareholders as part of a de without having to recognize gain or loss. Where applicable, Code §355 eliminates U.S. tax for both the corporation and its shareholders.7

Code §355 may apply regardless of the way in which the demerger is structured, provided all its requirements are met. Typically, a demerger would be structured either as a spin-off, a split-off or a split-up.

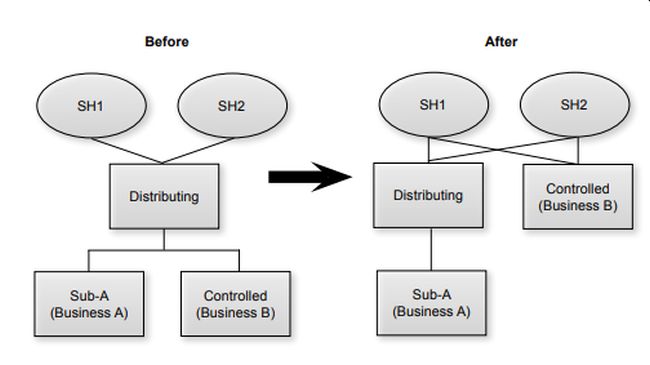

A spin-off is the generic label of a transaction that results in all shareholders of the demerging corporation (will be referred to as "Distributing") receiving stock in a demerged corporation (will be referred to as "Controlled")8

A spin-off can be structured as a distribution of Controlled by Distributing to Distributing's shareholders. However, even if structured differently, in substance, the shareholders receive a distribution in kind from Distributing, comprised of the stock of Controlled. Based on the principles of the "substance over form" doctrine, a spinoff transaction is typically characterized under U.S. Federal tax law as a distribution of the Controlled stock from Distributing to Distributing's shareholders.

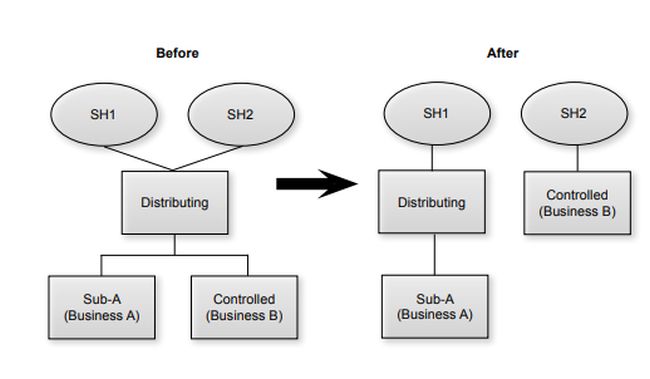

A split-off is the generic label for a transaction that results in some of the shareholders relinquishing their Distributing stock and receiving controlled stock, while the other shareholders keep their original Distributing shares. The ownership percentage in Distributing increases for the remaining shareholders.

In the split-off scenario, Distributing's exchanges Controlled stock in return for its own stock from some of its Shareholders. This type of transaction is effectively a redemption of the Distributing shares by shareholder 2.9

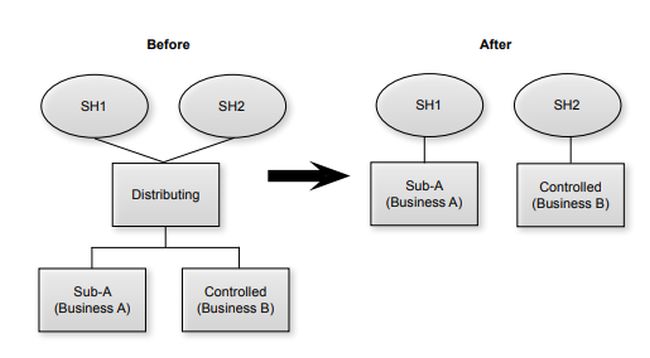

A split-up is the generic label of a transaction that results in Distributing being split into two new corporations and going out of existence.

A split-up scenario is economically equivalent to the liquidation of Distributing.

TAX CONSEQUENCES OF A BAD DEMERGER – THE STRUCTURE MATTERS

As mentioned above, whether the demerger is structured as a spin-off, a split-off or a split-up, no gain is expected to be recognized by the demerged corporation or its shareholders if the requirements of Code §355 are met.

However, to the extent that the requirements of Code §355 are not met (referred to as a "bad" transaction), the characterization of the transaction either as (1) a distribution of property in the case of a spin-off, or (2) a redemption of stock in the case of a split-off, or (3) a liquidation of the demerged corporation in the case of a split-up makes a great difference, because each type of transaction entails different tax implications.

In a bad spin-off, which is usually characterized as a distribution, dividend income will generally be recognized by the shareholders receiving the distribution, to the extent of the distributing corporation's earnings and profits.10 Any distribution amount exceeding the earnings and profits, if any, will be treated as a return of basis to the extent of the adjusted basis in the corporation's shares,11 with any remaining amount treated as a capital gain.12 In addition, the distributing corporation will be required to recognize gain on the distribution of appreciated property as if such property were sold.13 The amount of gain will be equal to the excess of the fair market value of the appreciated property over its adjusted basis.14 This recognition of gain by the corporation will increase the corporation's earnings and profits, thereby increasing dividend treatment for the shareholder.

In a bad split-off, which is typically characterized as a redemption, further analysis will be required to determine whether the redemption (i) is essentially equivalent to a dividend or rather (ii) should be treated as a sale of stock.15 If the redemption is treated as a dividend, the above consequences will apply. If the redemption is characterized as a sale or exchange, the participating shareholders will be treated as if they sold the redeemed shares and will recognize gain or loss on such deemed sale. The demerged corporation will be treated as if it distributed property to the redeeming shareholder in exchange for the shares redeemed.16 To the extent the property distributed was appreciated property, the corporation will be required to recognize gain equal to the excess of the fair market value of the appreciated property over its adjusted basis.

Lastly, in a bad split-up which is typically structured as a liquidation, the liquidating corporation will be treated as selling its property in exchange for its stock.17 The liquidating corporation is generally required to recognize gain on the deemed sale of any appreciated property and the shareholders are required to recognize gain on the deemed sale of their stock in the liquidating corporation. An exception may apply if more than 80% of the shares in the liquidating corporation are owned by another corporation.18

While gain is expected to be recognized in each of the above scenarios, significantly different tax consequences are expected when it comes to a demerger of a foreign corporation in which one or more of its shareholders is a U.S. individual or corporation. We will illustrate some of these differences in the two examples that folloW.

EXAMPLE A – U.S. TAX IMPLICATIONS OF A BAD SPIN-OFF OF A FOREIGN CORPORATION

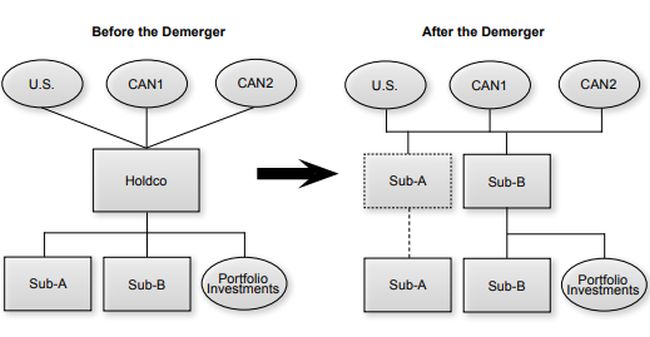

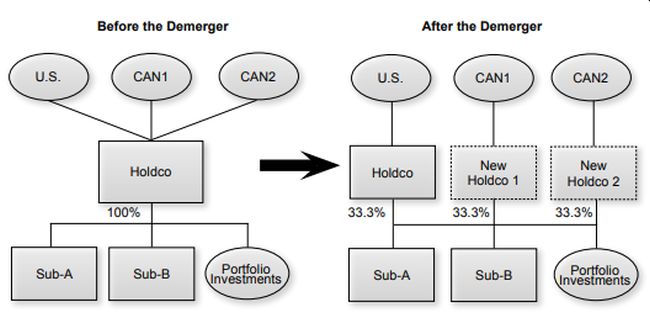

Assume a Canadian holding company ("Holdco") owned by three shareholders in equal shares. Holdco operates two different lines of business, "A" and "B, through two Canadian subsidiaries, Sub-A and Sub-B, respectively. In addition, Holdco owns some portfolio investments. Two of the shareholders of Holdco are Canadian residents and the other is a U.S. resident ("U.S. Resident"). The shareholders decide to demerge Holdco by transferring Sub-A to a separate newly formed corporation ("Newco") by way of a tax-free "Butterfly Transaction"19 under Canadian law.20

The Butterfly Transaction does not involve any actual distribution of stock. Instead, property (here, the Sub-A stock) is transferred by Holdco to Newco in exchange for Newco shares.21 Nevertheless, the economic substance of the above Butterfly Transaction seems to be equivalent to a distribution of the Sub-A stock by Holdco to its shareholders, followed by a contribution of the Sub-A stock to Newco. The I.R.S. ruled on several occasions that a Butterfly Transaction may be treated as a distribution followed by a contribution, and further confirmed that the Butterfly Transaction may qualify as a "good spin-off" provided all the requirements under Code §355 are met.22

In light of previous letter rulings, it is expected that the demerger in the example above will be characterized as a distribution, followed by a contribution, for U.S. federal tax purposes. However, the demerger might not meet all the stringent requirements of Code §355. In that case, the demerger will be treated as a taxable distribution of Sub-A stock by Holdco to Holdco's shareholders, followed by contribution of the Sub-A stock by the shareholders to Newco.23

If the demerger is a bad spinoff, U.S. Resident is expected to recognize dividend income. The amount of income to be included is equal to the fair market value of the Sub-A shares that U.S. Resident deemed received.24 In addition, U.S. Resident will be treated as if he or she contributed shares in Sub-A to Newco. While such contribution is generally expected to be subject to non-recognition under Code §351, U.S. Resident will be required to enter a gain recognition agreement with the IR.S. under Code §367(a) if he or she owns 5% or more of Newco and wishes to defer gain recognition.25

The Canadian shareholders are non-U.S. citizens and non-U.S. residents. Therefore, they are not subject to tax in the U.S. Federal tax on their deemed dividend income.26

Holdco is a foreign corporation and, as such, capital gain derived by it is generally not subject to U.S. Federal tax.27 Therefore, even though Holdco is viewed as if it recognized gain on the distribution, no tax liability is expected for it under U.S. Federal income tax law.

EXAMPLE B – U.S. TAX IMPLICATIONS OF A BAD SPLIT-OFF OF A FOREIGN CORPORATION

Assume the same set of facts as in example A, above. However, in this case, the shareholders decide to split the ownership in Holdco so that each shareholder owns Holdco's assets through its own holding company. A new holding company is formed by each of the Canadian shareholders and one-third of each of Holdco's assets is transferred to each new holding company.

If the demerger does not meet the requirements of Code §355, the demerger is expected to be treated as a redemption of the Holdco stock by the Canadian shareholders. Since the redemption in this case is not substantially equivalent to a dividend,28 it is expected to be treated as a distribution of property by Holdco in exchange for the Canadian shareholders' Holdco stock under code §302(a).

In comparison to Example A, in this case U.S. Resident receives no dividend income, either directly or indirectly.29

The Canadian shareholders are viewed as if they sold their Holdco Stock but, since they are neither U.S. citizens nor U.S. residents, they are not taxable under U.S. Federal tax law on capital gains.30

Similarly, Holdco is treated as if it distributed 66.67% of its assets to the new holding companies. Under Code §311(b), gain must be recognized by Holdco as if it sold the assets for fair market value. However, as mentioned, Holdco is also not subject to U.S. Federal tax.

Although it seems as if none of the parties to the transaction incurred any U.S. Federal tax liability on the demerger, this is actually not the case for U.S. Resident.

Pursuant to the demerger, Holdco will become a Controlled Foreign Corporation ("C.F.C.") and U.S. Resident is expected to become a "U.S. Shareholder" of the C.F.C. In a nutshell, a C.F.C. is any foreign corporation in which shares representing more than 50% of the voting power of all shares or more than 50% of the value of all shares are owned by five or fewer U.S. Shareholders. A U.S. Shareholder is defined in Code §951(b) as a U.S. person31 who owns or who is considered as owning shares representing 10% or more of the total voting power of all shares of the corporation or 10% or more of the value of all shares of the corporation.

of all shares are owned by five or fewer U.S. Shareholders. A U.S. Shareholder is defined in Code §951(b) as a U.S. person31 who owns or who is considered as owning shares representing 10% or more of the total voting power of all shares of the corporation or 10% or more of the value of all shares of the corporation.

As a U.S. Shareholder who owns shares of a C.F.C., U.S. Resident will be taxable on his or her share of Holdco's income that is "Subpart F Income" as defined in Code §952 ("Subpart F Income"). U.S. Resident will also be required to include in gross income some or all of the tested tax income under the G.I.L.T.I. regime as provided in Code §951A(b).

This change in Holdco's status when it becomes a C.F.C., is expected to result in U.S. Resident being subject to tax on the demerger. Although U.S. Resident does not become a U.S. shareholder in a C.F.C. until after the demerger is completed,32 tax liability under the C.F.C. regime extends to any Subpart F Income and tested income under G.I.L.T.I. income that Holdco earns from the beginning of its taxable year,33 including income earned before or on the demerger. For that purpose, the taxable income of the C.F.C. is determined based on U.S. Federal tax principles.34

As mentioned above, U.S. tax law provides that Holdco must recognize all gain realized on the demerger.35 Gain from sale of stock and other passive assets is generally treated as Subpart F Income.36 Therefore, Holdco is expected to incur Subpart-F Income as a result of the demerger.

At the end of the taxable year, U.S. Resident will be required to include in taxable income his or her pro-rata share of Holdco's Subpart-F Income for the entire year. The pro rata share of the Subpart F Income will be reduced to reflect only the portion of the year during which Holdco was a C.F.C.37 For example, if Holdco is a calendar-year taxpayer, the amount of deemed gain recognized by Holdco is $1M, and the demerger is effectuated on June 30th, U.S. Resident's pro-rata share of Holdco's Subpart F income is expected to be $500K. U.S. Resident would have to include the $500K in his or her taxable year for the fiscal year.

It follows that, although not apparent at the outset, U.S. Resident will end up paying U.S. Federal taxes on Holdco's deemed gain pursuant to the demerger in Example-B.38

CONCLUSION

Regardless of how a demerger is structured, any disposition of appreciated property by the demerged corporation is treated as a taxable transaction under U.S. Federal tax law, unless the demerger meets the requirements of §355 of the Code.

Even where the demerged corporation is a non-U.S. corporation and it has only non-U.S. operations, a shareholder who is a U.S. citizen or a U.S. resident might end up being subject to U.S. Federal tax in certain circumstances.

Therefore, in structuring a demerger of a non-U.S. corporation with at least one U.S. shareholder, U.S. Federal tax considerations must be taken into account and careful consideration should be given to every step of the plan. Those who fail to consider the Code §355 rules thinking they are passive participants in a demerger do so at their peril.

Footnotes

1. See, for example, the Directive (E.U.) 2019/2121 of the European parliament and of the council of 27 November 2019 (came into force on January 31, 2023), that allows for a complete demerger, a partial demerger, and a demerger by separation. The E.U. Directive harmonizes the legal framework for cross-border conversions, mergers, and demergers of E.U. companies.

2. The Internal Revenue Code of 1986, as amended.

3. Appreciated property is property the fair market value of which exceeds its adjusted basis in the hand of the corporation.

4. Code §§61(a) and 1001(a).

5. Code §§301, 311, and 317.

6. A discussion on the requirements of Code §355 and the regulations promulgated thereunder is beyond the scope of this article.

7. However, gain will be recognized on the distribution of any property other than stock and securities of the controlled corporation that qualify under Code §355. See, Code §355(a)(3) and (4).

8. Usually, such distribution would be made on a pro-rata basis. In rare circumstances a spin-off can be non pro-rata, see P.L.R 8825058; Ginsburg, Levin and Rocap, Mergers, Acquisitions and Buyouts, at 1001.1.

9. Code §317(b).

10. Code §301(c)(1).

11. Code §301(c)(2).

12. Code §301(c)(3).

13. Code §311(b).

14. Code §1001(a).

15. Code §302.

16. Code §302(a).

17. Code §331.

18. Code §332.

19. Several anti-abuse rules apply in Canada to prevent tax free treatment for a Butterfly in the context of identified aggressive tax planning. Whether the transaction described in the text qualifies as a good butterfly requires advice of competent Canadian tax counsel. In the diagram, it is assumed that the anti-abuse rules under Canadian tax law are not applicable to the facts.

20. The transaction gets its name because all assets must be divided evenly, subject to slight variations. When diagrammed, the split resembles the image of a butterfly image.

21 constituting a "Butterfly Transaction" generally include the following: (1) Newco is formed by the shareholders, (2) the shareholders contribute Holdco stock to Newco, (3) Holdco transfers the subject property to Newco in exchange for Newco shares, and (4) the shares owned by each corporation are redeemed.

22. See, for example, P.L.R. 200505009 and P.L.R. 200212012.

23. We analyzed this transaction as a distribution of the Sub-A stock followed by the contribution of the Sub-A stock to Newco, based on the above-mentioned private letter rulings. However, an alternative approach would suggest that the transaction should be viewed as if Holdco contributed the Sub-A stock to a new company formed by Holdco, followed by a distribution of the new company shares to Holdco's shareholders. See, I.R.S. Rev. Rul. 77-191.

24. A dividend-received deduction might have been allowed to essentially offset the dividend income, if U.S. Resident owned the Holdco stock indirectly through a U.S. corporation, provided the requirements under Code §245A were met.

25. Treas. Reg. §1.367(a)-3(b)(1).

26. Nonresident aliens are only taxable in the U.S. on dividend income if the dividend is from sources within the U.S. Code §871(a)(1)(A). Dividend income arises from U.S. sources if it is distributed by a U.S. corporation. Dividends from a foreign corporation may also be U.S. source in certain circumstances specified in the Code. See, Code §861(a)(2). However, no income or withholding tax is due if the foreign corporation is subject to branch profits tax. See Code §84(e) (3)(A).

27. Code §882(b).

28. A complete termination of the shareholders' interest in the corporation is not essentially equivalent to a dividend. See Code §§ 302(a) & (b)(3).

29. U.S. Resident did not receive any actual distribution. In addition, U.S. Resident did not receive any constructive dividend. Economically, he or she indirectly owned 33.3% of Holdco's assets both before and after the demerger.

30. Code §872(a).

31. A "United States person" is defined in Code §957(c) which further refers to Code §7701(a)(30) with certain modifications. With respect to individuals, a "United States Person" means a U.S. citizen or resident. See Code §7701(b) for the definition of a U.S. resident.

32. See, Treas. Reg. §1.951-1(f), which provides that for purposes of Code §§951 through 964, the holding period of an asset (including stock of a C.F.C.) is determined by excluding the day on which such asset is acquired and including the day on which such asset is disposed of.

33. Pursuant to Code §951(a), any U.S. Shareholder who owns stock in a C.F.C. on the last day of the taxable year in which the corporation is a C.F.C. must include in that year's gross income his or her pro-rata share of the C.F.C.'s Subpart-F income.

34. Code §964(a) and Treas. Reg. §1.952-2(a)(1).

35. The amount of such gain is expected to be the excess of the fair market value of the deemed distributed property over Holdco's adjusted basis in such property.

36. Code §954 provides that net gains from the sale of shares of stock of a corporation are considered to be Foreign Personal Holding Company Income, a subcategory of Subpart F Income.

37. Treas. Reg. §1.951-1.

38. For a deep dive into the computation of amounts included in income by a U.S. Shareholder acquiring or disposing of shares in a C.F.C., see Stanley C. Ruchelman and Neha Rastogi, "Peeling the Onion to Allocate Subpart F Income – This Will Make You Cry," Insights Vol. 6 No. 5 (May 2019)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.