INTRODUCTION

This article addresses the G.I.L.T.I. rules that currently are in effect in the U.S. when a U.S. Shareholder of a C.F.C. engaged in an active business run at a loss sells its business assets at a gain. It also addresses certain reporting obligations on a U.S. Shareholder when a C.F.C. undergoes some form of tax-free merger or reorganization abroad.

BACKGROUND

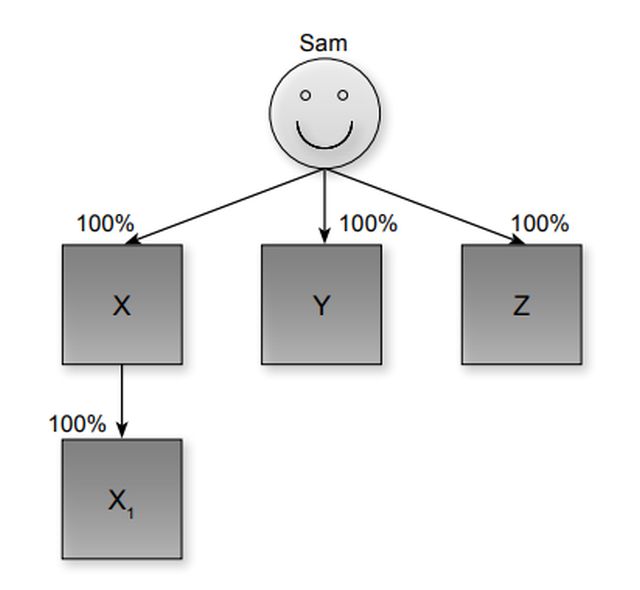

Sam is a U.S. citizen who is the sole shareholder of three foreign corporations, X Co, Y Co, and Z Co, that are tax residents of country A. Sam is an indirect shareholder of X1 Co, a tax resident of Country A, that is wholly owned by X Co.

All of the Country A corporations are C.F.C.'s. Both X Co and X1 Co are engaged in the hospitality business, and each owns a fully operational multi-story hotel in Country A (Hotel X and Hotel X1 respectively). Y Co and Z Co are also engaged in active trade or businesses in country A.

The annual financial and tax statements of each of the three C.F.C.'s have reported operating losses for several years. X Co and X1 Co were merged under the corporate law of Country A in 2022, with X Co as the surviving company (the "Merger"). Post-Merger, X Co sold a portion of Hotel X, reporting a substantial gain for both U.S. and Country A purposes.

The Merger was effected as a tax-free transaction in Country A. Further, the laws of Country A allow X Co to fully offset the gain arising from the sale with losses of Company X and Company X1 . As a result, no tax was paid in Country A in connection with the Merger and the sale.

As Sam narrated the transaction to his U.S. tax adviser as the U.S. tax filing due date approached, he was hopeful that similar tax results as in Country A can be achieved in the U.S. However, as he came to realize, he had manifested just the opposite of what he wanted. The tax adviser advised him of the following hurdles the transaction must overcome to achieve a tax-free treatment in the U.S. In principle, specific conditions must be satisfied in order for a merger involving a C.F.C. to be tax-free for a U.S. Shareholder. He also came to realize that the G.I.L.T.I. provisions of U.S. tax law that apply to U.S. Shareholders and C.F.C.'s may not provide the results that Sam anticipates.

Definitions

A foreign corporation is a C.F.C. for U.S. income tax purposes if more than 50% of the total voting rights of all classes of stock or the total value of the stock is directly or indirectly (through another corporation) owned by "U.S. Shareholders."1 A U.S. Shareholder is a U.S. person that directly, indirectly, or constructively owns shares of the foreign corporation that represent 10% or more of the vote or value of all shares issued and outstanding.2 A U.S. person includes a citizen or resident of the United States.

Indirect ownership includes ownership through foreign entities.3 Constructive ownership in general includes ownership attributed to a person under Code §318(a)4 with certain modifications.5

Based on the above, X Co and X1 Co are C.F.C.'s for U.S. income tax purposes because more than 50% of the voting rights or value in each of the companies is either directly or indirectly held by Sam, a U.S. citizen. Also, Sam is a U.S. Shareholder of each C.F.C. since he owns directly or indirectly 10% or more of the voting stock or value of each company.

A STATUTORY MERGER

Merger Defined

Typically, a statutory merger of two or more corporations by operation of law is included in the term "reorganization," meaning a tax-free, nonrecognition transaction for U.S. tax purposes.6 One noted treatise describes a merger in the following language:

Under § 368(a)(1)(A), a statutory (i.e., under the controlling corporate law statute) merger or consolidation is the oldest of, and the prototype for, the various reorganization forms. In a merger, one corporation absorbs the corporate enterprise of another corporation, with the result that the acquiring company steps into the shoes of the disappearing corporation as to its assets and liabilities. * * *. In these transactions, shareholders and creditors of the disappearing transferor corporations automatically become shareholders and creditors of the transferee corporations by operation of law, assets move by operation of law, and transferor corporations can disappear as legal entities, resulting in a dissolution of the acquired corporations. [Footnotes omitted.]7

In addition to the above, the Merger must meet the following non-statutory requirements to qualify as a tax-free merger for U.S. tax purposes

Valid Business Purpose

There must be a valid business purpose other than tax avoidance. In other words, the purpose of the reorganization must be required by business exigencies, an ordinary and necessary incident of the conduct of the enterprise, and not a device or scheme to avoid tax.

Continuity of Interest

The purpose of the continuity of interest requirement is to prevent transactions that resemble sales from qualifying for nonrecognition of gain or loss available to corporate reorganizations. This requirement, in general, therefore, requires that the shareholders of the target corporation receive a substantial equity interest in the acquiring corporation. In the present case, the statutory merger involves a merger of the subsidiary with the parent, and therefore, the continuity of interest condition should be deemed satisfied since the parent acquired all of the assets and liabilities of the subsidiary.

Continuity of Business Enterprise

After the transaction, the acquiror must either continue the target's historic business or use a significant portion of the target's assets in an existing business. The policy underlying this general rule is to ensure that reorganizations are limited to readjustments of continuing interests in property under modified corporate form. The fact that X Co sold a portion of the first floor of Co X1 's hotel should not fail this requirement since X Co continues to own and operate a substantial portion of the property as a hotel after the Merger.

To view the full article, click here.

Footnotes

1. Code §957(a).

2. Code §951(b).

3. Code §958(a)(2).

4. Relationships are as follows: (i) from members of family, (ii) from partnerships, estates, trusts, and corporations, (iii) to partnerships, estates, trusts, and corporations, and (iv) under options. Certain operating rules can affect how the attribution rules are applied.

5. Code §958(b).

6. Code §368(a)(1)(A).

7. Bittker & Eustice: Federal Income Taxation of Corporations & Shareholders (WG&L), ¶ 12.21 Statutory Mergers and Consolidations (Type A Reorganization).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.