Effective December 31, 2018 both the state minimum wage and the minimum salary level for employees to be exempt from overtime pay have increased.

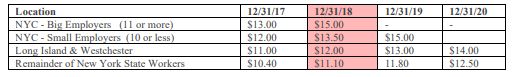

Minimum Wage: Employers must now pay minimum wages ranging from $11.10 to $15.00 per hour depending on its size and location. Note that different rules may apply to specific industries, such as the hospitality industry. Additionally, the minimum wage cannot be satisfied by bonus payments. This requirement covers all employees in New York, including those paid a fixed weekly or biweekly salary. Employers must also provide notice to its employees by posting the applicable minimum wage poster. The following table highlights the new requirements:

Minimum Weekly Salary for Overtime Exemption: The new state minimum weekly salary for administrative and executive employees to be exempt from overtime eligibility for employers with 11 or more employees will range from $832.00 per week ($43,264 annually) for employees outside of New York City and Nassau, Suffolk and Westchester counties, to $1,125.00 per week ($58,500 annually) for employees who work in New York City. For employers with 10 or fewer employees, the threshold in New York City increased to $52,650.

All employees earning above the new threshold are not automatically exempt from overtime pay, but those earning below the threshold may now be eligible for overtime compensation whereas they had previously not been. Employers may not account an employee's discretionary bonuses, incentive payments or commissions towards salary to reach the minimum level. Employers must ensure that their payroll practices reflect these recent changes.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.