Stock Market Commentary

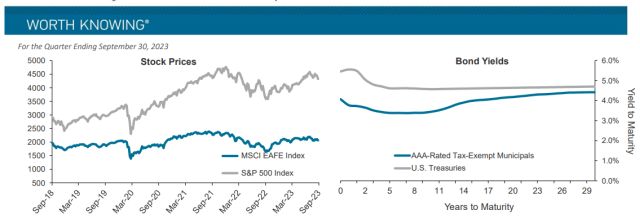

The S&P 500 Index fell 3.30% during the third quarter of 2023, with growth stocks losing slightly less than value stocks. Interest rate–sensitive stocks in the utilities and real estate sectors fell the most as the Federal Reserve indicated rates may remain higher for longer to combat recent upticks in inflation. The energy sector rallied over 12.22% as oil prices climbed back above $93 during the quarter, contributing to the increasing inflation. The U.S. stock market remains highly concentrated, with returns centered around a narrow group of high-flying tech stocks. Just seven stocks contributed nearly 82% of the S&P's year-to-date return.

International markets fell 4.04% as measured by the MSCI EAFE Index, while emerging markets were down 2.93% as measured by the MSCI Emerging Markets Index. China continues to struggle to stabilize its faltering real estate market. Europe, Canada, and other developed markets are fighting their own battles against inflation and, in cases such as Germany and New Zealand, recession.

The S&P 500 is trading on a price-to-earnings multiple below its pre-pandemic levels while earnings per share have far surpassed the pre-pandemic highs, making for a reasonably attractive valuation.

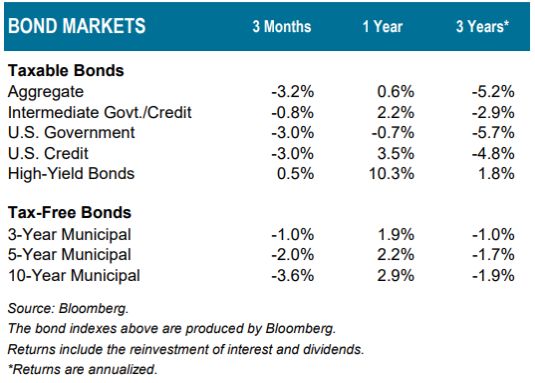

Bond Market Commentary

Following the worst year for bonds ever in 2022, fixed-income markets largely normalized and rebounded somewhat in the first half of 2023 as higher yields helped generate positive returns. However, the Bloomberg U.S. Aggregate Bond Index, a benchmark that measures U.S. government and corporate bond performance, fell 3.23% for the third quarter as investors adjusted to expectations that inflation and interest rates will continue to remain high.

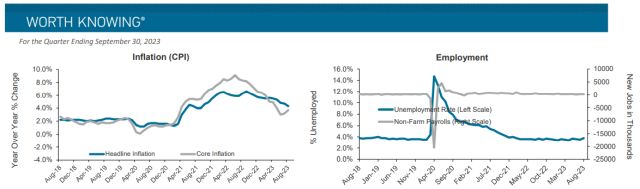

The Fed has been executing one of the most aggressive tightening campaigns in history and continued to telegraph that more moves are coming. The Federal Open Market Committee (FOMC) has slowed the pace of rate hikes, even choosing to skip a move at the June and September meetings; however, FOMC members have been united in professing a need for rates to remain elevated well into 2024 before they pivot toward lower rates. Their messaging is still quite "hawkish," leaving investors, the financial markets, and most of the world waiting to see how much impact the tightening campaign will have on inflation and the economy. As the federal funds rate has risen, other interest rates, including mortgage rates, have followed. The 30-year fixed-rate mortgage climbed to 7.83%, hitting its highest level in nearly 23 years.

Economic Commentary Key Economic Releases

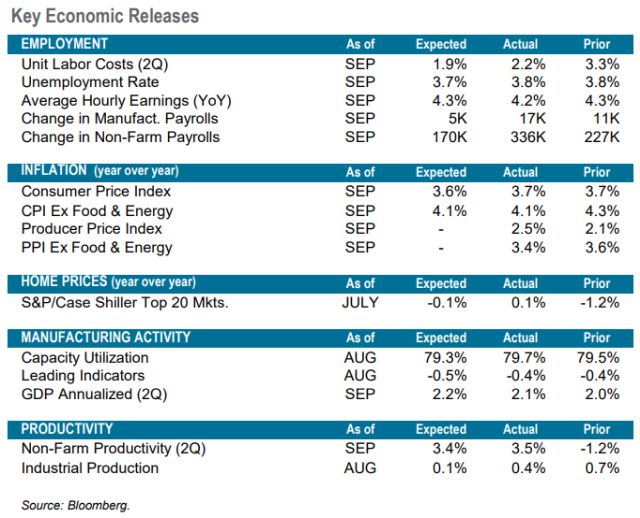

The Conference Board's Leading Economic Index (LEI) fell slightly less than expected in August but experienced its 17th consecutive monthly decline. The LEI is composed of indicators that tend to precede changes in the overall economy, such as initial unemployment claims, manufacturers' new orders, and new housing building permits. While the LEI has been warning of an approaching recession for over a year, one has not yet materialized as consumers and businesses have drawn on excess savings and fiscal stimulus such as the Inflation Reduction and CHIPS Acts.

Though unemployment experienced an uptick during the third quarter, the labor market remained strongly in favor of workers. In mid-September, the United Auto Workers initiated a strike against three large automakers. The targeted factories produce about 50% of the vehicles manufactured annually in the United States, accounting for 1.5% of gross domestic product.

Government stimulus, pandemic-related supply chain issues, and geopolitical tensions have increased incentives to onshore or nearshore U.S. manufacturing. Mexico has benefited from this shift and for the first time since 2003, monthly imports into the United States from Mexico exceeded those from China on a trailing 12-month basis. Since peaking at 21.5% in 2018, imports from China accounted for 14.4% of total imports over the last year compared to 14.8% from Mexico.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.