We expect "windfall gains" to be one of the key issues for UK-listed companies during this year's AGM season, an assumption supported by recent updates to shareholder guidance which again highlighted this area. Despite this, the phrase is still not well defined or understood by the market. While the underlying concept is simple (that a relatively large number of shares may have been granted under long-term incentive plan ("LTIP") awards made in early 2020 following significant COVID-induced share price declines), it is much more challenging to subsequently determine whether this has ultimately translated into a so-called "windfall gain" and, if so, what if anything should be done about it?

In addition to understanding the latest shareholder perspectives, it is important that committees also reflect on the potential management perspective, including the impact of COVID-19 on all remuneration outcomes over the period. A downward adjustment to one LTIP award at vesting can feel unfair and inconsistent if other elements of the package over the same period (including other in-flight LTIP awards) have been negatively impacted by COVID-19, without any adjustment.

In our view, a "formulaic" approach to assessing windfall gains is unlikely to be appropriate, and remuneration committees will need to use judgement. To support committees in making an informed judgment, we have therefore developed a framework of risk factors to take into account in determining whether a windfall gain may have occurred. It includes consideration of various factors related to the share price trajectory (such as the magnitude, timing, relativity, and drivers of share price recovery) as well as the broader remuneration context over the period. We also provide reference points which might be used if it is concluded that some adjustment should be made. Throughout the process, it is important to take a balanced approach, and to ensure appropriate engagement and communication with all stakeholders.

In this guide, we consider the issue which has come to be known in the UK-listed environment as "windfall gains". We explain what is specifically meant by the term in its current usage, exploring how it rose to prominence in early 2020 as a result of the equity market shock brought on by the COVID-19 pandemic. We look at the different stakeholder perspectives, outlining both the evolution of shareholder guidance up to the most recent releases, as well as considering the potential management perspective.

Finally, we then outline our suggested framework to assist remuneration committees in determining whether a windfall gain may have occurred and, if so, what type of adjustment might be made. The guide will be most relevant for those companies that granted their 2020 LTIP awards following a significant decline in the share price without making an adjustment to the size of the awards and instead deferring consideration of the impact until the point of vesting.

What is currently meant by the term "windfall gain"?

For anyone casually observing the world of executive remuneration, where the potential regularly exists for the receipt of multi-million pound payouts under incentive programmes, it may seem that the opportunity for "windfall" pay-outs is a common occurrence. But for those working in the field, the phrase has come to represent a more specific set of circumstances related to the number of LTIP shares granted following a material share price decline.

Before we describe those specific circumstances, it is worth remembering that it is now well-established best practice for remuneration committees to consider, at the point of vesting of any incentive award, whether the "formulaic" outcome is appropriate based on a broad assessment of overall performance in context. Where the formulaic outcome is not supported by this assessment, shareholders expect awards to be subject to a discretionary downward adjustment, and we have seen examples of some companies making such adjustments in recent years. The committee's broad assessment should

consider whether the value being received by executives "feels right" in the context of a range of contextual factors, such as the underlying performance of the business, the stakeholder "experience" over the period, and the macroeconomic and trading environment. This process should naturally capture, and adjust for, situations where a "windfall", conceived in the broadest sense of the term, might have occurred. An example might be where large pay-outs were due based on performance which had been significantly enhanced as a result of a substantial and beneficial change in government policy, which had not been anticipated when the targets were originally set.

While the phrase "windfall gain" could be thought of as one aspect of this overall assessment, in current UK discourse it is one with a very specific meaning related to the number of LTIP shares which were originally granted in certain circumstances, as set out below. It is this exact set of circumstances which we are referring to in this note by the phrase "windfall gains".

Where a company has experienced a significant fall in its share price since the prior year's LTIP grant, then if the next LTIP award is made on the same percentage of salary basis it will result in a material increase in the number of shares awarded to the executive. Where the share price subsequently recovers, this could create the potential for a so-called "windfall gain" as a direct result of the increased number of LTIP shares which were awarded at grant.

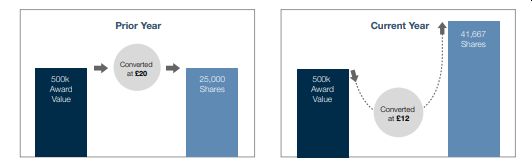

To illustrate this with an example, assume an executive on a salary of £500,000 is granted an LTIP award annually at a level of 100% of salary (i.e. a "face value" of £500,000 is awarded each year, converted into a number of shares to be granted at the prevailing share price at the point of grant). For the award in the prior year, assume the share price was £20 and therefore 25,000 shares were awarded (£500,000 of award value divided by £20 per share). Then assume the share price fell by 40% to £12 per share in advance of the next grant. Without any adjustment, the number of shares awarded would increase by 67% to 41,667 (£500,000 / £12).

Although the same monetary value has been awarded, it is the significant increase in the number of shares granted which creates the potential, in the eyes of shareholders, for a future "windfall gain".

Impact of the COVID-19 pandemic and evolution of shareholder guidance

Shareholders have been cognisant of this issue for a number of years. In fact, reference to the "windfall gains" risk has been explicit in the Investment Association's Principles of Remuneration for over ten years. In our experience, however, it has historically rarely been a major area of investor focus, outside of those individual companies which had experienced exceptional and sustained periods of share price decline. This changed almost overnight following the onset of the COVID-19 pandemic.

Cast your mind back to early 2020....

Given the significant shock to equity markets in response to the impact of the pandemic on the macroeconomic outlook, a large number of companies experienced a rapid and material decline in their share price at that time. While the extent of the impact was sector dependent, across the FTSE All Share, the average level of annual share price decline to mid-March 2020 was 26%, with over a quarter of the market experiencing falls in excess of 40%.

In an immediate response to the pandemic (in late April 2020), the Investment Association ("IA") issued new guidance around executive pay, which included addressing this issue. The guidance noted that for awards which had already been granted in 2020 following the share price declines:

"It is important for the Remuneration Committee to confirm that they will look at the general market and share price response over the performance period to ensure that windfall gains will not be received on vesting. Shareholders will expect the Committee to use their discretion to reduce vesting outcomes where windfall gains have been received."

The above guidance was relevant for a large number of December year-end companies where awards had been granted. For those who had not yet granted awards in 2020, the IA guidance "discouraged" remuneration committees from granting at the normal award level, and instead advised committees to "consider reducing" the award level. In practice, a substantial majority of companies granting after April 2020 continued to make awards at the normal level, but typically disclosed that they were aware of the investor view and committed to review the outcome at vesting (and included provisions in their award documentation to ensure this could be undertaken).

Fast forward to 2023... shareholders provide a timely reminder

Most awards made in 2020 will be due to vest in 2023. In their recent letter to remuneration committee chairs, the Investment Association provided a timely reminder that this remains a key area of shareholder focus:

"In 2023, many Remuneration Committees will be making those vesting decisions, assessing executive's performance against performance measures of long-term incentive grants made in 2020. These 2020 grants were made in the midst of the pandemic following significant share price falls, so a greater number of shares were granted compared to previous years. To ensure that participants do not benefit from being granted significantly more shares, it is important that Remuneration Committees consider if vesting outcomes need to be reduced. Committees should clearly articulate to shareholders how they have considered the impact of any potential windfall gains when determining vesting outcomes and why any reduction is appropriate. If the Committee has decided not to adjust for windfall gains it should explain and disclose its rationale for doing so."

Other prominent institutions have issued similar guidance on this issue (LGIM). While the proxy advisors, most notably ISS, have not issued any updated guidance on the windfall gains issue, we understand that their thinking is broadly aligned with that described above.

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.