The concept of self-conducted diagnostic tests, administered by patients in their own home, would likely have been thought completely preposterous 100 years ago – conjuring-up images of an array of test-tubes, flasks and Bunsen burners. Today, however, home diagnostics (HD) are one of the fastest growing categories of what has been termed consumer-driven healthcare1. Although there are certain self-administered tests that have been used for decades, such as the home pregnancy test, consumers have been attracted to the convenience, privacy, time and cost benefits of the latest home-testing kits when compared to visiting a primary care physician. This shift has largely been driven by continued technological advances that have brought the testing means out of the lab and into small, cheaply produced, easily operated medical devices.

Traditionally, there are 3 main areas for these devices:

- Electronic devices (usually reusable e.g. blood pressure monitor / pulse oximeter)

- Chemical or Bio-marker assay devices (usually single use, e.g. urine-test paper-strips)

- Sample collection devices (the user collects the sample at home then sends it to a lab for testing)

Because of the falling price of simple electronic components, there are increasingly more examples of chemical or bio-marker tests which include an electronic readout such as http://www.quickcheckhealth.com/ (see Figure 1).

In terms of patents, this is a rather complex area as much of the early patented technologies covering many of the standard physical / chemical / biological assays used in these devices have long expired. Consequently, many home diagnostic-related patents tend to disclose an implementation of a standard testing method in an overall "package" which may be used/ interfaced with new technologies such as, for example, using the internet ("telemedicine") or mobile devices (known as "mHealth" – see Figure 2). The strongest patents with relevance to HDs, however, are those which claim a fundamentally new type of sensor or testing means.

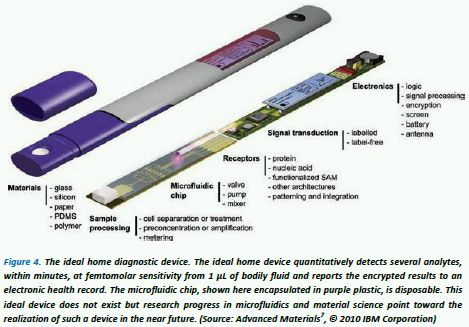

New types of bodily-fluid diagnostic tests are usually first implemented clinically in the laboratory, often taking many years of technological advances for miniaturisation into a cheap home testing device – miniaturisation being desirable so only small quantities of expensive testing materials are needed. Recently, it is becoming more and more apparent that the fast-developing field known as microfluidics (MF) is going to play a key role in realising the miniaturization process more rapidly by enabling extremely small volumes of bodily fluid samples to be examined within so-called "lab-on-a-chip" miniature testing components2,3,4. IBM have created their own concept of an "ideal home diagnostic device" (see Figure 4), which incorporates a disposable "microfluidic chip". From this concept it is evident that new developments in materials, microfluidics, sensor/receptors and electronic components will be essential for the realisation of these types of devices. It is possible then, that the forthcoming high-tech, multi-component HD devices will go the way of mobile phone handsets where hundreds of patents can be associated with each device, often from many different companies under specific license agreements – this patent model for HD is in-line with the current trend towards "open innovation 5 " in the medical device sector6.

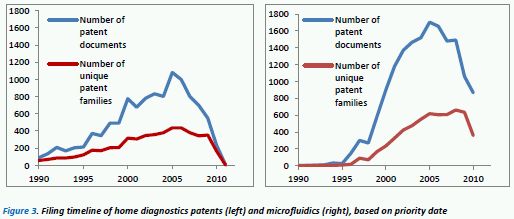

Figure 3 shows the filing timelines of both HD patents (left) and microfluidics (right). The blue lines indicate the total number of patent documents that have been published worldwide, while the red lines indicate the number of separate, unique inventions. What these graphs clearly show is that since the mid-90s there has been a steady rise in patented technology in these areas (note: the severe tail-off from 2008 onwards is an artefact due to patent documents still awaiting publication).

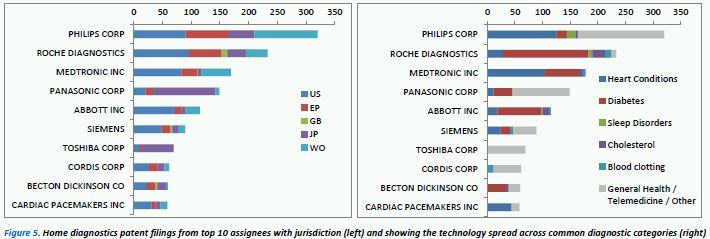

To investigate the HD IP, a patent dataset was collected based on the identification of patents which explicitly state that the device/method can be self-administered or is suitable for home testing – this was to exclude many diagnostic methods which can only be conducted in a laboratory. Based on these search criteria, Figure 5 (below, left) shows the top 10 patent assignees with their associated jurisdiction coverage – Japan notably being a key territory in this field.

Philips appears to dominate the IP landscape in terms of volume of patents, with a relatively equal spread across jurisdictions. Other key players are Roche, Medtronic and Panasonic. Panasonic and Toshiba's HD patent portfolios are notably weighted towards coverage in Japan, with considerably less filings in EP and US territories. Some of the key diagnostic areas in terms of the volume of patents appear to be: heart conditions, diabetes, sleep disorders, blood coagulation and cholesterol. Figure 5 (right) shows the proportion of the HD portfolios of these top 10 assignees that are focussed on these key diagnostic areas (note: some patents appear in more than one of these diagnostic categories). Patents that do not fall into these categories are often telemedicine-related or describe non-specific "health monitoring" devices where the novelty focus lies within other, non-health-related, technological attributes.

Philips, Medtronic and Cardiac Pacemakers are the key players in the heart condition field. While Roche, Abbot and Medtronic have significant proportions of their HD portfolios related to diabetes care. Home cholesterol monitoring is a smaller area in terms of IP – Roche, Abbot and Medtronic being the top 3 patent assignees. The major focus of Cordis' portfolio appears to be blood clotting related, while Roche and Siemens also have some IP in this area. Toshiba's HD patents lie outside the 5 key diagnostic areas and on further investigation they appear to be primarily telemedicine-related.

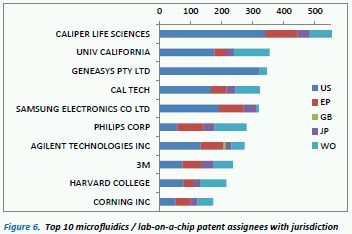

Figure 6 shows the top 10 microfluidics / lab-on-a-chip patent assignees. Unsurprisingly, there is a mix of electronic goods manufacturers and biotech / life science companies; three American universities also feature in the top 10. Caliper Life Sciences dominates this space in terms of patent numbers and is actively licensing their technologies to companies such as Aglient, Canon Life Sciences and Affymetrix 8 . Indeed, their extensive MF-related patent portfolio has been ranked as high as #2 for its technological strength in the MIT Technology Review Patent Scorecard9. The University of California and Caltech also have a large number of MF patents and are again licencing these technologies or forming spin-off start-ups with the IP – e.g. Fluidigm10 which is a MF company based upon technology licensed from Stanford University and Caltech.

In terms of jurisdiction coverage, microfluidics appears to be quite a US-driven innovation area, thus the filings have been predominantly in the US, with Japan being notably less prevalent a territory than for home diagnostic patents.

An important observation from Figure 5 & 6 is that Philips is the only company to feature in the top 10 of both HD & MF patents. Figure 7 puts their position in these areas into context with some other prominent HD / MF patent assignees. The diagram shows that Philips has a comparatively very large, evenly spread HD + MF portfolio with a 53% / 47% split of patents, respectively. This puts them in a strategically excellent position for the continued development of MF-chip-based HD devices.

Roche and Siemens also appear to be in excellent strategic positions for the development of MF-chip HD devices, with Roche slightly leaning towards HD patents at 61% HD, and Siemens slightly leaning towards MF patents at 58% MF. Assignees with extremely MF-heavy portfolios include Caliper, Geneasys, Samsung and the University of California. Whereas, Medtronic, Panasonic and Abbot have HD-heavy portfolios – the latter less so having an 85% / 15% split.

Due to the strong MF portfolios of companies such as Caliper, HD developers with virtually no MF patents, such as Panasonic, may find themselves in a situation of needing to license technologies from these MF companies should they shift their commercial focus to MF-chip HD products in the future. Indeed, Panasonic appears to be playing catch-up, having quite recently partnered with IMEC in 200811 with whom they have jointly developed various critical components of a biomedical lab-on-chip sensor12.

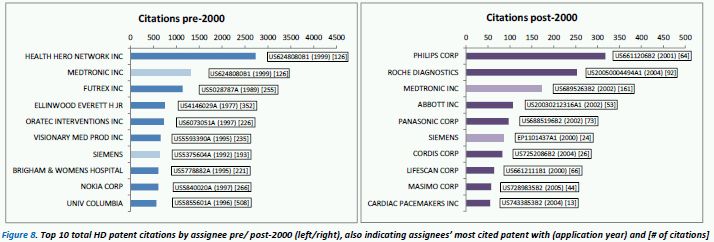

Patent citation analysis is a useful method to see which patents stand out and act as key reference points for forthcoming research and development. Figure 8 shows the top 10 cited patent assignees both pre-2000 (left) and post-2000 (right). The picture is quite different pre/post 2000, with Medtronic and Siemens being the only assignees to have continually high citation levels. Pre-2000, the most highly cited patent documents from these top cited assignees are all from the 1990's except one, from inventor E. Ellinwood in 1977 – "Self-powered implanted programmable medication system and method", which appears to have introduced some key concepts for implantable medication delivery devices.

Interestingly, pre-2000, Nokia have some very highly cited patent documents in the 1990's relating to diabetes monitoring equipment used in conjunction with a mobile phone – this strongly relates to the core concepts of the upcoming field of mHealth. Post-2000, Roche have a key highly cited patent application from 2004 (granted in 2010) which covers a device for sampling body fluid and a means for measuring the body fluid (e.g. porous test strips, electronic testing, optical/reflectance testing or visual inspection).

Many of the assignees with the highest post-2000 citation levels also appear in the top 10 patent assignees (Figure 5). This indicates that the new players in this area are now dominating the field in terms of patent volumes and technological significance of their patents.

Looking at the whole home diagnostics patent landscape, there is a clear split between companies developing diagnostic technologies which (a) do not require a sample of bodily fluid and (b) those that do. Companies such as Panasonic, Medtronic, Toshiba and Cardiac Pacemakers have their IP aligned with devices in category (a) and as such have not developed a microfluidics patent portfolio to date. Conversely, it is also evident that the key companies that have at least some devices in category (b), such as Siemens, Philips and Roche have developed significant microfluidics patent portfolios.

If the ideal bodily-fluid home diagnostic device (Figure 4) is to be realised, the key question is whether it will be through open innovation which is the current trend in the medical device sector, or will a powerful leader use IP to dominate the field though rigorous enforcement of their patents. The first sign of this was seen in 2007 when Roche sued Home Diagnostics Inc. for patent infringement relating to a home-testing glucometer13 – could this be a warning sign of things to come? The fact is, there are only a handful of very large corporations with the resources and the necessary volume, type and technological quality of patents to go it alone without adhering to the open innovation model.

The telemedicine and mHealth fields continue to grow in terms of products; although patents seem to feature less in these areas as the majority of embodiments to date often rely on older fundamental testing principles (e.g. Figure 2). Nevertheless, this is a rapidly expanding field with mobile phone manufacturers eager to show off innovation in this area, as demonstrated at the Mobile World Congress 201214. It is quite likely that in the future, there will be technological convergence between mHealth / telemedicine and microfluidic-chip diagnostics devices. With this convergence of products will come a whole host of IP issues – this could well become a future focus of the Smartphone / Tablet Patent Wars15.

1 https://www.bioiq.com/press/consumer_diagnostics_poised_for_growth.pdf

2 http://www.nanowerk.com/news/newsid=15949.php

3 http://www.nanowerk.com/spotlight/spotid=21383.php

4 http://www.sciencedaily.com/releases/2011/03/110324104410.htm

5 http://en.wikipedia.org/wiki/Open_innovation

6 http://bloinc.ninesigma.com/post/2011/02/09/title.aspx

7 http://onlinelibrary.wiley.com/doi/10.1002/adma.201100464/pdf

9 http://www.technologyreview.com/magazine/25/

12 http://www.sciencedaily.com/releases/2010/12/101210075918.htm

13 http://www.patentdocs.org/2007/03/roche_diagnosti.html

14 http://www.mobileworldcongress.com/mobile-health.html

15 http://www.ambercite.com/downloads/The%20Smartphone%20Patent%20Wars%20whitepaper_March%202011.pdf

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.