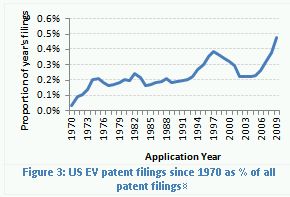

In 1996 General Motors released the EV1, the first mass-produced electric automobile from a major auto-manufacturer. It was not a success; its production, then subsequent recall and destruction formed the basis of the 2006 documentary 'Who Killed The Electric Car?'1. While the level of production was unprecedented, the technology itself was not, Electric Vehicle (EV) technology stretches back as far as 1900 when a series hybrid Porsche EV was released, recently rebuilt and on display as the Semper Vivus2. EV technology has long been in development, related patents can be found in 19th century filings, although it is only since 1970 (Figure 2) that sustained filings in this area have been made, quickly rising to around 0.2% of all patent filings per year and then remaining fairly steady for around 20 years as the technology was making inroads. In the mid 1990s patent filings on EV technology doubled, and with the release of the GM EV1 the future of the EV looked assured. But it didn't quite work out as planned, almost 100 years after the first EV release, still the petrol engine was far ahead of the field and showed little sign of slowing.

It took a petrol electric hybrid to become the first real EV success story. Shortly after the release of the EV1, in 1997, Toyota released the Prius, a series hybrid electric vehicle that has since risen to become the largest selling EV of all time, with over 2 million sold worldwide. With proof that there was a market for EV technology outside of a few select niches, patent filings began to rise and the rest of the auto-industry put their EV plans into play, but with such a head start, could anyone catch Toyota and the Prii3? A search for electric vehicle focused patents show that the largest holder is Toyota, little surprise there given their dominant market position. Other major manufacturers such as GM, Ford and Honda are closest behind shown in Figure 2. However with almost twice as many EV patents as the next highest, GM, this still suggests the upper hand for Toyota.

But Toyota don't just have a large number of EV patents, they have a large number of patents full stop, and as a percentage of their overall IP output, the level of EV filing is only on a par with several of the other 'pioneers'. In fact only two companies of the top 15 EV patent holders have any more than 10% of their patents directly related to EVs - Hyundai and Tesla, with Tesla by far and away the most committed with around 40%, even selling their EV components to rival companies such as Toyota and Daimler. A look at Figure 4 will show the difference between a strategy such as theirs in EV IP filing and that of the larger companies with a greater legacy focus on combustion engine technology. Standing out from such companies is Hyundai, who seem to have an almost total inclusion of EV technology in recent filings. Does this suggest a shift in their strategy heavily towards electric vehicles or simply a more generic approach to description of application within patent filings?

Looking closer at the data, EV patents that directly reference hybrid drive technology can be examined to attempt to understand the uptake of this technology area, seen by some as a stopgap measure on the way to cutting out the combustion engine entirely. Others are not so sure, and development interests are often hedged between full EV, hybrid and other methods. Figure 5 shows the relative uptake of hybrid related IP within a company's portfolio and from both of these charts we can see that ahead of Toyota, Ford and GM, it is Hyundai which emerges as a company placing a large amount of emphasis on the EV and within that, hybrid drives. Patents relating to hybrids alone form over 50% of their last 3 years' filings, given this information and their upcoming products, EVs will be a key area.

It's hard now to find an auto-manufacturer that doesn't have a pure EV, hybrid or both in production and/or development, a fact which should assure the EV market as a whole is due for significant growth. Certainly consumer concerns on range, efficiency, and other key factors are being addressed with the increase in environmental conscientiousness and concern over fuel prices forcing the market down a one way street, towards EV technology and away from the petrol engine, and issues such as cost and infrastructure doing the same for other alternatives such as hydrogen cells. But having a strong IP position and a clear product strategy are by no means the same thing. Other companies, Renault, Jaguar and Lotus to name-check a few of many have announced a push into the EV market in the near future, whether that is through range extender technology (Lotus), luxury hybrids (Jaguar) or concept city cars (Renault). With a lagging or less complete IP position; companies such as these may have to rely on strategic partnerships, such as Renault's joint strategy with Nissan4.

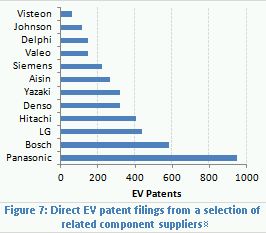

With the potential for increased intra industry cooperation rife, it won't just be the car manufacturers that have roles to play; developers of vehicle parts, batteries, electronics, and the whole power and charging infrastructure will be affected and will likely be relied upon by many of the companies with a less invested IP position in EV but with the desire to impact on the market. For batteries alone the market value is expected for rise to over $30bn in a few years5. With industries surrounding this and other technologies set for unprecedented levels of growth, the effectiveness of car manufacturers in establishing links with component producers will be vital. Some of the companies with significant amounts of EV related IP can be seen in Figure 3. With the ever increasing level of integration and dependence of electronics in cars, the need for such cross-industry collaboration and partnerships is on the increase, but with this comes a minefield of increased competition and litigation that has long become a recognised risk of operating in consumer electronics and telecommunications.

Automotive manufacture is historically considered to be relatively low on incidents and technologies that have brought about infringement litigation between parties, but this looks set to change. Several recent high profile cases look set to highlight not only the increasing value of IP in the industry, but the lengths some people will go to obtain it. In one case, according to reports between 2003 and 2006, A GM employee, Sanshun Du and her husband, Yu Chin conspired to obtain IP relating to GM's hybrid technology for use in their own company, information estimated to be worth around $40 million. This is by no means an isolated incident, and the levels of suspicion surrounding EV IP led to three of Renault's top executives being dismissed when it was suggested that they had been selling information relating to Renault's 4bn Euro EV plan; a claim made with little more evidence than an 'anonymous' tip-off letter, since thought to be part of an elaborate fraud or even a plan to destabilise Renault's EV programme6. More conventional cases are also becoming more common such as Paice's litigation against Toyota7 for infringement of microprocessor technology, now settled with Toyota making sizable royalty payments. This is almost certainly a sign of things to come as the electronics and components market make inroads into EV manufacture; investment in research and a strong market position is good for business, but success won't come without the need for defensive IP action.

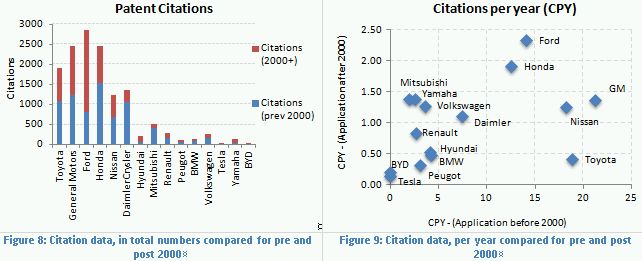

A good indication of which companies are leading the field in terms of research and adopted technology can be gleaned by looking at the level of patent citation, and with almost double the number of EV patents as its nearest rival, you would expect that Toyota would be ahead. However looking at the level of citation for patents of pre and post 2000, Ford, GM and Honda all are clearly ahead based on number of citations. Ford in particular since 2000 have gathered many more (Figure 4). Normalising per year to shift the focus to quality over quantity of citation, Toyota, along with Nissan and GM clearly are ahead on the pre 2000 axis, confirming their status as important early adopters of EV technology, but on the post 2000 axis patents, Ford and Honda lead, closely followed by a chasing pack that are all ahead of Toyota. Suddenly this race just got interesting.

So while more established companies such as Toyota hold the largest share of IP, companies such as Tesla show that a new face can certainly enter the game - It's just a question of now staying the course and surges from companies such as Hyundai may yet produce an upset in the market. So can anyone catch Toyota? The adoption of EVs is only just beginning, and with the number of automobiles in the world approaching 1 billion, a head start of a few million sales is just the start of a long and tough race that anyone could win.

Suggested Links

1 http://www.whokilledtheelectriccar.com/

2 http://www.wired.com/autopia/2011/04/porsche-semper-vivus/

3 http://www.engadget.com/2011/02/21/toyota-decrees-the-plural-of-prius-is-prii-your-latin-teach/

4 http://analysis.evupdate.com/industry-insight/renault-nissan-v%E2%80%99s-ford-tale-two-ev-strategies

5 http://techcrunch.com/2011/04/13/for-the-electric-vehicles-market-small-batteries-mean-big-sales/

6 http://www.bbc.co.uk/news/world-europe-12732421

7 http://www.paice.net/toyota-settles-infringement-case-over-hybrid-patent

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.