The introduction of the Consumer Duty (the Duty) is the biggest regulatory shift in financial services in recent years, with a very tight timescale for implementation set out in the FCA's policy statement of 28 July 2022 (PS 22/9).

We have scrutinised each of the FCA's consultations leading up to its final rules and engaged with clients on the key issues, advising them on their implementation plans and how to put plans in place. Drawing on this experience, we have set out in this article guidance on implementing the Consumer Duty for asset managers.

Asset managers should note that the FCA has been clear that there is no 'one size fits all' approach and that implementation plans should be tailored to each firm. Therefore, we recommend firms receive advice on their specific implementation plans and needs.

What is the Consumer Duty?

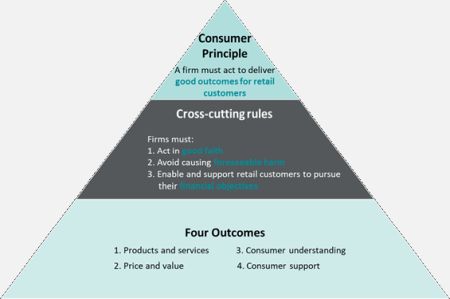

Understanding the structure of the Consumer Duty is crucial to then being able to implement it properly. The Consumer Duty has the following structure:

The Principle

The Duty amends the FCA's existing Principles for Business (PRIN) introducing a new Principle 12, the Consumer Principle, which is intended to set higher standards for firms than the existing Principles. This is shown at the top of the triangle. In particular, when Principal 12 applies, the existing Principle 6 (treating customers fairly) and Principle 7 (clear, fair and not misleading communications) are disapplied. Principle 12 is outcome-focused so the new Consumer Duty requires a more proactive approach by asset managers.

The Duty applies to products and services offered to retail clients (for investments the FCA has made it clear that the Duty applies to business conducted with a customer who is not a professional client, as set out in the Conduct of Business Sourcebook (COBS)), and it applies to all firms that could have an impact on outcomes for retail clients, whether or not they have a direct relationship with the retail client. This means that the Duty will also apply to unauthorised funds and institutional mandates where these ultimately affect retail investors (for example, a pension fund). In relation to firms that have an indirect relationship with retail clients, it applies in a way that is proportionate to the firm's role and impact on customers.

The Duty does not apply to customers who elect to be treated as professional clients under COBS. It does, however, apply to the process a firm uses to determine a client's status. A firm that encourages a customer to seek a 'professional client' classification simply to avoid providing consumer protection would breach the Duty. This means that if an asset manager or a platform provider is aware that a customer has been incorrectly classified by another firm earlier in the distribution chain, including an unauthorised firm, they should reclassify the customer and provide the correct level of consumer protection.

The FCA rules state that, where a firm's retail market business involves "operating in a distribution chain", the duty will apply "only to the extent that the person is responsible in the course of that retail market business for determining or materially influencing retail customer outcomes". The FCA includes within the term "distribution chain" all firms (including manufacturers) involved in a service to an end-retail customer. Interestingly, this excludes a portfolio manager whose role is limited to managing assets under a mandate determined by a professional client that is entirely independent of the manager.

The Duty applies to firms dealing with prospective as well as actual customers. For example, the Consumer Duty applies:

- when approving or communicating a financial promotion;

- when answering a question from a prospective customer; or

- where a prospective customer applies for a product or service.

The FCA has provided some comfort that the Consumer Duty is not a duty of care, is not a fiduciary duty and does not require firms to provide advice where they would not otherwise do so. For instance, firms are not expected to protect customers from risks that come from the nature of the product (such as investment risks), where they have complied with their obligations under the Duty and have good reason to believe the customer understands and accepts that risk.

The cross-cutting rules

Underpinning the new principle are three cross-cutting rules.

- Acting in good faith

- The FCA has provided examples where a firm would not be acting in good faith. Asset managers will particularly want to consider:

-

- Taking into account retail customers' interests - for example, a fund manager must develop a fund and design ongoing services to meet the needs, characteristics and objectives of the target market that it will be distributed to. This includes, for example, considering the needs of the target market, following the consumer understanding rules for its communications and considering if its charges provide fair value.

- Not exploiting retail customers' behavioural biases (e.g. some retail customers may have a bias towards investing in higher risk products when it is more prominently displayed than other options).

- Ensuring the product is suitable for the target customer (e.g. last year the FCA released a strategy to halve the number of consumers who are investing in higher risk products that are not aligned to their needs).

- Not taking advantage of a retail customer or their circumstances (e.g. pension fund asset managers are likely to have an older customer base who have characteristics of vulnerability).

- Not carrying out the same activity to a higher standard or more quickly when it benefits the firm than when it benefits the retail customer (e.g. in particular when providing customer support).

- Avoid causing foreseeable harm

- A firm must avoid causing foreseeable harm to retail customers, whether by act or omission, and whether in a direct relationship with the retail customer or through its role in the distribution chain (even where another firm in that chain also contributes to the harm).

- This cross-cutting rule was amended from "avoiding foreseeable harm" to "avoid causing foreseeable harm" to underline that firms are not required prevent harm where a properly informed retail customer has made the decision to proceed (e.g. in the context of investments, the risk of underperformance or losses is not a risk that can be completely prevented unless such risks were risks the customer was only exposed to because the investment was unsuitable for them). Indeed, one of the FCA's regulatory principles is that customers are responsible for their own decisions.

- Whether harm is foreseeable will depend on whether a prudent firm acting reasonably would be able to predict or expect the ultimately harmful result of the firm's act or omission. The Consumer Duty is "underpinned by the concept of reasonableness" so firms are only responsible for addressing the risk of harm that is reasonably foreseeable at the time. Where harm was not foreseeable at the outset of an arrangement but becomes apparent later, firms must take steps to take appropriate action at that stage to mitigate the risk of harm, whether actual or foreseeable.

- Enable and support retail customers to achieve their financial objectives

- The implementation of this cross-cutting rule will depend on the type of investment and the target customer base identified by the asset manager.

The four outcomes

As set out above, the Consumer Duty focuses on outcomes. The four outcomes should therefore be central to firms' implementation at every stage.

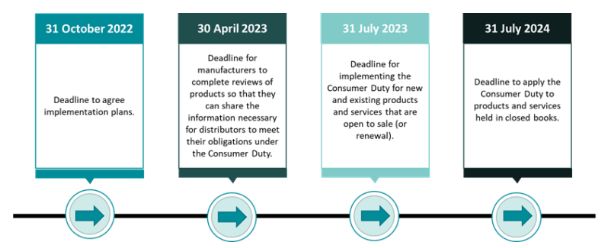

Implementation timeline

Firms should focus on the implementation timeline to ensure implementation is feasible within the regulatory timescales.

Implementation for asset managers

Implementation should focus on the four outcomes identified above but asset managers should be careful to ensure the entire product and customer journey is considered. In short, asset managers must develop a fund to meet the needs, characteristics and objectives of the identified target market of customers. They must develop an appropriate distribution strategy and set charges to provide fair value to customers. Distributors of the fund must obtain sufficient information to understand the value assessment and whether any remuneration they receive would result in the product no longer providing fair value. They must design an appropriate distribution strategy, provide appropriate customer service standards and regularly monitor how the platform is used in practice.

We have expanded on the key issues below:

Products and services

Firms must identify a group or groups of customers sharing common features whose characteristics, needs and objectives the product is or will be designed to meet (the target market). These customers are the end-users of the product or service, not other firms in the distribution chain. The rules require firms to identify the target market at a sufficiently granular level, considering the characteristics, risk profile, complexity and nature of the product or service.

One way firms may wish to test whether the target market has been identified appropriately is to consider if it would include any groups of customers for whose needs, characteristics and objectives the product or service is generally not compatible. For example, an investment fund might start with a target market described in terms of investment objective and investment risk. However, the target market should be refined and clarified if the product is generally incompatible with the needs, characteristics and objectives of people who cannot commit to hold the investment for more than five years or who cannot afford to bear potential investment losses.

For more complex or niche products or services, firms should define target markets in more detail, taking account of any increased risk of consumer harm associated with these products or services and their potential mis-sale. For example, a structured product with capital at risk that offers high headline rates of return but with complicated features that make it difficult for investors to understand what returns are likely in practice may need a more defined target market and a particular distribution strategy, such as being sold only with advice.

Asset managers and platform providers acting as manufacturers must develop the product or the platform, including decisions over the range of investments it provides, to meet the needs and characteristics of the identified target market.

A firm would be considered a co-manufacturer where they can determine or materially influence the manufacture of a product or service. This would include a firm that can determine the essential features and main elements of a product or service, including its target market. There may be multiple manufacturers for a single product or service. For example, an intermediary might design an investment fund and work with a fund manager to launch it, in which case both could well be co-manufacturers. Where firms collaborate in this way, they must have a written agreement outlining their respective roles and responsibilities and which firm is responsible for meeting different aspects of the rules under the products and services outcome so that, in the event of a problem, it is clear which firm is accountable.

Firms will need to continually monitor and update the product where necessary to ensure it continues to meet the needs of the customer throughout the product lifecycle. The new rules state that manufacturers must regularly review whether any aspects of closed products may result in the firm not complying with the cross-cutting rules. While the FCA is not intending to apply the Consumer Duty retrospectively, firms will need to review whether closed products meet the on-going requirements of the Duty.

The product must also take into account the risk of harm to consumers: for example, if a manufacturer is developing a higher risk product, it should take additional care to ensure it meets customers' needs and is targeted and distributed appropriately. There will be types of products (such as those that are higher risk) and types of services that may only be appropriate for certain types of customers or certain customer needs and firms will need to be particularly careful with these products.

Price and value

This outcome requires manufacturers to ensure that their products provide fair value to retail customers and to consider their value assessment when selecting distribution channels. Distributers must consider at least the following when assessing value:

- the nature of the product or service, including the benefits that will be provided or may reasonably be expected and their qualities;

- any limitations that are part of the product or service; and

- the expected total price customers will pay, including all applicable fees and charges over the lifetime of the relationship between customers and firms.

Distributors must obtain relevant information from manufacturers to understand the value a product or service is intended to provide and to enable them to understand whether their distribution arrangements (including any remuneration it or another person in the distribution chain receives) would result in the product or service ceasing to provide fair value to retail customers.

This means that the distributor will need to consider the cumulative impact of the remuneration added by each person in the chain on the overall value of the product to the customer. This is important as fees charged by different firms along the distribution chain might together result in a higher overall fee that does not represent fair value for consumers. This is likely to be particularly relevant where there are long or complex distribution chains with multiple fees added by multiple parties. In this scenario, each firm will need to work out its role in assessing value. For example, co-manufacturers of a fund where there is a delegation or sub-delegation arrangement must outline their respective roles in a written agreement.

Where different firms are involved in the distribution chain for an investment product, they all have responsibility to consider fair value as part of avoiding foreseeable harm and helping support customers in pursuing their financial objectives. For example, fund managers will need to ensure they assess whether their charges are justified in the context of the overall value of the product, and platform providers must ensure that they set fair value charges for using the platform. In some cases, the platform provider will be the final firm in the distribution chain. In this case, the platform provider will need to consider the overall impact of the remuneration added by each person in the chain on the value of the product to the consumer. It is important to note that an unreasonably high platform fee can sometimes undermine the value that an investor is getting from the products they are being advised to buy.

By way of example, if a platform provider is charging a high annual fixed fee (this can be the case if the platform has a lot of research on it) but low trading costs (this type of a model can be attractive to customers), but the data shows that customers are only investing relatively low capital with low frequency, this could be an indication that this may not be the right product for them and that the target market does not have a comprehensive understanding of the product. In this case, it would be prudent for firms to review their on-boarding processes as well as their literature to ensure that the products are directed towards the right target market. This would also be a good opportunity to examine whether certain groups of customers are paying higher fees and charges for a particular product (for example, are long standing customers paying a 'loyalty penalty' when compared to new customers?).

The FCA has provided some comfort in that where a manufacturer sets the final price that the retail customer receives, including distribution charges then they are responsible for ensuring that the product provides fair value. The distributor does not need to carry out a value assessment - though they must confirm that the manufacturer has carried out a value assessment and review the information shared by the manufacturer to understand the benefits for the target market before they distribute.

Price and value assessments should be supported by customer research and data collected on retail customers and should be scrutinised at board level.

Price and value assessments will require careful consideration of the fundamental ways firms make money from retail customers. The value assessment is wider than just financial considerations. For example, the non-financial costs customers may incur include the firms' use of customer data. If customer data is used to develop and sell new products and services, the firm should consider the value of this and factor it into the fair value assessment.

Finally, it is important to note that there are rules on 'fair and value', and 'value assessments' elsewhere in the FCA Handbook. For example, authorised fund managers will already be carrying out a detailed annual assessment of the value that their authorised funds deliver under the Collective Investment Schemes sourcebook in the FCA Handbook. It is useful note that where a fair value assessment has been carried out under other rules, there is no need to repeat the fair value assessment separately under the Duty. However, as mentioned above, the Duty covers all firms that manufacture or distribute products for retail customers which means that distributers including authorised investment fund managers managing unauthorised funds with retail customers will be required to demonstrate that they are providing fair value for the first time.

Consumer understanding

This outcome focuses on the whole consumer journey, and so goes beyond the existing Principle 7 (clear, fair and not misleading communications). This outcome will be particularly important for asset managers, as asset managers can act in situations where there can be significant information asymmetries and behavioral biases. Indeed, consumer harm arises where communications encourage customers to make decisions without full awareness of relevant information (especially in relation to costs and exclusions about a particular product or service). For instance, the FCA has identified poor practices in relation to charging information, including:

- a lack of succinct comprehensive list of charges being clearly sign-posted;

- information being spread out across different webpages;

- too many links to different sections and pages;

- omission of a clear statement of the interest applying to any cash held or the information being 'hidden away' in legalistically worded terms and conditions.

Asset managers must communicate in a way that customers can understand and offer appropriate customer support standards. Asset managers must support their customers' understanding by ensuring that their communications meet the information needs of customers and equip them to make decisions that are effective, timely and properly informed. The communications must also be tailored to take into account the characteristics of the customers intended to receive the communication - including any characteristics of vulnerability, the complexity of products, the communication channel used, and the role of the firm. In relation to communicating complex products, we recognise that some documents, such as the UCITS prospectus, require firms to communicate large amounts of relatively complex information to customers. This is where firms need to pay attention to the FCA's guidance on 'simple' communications. For example, where the use of jargon or technical terms is unavoidable, firms should explain the meaning of key terms in plain and intelligible language that retail customers are likely to understand. Expanding on this, the FCA has found evidence that having risk warnings that clearly describe the risks can help customers better understand the risks associated with high risk investments. The prescriptive nature of some customer communications (such as the UCIITS KIID or PRIIPs KID) means firms have little flexibility in adapting them. This is where firms need to pay attention to the FCA's guidance on 'layering' information. This is presenting information in a logical order with key information up front and signposting more detailed information in a logical order with key information up front and signposting more detailed information that can be accessed later on.

Importantly, the Duty requires firms to test communications before sending them out, and to monitor their impact regularly, where these steps are proportionate taking into account factors such as the scope for harm if retail customers misunderstand or overlook the information. In addition, in one-to-one interactions with retail customers, firms should use opportunities to check that customers understand relevant information provided to them, particularly if the information prompts the customer to make a decision. For asset managers, examples of communications that require testing and ongoing monitoring may include information on costs and charges, fund objectives and investment policy, risk and reward profile, performance and redemption terms. At Freeths, our Terms of Business have been given the Crystal Mark by the Plain English campaign, which is part of our work to test the clarity of our communications. This could be a useful starting point for asset managers, but data on consumer understanding should also be collected.

Firms should take particular care when communicating with consumers in vulnerable situations. Asset managers in particular should consider how they can accommodate the needs of vulnerable investors, who for example, may need to receive their money promptly on redemption or have difficulty with a particular communication channel. For example, some customers may find it difficult to take in information provided over the phone and have a need for written communications. Other customers may find written communications difficult to deal with and have a need for additional support. Firms will usually need to be able to provide support to their customers through different channels or by adapting their usual approach.

Firms offering more complex products and services should take extra care to promote, and monitor, customer understanding.

Consumer support

Under the consumer understanding outcome firms should communicate with customers in a way that equips them to make effective, timely and properly informed decisions. Under the consumer support outcome firms should enable customers to act on these decisions without facing unreasonable barriers.

The FCA states that in complying with customer support outcome, firms should consider their call waiting times. Customers should not be waiting significantly longer for their call to be answered in relation to a post-sale issue than to take out a product or service.

Asset managers should identify all channels of communication and support customers might access and consider how each of these channels will meet the new standards. In doing so, firms should ensure the various channels of communication meet the needs of customers, including customers dealing with non-standard issues, and customers with characteristics of vulnerability. For example, platform providers should be aware that badly designed websites that make it difficult for customers to find key information online are likely to be non-compliant. In relation to vulnerable customer redeeming investments, the guidance also states that unreasonable delays in making payments to retail customers will be non-compliant.

Actions for asset managers

Asset managers should currently be implementing their implementation plans. Manufacturers should also be preparing for providing information on the target market and customers to distributers by 30 April 2023. The FCA has stated that it expects firms to make use of the whole implementation period and to be able to demonstrate the progress of this when asked.

In addition to the above, we recommend you take the following actions, if you have not already done so:

- Undertake training to ensure all senior management are aware of the significance of the new Consumer Duty and their role and obligations in terms of ensuring compliance with the new standards.

- Evaluate the implications of the Duty on your business model and strategy - for example, asset managers should consider whether any changes are needed to products, services or distribution channels to ensure that customers get a fair value.

- Take into account any cultural changes in the business that are needed to ensure that the staff are proactive in complying with the Duty.

- Engage early with platform providers and other firms in your distribution chain and obtain any information, such as information from platform providers on distribution.

- Take ownership of the implementation plan at a board level, ensuring each step is implemented on time and the plan is continually updated.

- Start thinking about the annual assessment of compliance with the Consumer Duty early (the FCA expects Boards to review at least annually an assessment of whether the firm is delivering good customer outcomes in line with the Duty).

How can our financial services team help?

Our team would be very happy to advise on and assist you with your next steps. Our Financial Services Regulation team can assist you with all aspects of complying with the Duty and putting your implementation plans into practice in your business. We regularly advise on complying with regulatory obligations and implementing and adapting to regulatory change. Our Financial Services Regulation team has extensive experience in the asset management sector (some of our experience can be viewed here) and has experience assisting firms to prepare for the Consumer Duty. Our expert team is able to assist you with considering how the Consumer Duty regime will impact your firm and what changes and reviews will be needed so as to ensure that you can be confident in your ability to evidence immediate compliance once the new rules take effect.

Originally published 15th Nov 2022

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.