Any activity that positively impacts the physical, social, mental or financial well-being of an individual must as a principle be democratic and allow everyone to participate without any obstacles.

We believe in democratic participation creating equal opportunity and we are about to extend this philosophy to the world's largest market - the financial derivatives industry worth about $1200 trillion annually in traded value.

That's a few trillion dollars every day.

Click here to see the relative market sizing as shown by the money project.

To bring real and true democracy to the financial derivatives space we have followed a 2-part process.

First, we focused on enabling the true decentralization of the derivatives market.

Second, we address all the discriminatory factors keeping the vast majority of the global population out of the derivatives space. We are driving a fundamental ground-up overhaul of the derivatives industry with the sole purpose of creating additional value for all market participants - current and new.

Get a handle on derivatives with this quick

overview:

https://www.investopedia.com/terms/d/derivative.asp

And this point is especially important - opening up this market to new participants, who have (up until now) been disenfranchised by the system, will ultimately benefit everyone.

Because at the end of the day - democracy pays.

The way we at CloseCross have set about meticulously addressing all the failures of the current system and creating a ground-up new derivatives environment is a testament to how strongly we feel about economic discrimination and our faith in the power of democratic participation as it pertains to everything in our society.

Derivatives and their role in a Decentralised Economy

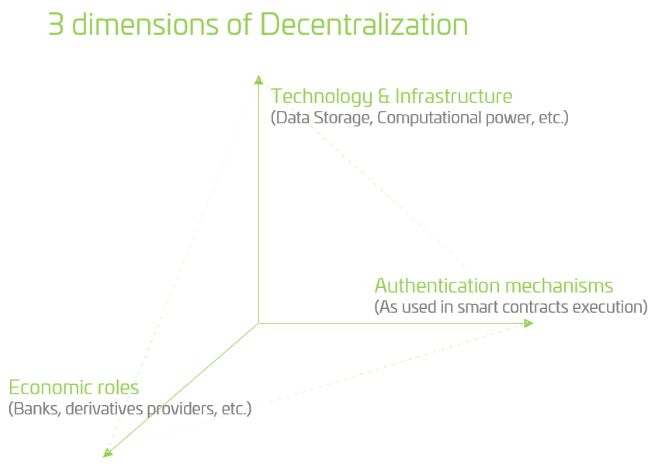

Decentralization is a core theme to every crypto start-up and this can occur along one or all the 3 dimensions of decentralization - technology/infrastructure; authentication mechanisms and economic role decentralization.

Technology/infrastructure decentralization and authentication mechanisms' decentralization are brought to life by the use-cases where they are used - that is where the real value add for the end-users and society lies - in the creation of true decentralized societies covering the depth and breadth of everything we do.

CloseCross goes a step beyond and utilizes these decentralized infrastructure and authentication layer to eliminate the role of financial derivative providers (such as Goldman Sachs, JPMorgan, Citi, etc.) as well as all the other intermediaries that lay between a market participant and the said derivatives issuer/provider - for example the banks, trading houses1, brokerage firms, etc.

Read on to see how we enable direct interaction of all market participants through Virtual Prediction Floors (VPFs) and create a completely transparent environment with access to crowd wisdom information sources and shared risk-reward mechanisms.

The guiding principle for us always will be the creation of additional value for the market participants - the common people. Through the elimination of the centralized economic role of a derivatives issuers and other intermediaries, we can reduce the cost of derivatives trading by as much as 90% for the non-professional traders.

More significant though is that CloseCross will never be a party to the VPFs where market participants direct trade between themselves.

Unlike the current system, there is no incentive or possibility of CloseCross (mis)using the crowd wisdom. We don't need to price the contracts, so there will be no price premiums and spreads to take into account. If you predict correctly, you will have a positive ROI.

Genesis

The idea for such a decentralized derivatives platform first occurred to CloseCross founder, Vaibhav Kadikar, in 2007 after years of centralized derivatives trading.

This idea was born of a deeply-rooted conviction (gained after years of working in the derivatives market) that there had to be a fairer and more transparent way for people to trade among themselves. And that it was possible to do this without some centralized party acting as a lord over our information and money.

The key to figuring out the solution lay in answering these questions:

- How to replace/replicate the efficient market dynamics that exist in a continuous trading environment?

- How to price in information and equate risk/reward in a decentralized environment where there isn't a central party performing that function?

The answer came in the shape of the, now patented, invention of the Virtual Prediction Floors' settlement mechanism (VPF) and the Knowledge Value of Time algorithms (KVOTA). These are the core innovations that we introduce.

VPFs allow all market participants to enter a single multi-party derivatives contract that drives a common settlement mechanism for all participants in an autonomous manner.

KVOTAs ensure that we can dynamically assess the risk each market participant undertakes at their point of entry and then reflect this in a differentiated return on investment at the derivative maturity time. Together they create a decentralized derivatives world all market participants will benefit from.

Need an overview of derivatives? Check out this video: https://www.youtube.com/watch?v=gCHiLLgO55o

Democratization by addressing systemic failures of the current derivatives setup

For financial inclusion and economic equality to become a reality, we cannot accept the fact that participation in derivatives markets is limited exclusively to a very small part of the population.

At CloseCross we feel very strongly about correcting the systemic failures of the current derivatives structure and operations that drive this discrimination and deter the vast majority of people from participating in this market.

The current system, enabled by the centralized parties and their complex instruments, discriminates against wider participation in several ways:

1. Limiting Participation: Complex knowledge required

The Problem: High knowledge threshold to participation

Unless you understand how to read a derivatives contract and create an excel sheet where you can calculate your break-even and ROI (return-on-investment) based on delta, vega, rho, etc. you will be lost and overwhelmed. This is one of the most important factors keeping people shut out from trading derivatives - the unnecessarily complicated terminologies used.

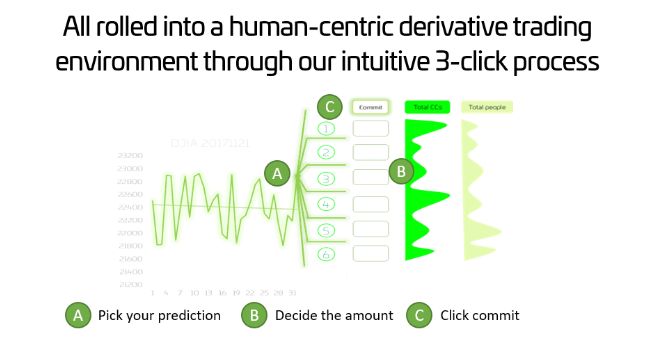

Our Solution: Placing all on an equal playing field

CloseCross simplifies the entire process of understanding and participating in derivatives market by introducing 3-click derivatives trading. This means the process is simple enough for any financial layman to understand and execute. Once you have selected the asset VPF you would like to trade in, you simply make a prediction (range bound options covering up and down movements) and commit any amount you like from $0.01 to infinity.

2. Limiting Participation: Significant investment needed

The Problem: High monetary threshold to participation

Unless you have a significant chunk of cash to invest, you may not even see a positive ROI or profits after correctly predicting the price of the underlying asset. This happens in cases where the fees you pay for the various intermediaries in the form of account maintenance fees, deposit accounts, brokerage fees, contract price premiums and the spread are higher than the potential profit you make.

Typically, one needs to invest at least a few thousand dollars on a derivatives trade to make a profit after recovering the costs of transacting. This keeps potential participants with smaller pockets out of the game altogether.

The Solution: No Threshold to Participation

The Solution: No Threshold to Participation

3. Limiting Participation: Risk

The Problem: Unquantified Risk driven by leverage and extreme volatility

Warren Buffet once called financial derivatives the "weapons of mass destruction" from an economic perspective. This was said to acknowledge the potentially unknown/unquantified risks that are a standard in traditional markets.

In current system, where each derivative contract is 1-on-1 each party assumes same level of risk and reward - your risk is the issuers reward, and their risk is your reward.

Hence, if you want to earn an extraordinary return you have to accept equal risk on the other hand. If you want to leverage and earn a higher return you in turn also accept the high risk to balance the transaction. The fear of losing more than you may possess keeps a vast majority of potential users out of the derivatives trading space

The Solution: Fixed Risk multi-party participation

We have eliminated the unquantified risk by converting the 1-on-1 relationship to 1-to-many. In doing so, you do not need to leverage and risk up in order to earn a higher reward. By participating in a multi-party VPF you have access not just to one counterparty but multiple counterparties simultaneously who take a different position within the VPF i.e. predict a different price range for the asset. You hence have access to a much higher potential return, whereas your risk is fixed to the amount you put into the VPF. You can never lose more than you put in, and your return is theoretically limited only by the amounts put in by all the counterparties.

4. Limiting transparency: Systemic opaqueness of current system

The Problem: Exclusive and limited access to information

When you participate in a derivatives trade today you do not have any information on how many others are participating as well. This means that for a particular asset (Gold, Bitcoin, Apple stock) there may be thousands participating - or none at all

You also do not know what these people are predicting - are they counting on the price going up or are they predicting the price will go down. You essentially miss out on this information set, which would be vital for you to see the evolution of the "crowd wisdom". Obviously, if you had this information, you would be able to make a much better prediction than without it!

However, the centralized parties who sit at the heart of the derivatives market do not miss out on this information. Essentially, once you have a few hundred predictions from different individuals, you can statistically have a very high level of confidence as to the market sentiment. The central issuers then use this information to price their call (you would buy call options if you thought the price would go up) and put options (conversely you buy put options if you think the price of asset is likely to fall) accordingly.

The same centralized parties also have price premiums to play with to make an adverse outcome more appealing to the participants - think of it as someone offering you higher odds on an unlikely event.

The Solution: Providing crowd wisdom as a source of information

With CloseCross, crowd wisdom comes as a standard feature. You will always know what all the other participants are predicting, how many participants there are and what is the spread of money along the range bound options. All anonymous aggregated information of course. This is radical and liberating transparency.

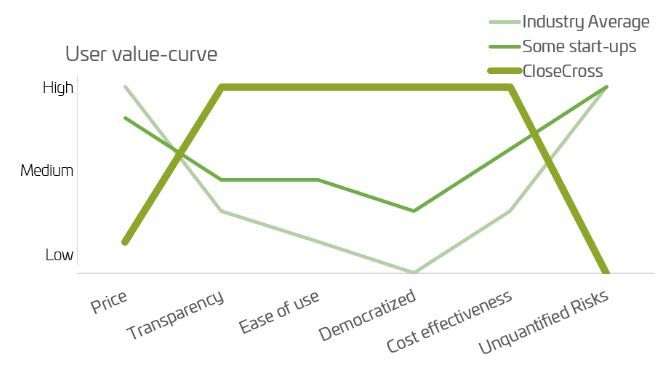

Turning the user value curve on its head

Close Cross stands on the three pillars of decentralization, transparency and enabling democratic participation to disrupt the derivative markets. We couldn't help ourselves and created the visualizations below as a guide to how we are changing the key parameters that are evaluated by potential participants. We believe that this can help set ourselves up to successfully disrupt and decentralise the derivatives space and expand to a whole new audience/participant base.

So now that you understand the core values behind the CloseCross platform, we invite you to follow us - and participate in our growing community. After all - we are about crowd wisdom and your thoughts and feedback are invaluable to us!

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.