Please find attached the monitoring report for the period 1 March 2023 to 31 March 2023. This monthly report aims to provide you with a summary analysis of the potential impact of new developments on your business.

Starting on 1 January 2023 we are limiting the monthly report to developments that we have identified as having a potentially medium or high risk impact (with all lower risk developments intentionally omitted). This change is intended to make the report shorter and more easily comprehensible. Should you however wish a full report – including all developments and all risks, and including direct hyperlinks and filtering/data extracting possibilities – please do not hesitate to contact us.

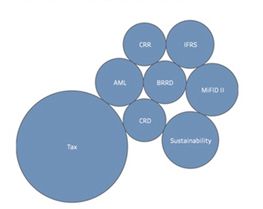

What is the origin of the documents reviewed?

What are the important tendencies?

What are the important documents of the month in review?

| Date | What is this about? | ⠀ | What is the title of the document? | What do you need to know? | Risk |

| 31/03/2023 | Funds | BE | Notification procedure for collective investment undertakings governed by the law of another Member State of the European Economic Area and meeting the conditions of Directive 2009/65/EC | The FSMA has published an update to the circular on the notification procedure for UCITS of another Member State of the EEA in Belgium. | Medium |

| 30/03/2023 | CRR | EU | Corrigendum to Regulation (EU) No 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investment firms and amending Regulation (EU) No 648/2012 | In this corrigendum to Regulation (EU) No 575/2013 the definition of "subsidiary" has been corrected. | Medium |

| 30/03/2023 | IFRS | EU | Report 27th Extract from the EECS's Database of Enforcement | ESMA has published extracts from its (confidential) database of enforcement decisions on financial statements, with the aim of strengthening supervisory convergence and providing issuers and users of financial statements with relevant information on the appropriate application of the International Financial Reporting Standards (IFRS). | Medium |

| 30/03/2023 | MiFID II | EU | Supervisory Briefing On supervisory expectations in relation to firms offering copy trading services |

ESMA has published a supervisory briefing on firms offering copy trading services. This briefing includes guidance on the qualification of copy trading services as an investment service and it sets out supervisory expectations with regard to MiFID II requirements on

|

Medium |

| 29/03/2023 | Credits | BE | Wetsvoorstel tot wijziging van het Wetboek van economisch recht voor wat betreft het vaststellen van de maximale dossierkosten bij een hypothecair krediet met een onroerende bestemming |

A draft bill to reduce the current ceilings for the different types of filing fees for mortgage loans has been introduced in the Belgian Parliament. The draft bill also foresees the inclusion of the ceilings in the Code for Economic Law. The draft bill also provides for a mandate to establish by royal decree a method for determining the maximum appraisal costs and for their possible adjustment. |

Medium |

| 28/03/2023 | AML | BE | Update of the section of the NBB's website devoted to anti-money laundering and counter-terrorist financing (AML/CFT) |

The NBB's AML/CFT site has been updated

|

Medium |

| 27/03/2023 | Fit and proper | BE | Shareholder supervision – New form "senior manager of a proposed qualifying shareholder" | The NBB informs any legal person intending to acquire, increase, reduce or transfer a qualifying holding in a financial institution governed by Belgian law and which is subject to the supervision of the NBB that a new standard form has been developed for assessing the professional propriety of their senior managers. | Medium |

| 27/03/2023 | Insolvency | BE | Wetsontwerp tot omzetting van Richtlijn (EU) 2019/1023 betreffende preventieve herstructureringsstelsels, kwijtschelding van schuld en beroepsverboden, en maatregelen ter verhoging van de efficiëntie van procedures inzake herstructurering, insolventie en kwijtschelding van schuld, en tot wijziging van Richtlijn (EU) 2017/1132 en houdende diverse bepalingen inzake insolvabiliteit. |

This Bill aims to transpose European Directive (EU) 2019/1023 into Belgian insolvency law. In addition, Book XX of the Code of Economic Law will also be adapted to the requirements set by the Court of Justice of the European Union in the Plessers rulings of 16 May 2019 and Heiploeg of 28 April 2022 that impose certain changes to the reorganisation by transfer of companies. Furthermore, bankruptcy laws are being amended and it will become easier to liquidate companies in certain circumstances. Post-bankruptcy debt discharge will be relaxed and brought in line with Constitutional Court case law. The second-chance policy, which encourages entrepreneurship and enables a fresh start, is central to this. |

High |

| 27/03/2023 | MIFID II | EU | Guidelines on MiFID II product governance requirements – Final report |

ESMA has published its Final Report on Guidelines on MiFID II product governance guidelines. The main amendments introduced to the guidelines concern

The Guidelines will be translated into the official languages of the EU and published on ESMA's website. The publication of the translations will trigger a two-month period during which national competent authorities must notify ESMA whether they comply or intend to comply with the Guidelines. The Guidelines will apply two months after the date of the publication on ESMA's website in all EU official languages. |

High |

| 27/03/2023 | Sustainability | EU | Proposal for a Directive of the European Parliament and of the Council on substantiation and communication of explicit environmental claims (Green Claims Directive) |

The EU Commission has adopted a proposal for a Directive on green claims – the "Green Claims Directive". This proposal aims to

To ensure consumers receive reliable, comparable and verifiable environmental information on products, the proposal includes

The proposal targets explicit claims that (1) are made on a voluntary basis by businesses towards consumers, (2) cover the environmental impacts, aspects or performance of a product or the trader itself and (3) are not currently covered by other EU rules. |

High |

| 27/03/2023 | Tax | BE | Wetsontwerp tot wijziging van het Wetboek van de belasting over de toegevoegde waarde betreffende de invoering van bepaalde informatieverplichtingen voor betalingsdienstaanbieders |

This draft Law makes amendments to the Value Added Tax Code to introduce certain information requirements for certain payment service providers, following the transposition of Council Directive (EU) 2020/284 of 18 February 2020 amending Directive 2006/112/EC as regards the introduction of certain requirements for payment service providers. This Directive introduces an obligation on payment service providers to keep sufficiently accurate records of relevant cross-border payments per calendar quarter and to then provide that information to the tax administrations of the relevant Member States. |

High |

| 20/03/2023 | Crypto assets | BE | Koninklijk besluit tot goedkeuring van het reglement van de autoriteit voor financiële diensten en markten dat beperkende voorwaarden verbindt aan de commercialisering van virtuele munten bij consumenten |

A Royal Decree has been published in the Belgian State Gazette that introduces a strict framework for any advertising of virtual currencies to consumers. The requirements shall apply when advertising virtual currencies in Belgium to consumers both as a regular professional activity and on an occasional basis for a remuneration. Commercialisation is broadly defined as any communication specifically aimed at promoting the purchase or subscription of one or more virtual currencies, regardless of the medium used or the measing of diffusion. The Royal Decree contains content requirements and a series of mandatory mentions but also foresees that the advertisements need to be notified to the FSMA at least 10 days before diffusion. |

High |

| 20/03/2023 | M&A | BE | Wetsontwerp tot wijziging van het WVV, van de wet van 16.07.04 houdende het Wetboek van internationaal privaatrecht en van het Gerechtelijk Wetboek, onder meer ingevolge de omzetting van Richtlijn (EU) 2019/2121 van het Europees Parlement en de Raad van 27.11.19 tot wijziging van Richtlijn (EU) 2017/1132 met betrekking tot grensoverschrijdende omzettingen, fusies en splitsingen |

A draft law transposing Directive (EU) 2019/2121 with respect to cross-border conversions, mergers and divisions and also contains various provisions on restructuring (merger and division) of companies (the Mobility Directive) has been introduced in the Belgian Parliament. Directive 2019/2121 aims to promote freedom of establishment within the EU by making it easier for companies to participate in cross-border mergers, divisions and conversions, while strengthening the rights of stakeholders (shareholders, creditors and employees). To this end, Directive 2019/2121 amends the already existing Directive (EU) 2017/1132 on certain aspects of company law. Directive 2019/2121 contains harmonized rules for cross-border conversions and divisions, on the one hand, and amendments to the existing cross-border merger procedure, on the other, in order to increase its effectiveness and efficiency. |

High |

| 01/03/2023 | GDPR | EU | Opinion 5/2023 on the European Commission Draft Implementing Decision on the adequate protection of personal data under the EU-US Data Privacy Framework |

The EDPB adopted its opinion on the draft adequacy decision regarding the EU-U.S. Data Privacy Framework in which it welcomes substantial improvements such as the introduction of requirements embodying the principles of necessity and proportionality for U.S. intelligence gathering of data and the new redress mechanism for EU data subjects. At the same time, the EDPB expresses concerns and requests clarifications on several points. These relate in particular, to certain rights of data subjects, onward transfers, the scope of exemptions, temporary bulk collection of data and the practical functioning of the redress mechanism. |

Medium |

| 01/03/2023 | Sustainability | EU | Sustainable finance: Provisional agreement reached on European green bonds |

Negotiators of the Council and the European Parliament reached a provisional agreement on the creation of European green bonds (EuGB). This regulation lays down uniform requirements for issuers of bonds that wish to use the designation 'European green bond' or 'EuGB' for their environmentally sustainable bonds that are aligned with the EU taxonomy and made available to investors globally. It also establishes a registration system and supervisory framework for external reviewers of European green bonds. To prevent greenwashing in the green bonds market in general, the regulation also provides for some voluntary disclosure requirements for other environmentally sustainable bonds and sustainability-linked bonds issued in the EU. The agreement is provisional as it still needs to be confirmed by the Council and the European Parliament, and adopted by both institutions before it is final. It will start applying 12 months after its entry into force. |

Medium |

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.