Nigeria's financial landscape has witnessed a remarkable transformation driven by the rise of financial technology (fintech). The concept of going cashless has gained significant momentum, particularly steered by the government's ambitious pursuit of a cashless economy coupled with the increasing adoption of digital payment solutions. Just a few years after the Central Bank of Nigeria (CBN) launched the country's (and Africa's) first digital currency – eNaira1, the CBN has launched a domestic card scheme, AfriGo,2 to fortify its quest for a cashless economy spiraling many including small and medium scale enterprises to brace up for change.

Download a copy of this full report in PDF here

Major Forces Driving the Cashless Movement

Firmus' evaluation of Nigeria's journey towards a cashless society is rooted in four fundamental premises: (1) a decrease in cash dependency, (2) growth in fintech infrastructure, (2) a boost in financial inclusion, and (4) an increase in cost savings.

- Decrease in cash dependency: Historically, Nigeria's reliance on physical currency has led to security vulnerabilities, inefficiencies, and challenges in maintaining transparency in financial transactions. The majority of the government's cash transactions for instance have crossed legal limits, with over $ 2.4 billion withdrawn from government accounts in the form of cash.[1] Also, a large percentage of adult Nigerians continue to use cash as the primary medium for completing transactions. Embracing digital payment solutions offers a way to reduce dependency on physical cash, mitigate risks associated with carrying large cash such as robbery, and enhance the overall efficiency of conducting transactions. As more individuals and businesses transition towards digital platforms, the advantages of conducting transactions without the constraints of physical cash become increasingly evident.

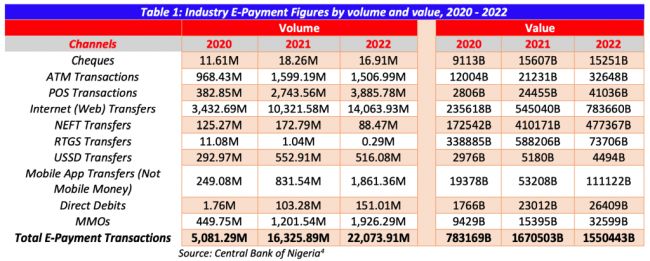

- Growth in fintech infrastructure: Nigeria's fintech ecosystem has evolved from its nascent stages to a robust and dynamic landscape. With the proliferation of digital payment solutions, mobile apps, and online platforms, Nigeria's fintech ecosystem is expanding at an unprecedented pace. This growing trend has not only revolutionized how Nigerians transact and conduct business but has also led to further diversified offerings including insurance technology, blockchain-based solutions, cryptocurrency adoption, and robo-advisors resulting in a growing number of Nigerians embracing digital assets for remittances and investments. Data from the Central Bank of Nigeria shows that the total volume of e-payment has increased significantly from about 5 billion in 2020 to about 22 billion in 2022. In terms of value, total e-payment transactions shot up from about ₦783 trillion to ₦1,550 trillion within the same period (See Table 1 on the breakdown of total e-payment transactions from 2020 to 2022).

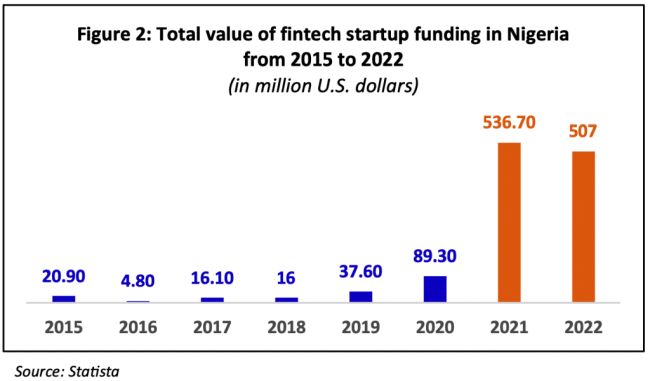

Noticeable within the growing fintech space is the emergence of Fintech startups as game-changers causing both innovations and disruptions within the fintech ecosystem. Between 2015 and 2022 alone, the total value of fintech startup funding in Nigeria increased more than twenty-fold (20x) shooting up from about $21million to $507million (see figure 2). Adding on to these figures, in the early quarter of 2023, Nigeria's government launched a $618 million fund under the Investment in Digital and Creative Enterprises (iDICE)3 and jointly financed by major developing partners such as African Development Bank, Agence Francaise de Developpement and Islamic Development Bank, to support young tech entrepreneurs who particularly find it difficult to raise capital.4 The expanding fintech infrastructure together with increased capital traction in the sector demonstrates the adaptability of the Nigerian market and signifies the readiness of consumers and businesses to embrace digital alternatives to traditional cash transactions.

- Boost in financial inclusion: Although Nigeria's evolved fintech ecosystem has led to a decrease in the unbanked population, there still remains a gap of about 64 million5 people that are yet to be captured. Firmus recognizes that one of the most transformative outcomes of Nigeria's cashless trajectory is the potential to promote financial inclusion on an unprecedented scale. With a significant portion of the population unbanked or underbanked, fintech companies are presented with a unique opportunity to bridge the financial divide. By providing accessible and user-friendly digital payment platforms, fintech firms are opening the doors to formal financial services for those who were previously excluded. With a cashless system in place, Firmus anticipates a potential faster rate of capturing the unbanked population, improving the socio-economic status of millions and propelling economic growth across various sectors.

- Increase in cost savings: The significant cost savings that the adoption of digital payment solutions and cashless transactions can yield cannot be overemphasized.Embracing digital payment solutions not only enhances convenience but also offers a cost-effective alternative to traditional cash transactions. The elimination of physical currency reduces the expenses associated with printing, transporting, and handling cash such as ATM fees and currency conversion costs. Businesses can streamline their operations by adopting digital payment methods, resulting in lower administrative costs and increased operational efficiency. By creating an environment where both businesses and consumers can enjoy the advantages of reduced transaction costs, Nigeria is incentivizing the adoption of digital payments, further driving the nation towards a cashless future. As the nation continues to navigate its path towards a cashless future, these driving forces provide a strategic framework for understanding potential impact, opportunities and challenges that lie ahead.

Current Fintech Solutions in Nigeria

Since the early 2000s when Nigeria began its journey towards a financially techy economy with the rapid adoption of mobile phones and growing need for innovative financial services, the country has seen a widespread introduction of fintech solutions that have significantly re-shaped the financial ecosystem. These solutions span various segments, from mobile payments and digital wallets that enable swift and convenient transactions, to peer-to-peer lending platforms that enhance access to credit. Online banking platforms or digital banking and neo-banks are also redefining traditional banking experiences, while remittance services are streamlining cross-border money transfers. In recent times, there has been a rise of cryptocurrency platforms and blockchain applications which are gradually gaining deep ground, introducing new ways of conducting transactions and opening new doors to financial activities. Below are key segments of fintech solutions in Nigeria including major players dominating these segments.

Impact on Economy, Sectors, and Industries

For the past decade, Nigeria has reaped huge benefits due to growth and transformations in the fintech sector. Since 2018, over $1billion has been invested into the fintech sector fueling economic growth and development.6 Additionally, the proportion of unbanked has decreased with improved access to payment services, credit and savings. For instance, an initiative undertaken by the Central Bank of Nigeria in 2012, the National Financial Inclusion Strategy in 2012, was set to see adult Nigerians with access to payments service increase from 21.6% in 2010 to 70% in 2020 while those with access to savings increase from 25% to 60. Additionally, those with credit access was to increase from 2% to 40% over the same period.7

The transition towards a cashless society in Nigeria holds significant potential to reshape the nation's economy including its sectors and industries across various dimensions as well as reap in positive benefits. This transformation, driven by the adoption of digital payment solutions and fintech innovations, has far-reaching effects that span economic growth, consumer behavior, operational efficiency, and overall market dynamics. We anticipate that the pursuit for a cashless society will not only further decrease the underbanked population but also enhance economic growth and productivity in Nigeria. With businesses having their operations streamlined and transaction times reduced following the adoption of digital payments, we project enhanced productivity across sectors, ultimately contributing to economic development. From our assessment, we predict that the outcome of this movement could see several million added to the economy. We also expect this transition to shift human behavior to seek more online transaction thereby boosting the need for e-commerce and online marketplaces. This behavioral pattern could trigger innovations from businesses to meet new demands, which could also stimulate cross-border trade and commerce.

Industries and sectors will experience their fair share of impact. While retail, e-commerce, and financial services will see an exceptional boost in their sectors, other sectors will also be hit with major transformations which present many opportunities amid setbacks and challenges. Nevertheless, these strides present a plethora of opportunities for potential investors.

Market Potential and Investment Opportunities

The convergence of a burgeoning fintech ecosystem, a tech-savvy population, and a government commitment to digital transformation creates fertile ground for both local and international investors. Firmus identifies six (6) major market potential and investment opportunities that the cashless drive presents in Nigeria.

To view the article in full click here

Footnotes

1. https://www.statista.com/outlook/dmo/ecommerce/nigeria

2. https://www.mckinsey.com/featured-insights/middle-east-and-africa/harnessing-nigerias-fintech-potential

3. Torsten Wezel ; Jack J Ree, IMF: Nigeria—Fostering Financial Inclusion through Digital Financial Services: Nigeria, March 2023

4. https://www.cbn.gov.ng/fininc/

5. https://africa.businessinsider.com/local/markets/64-million-people-in-nigeria-still-unbanked-world-bank/nxymp3b

6. iDICE is a government initiative aimed at fueling innovation and entrepreneurship within the digital tech and creative industries.

7. https://www.reuters.com/technology/nigeria-launches-672-million-tech-fund-young-investors-2023-03-14/

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.