Understanding Capital Reduction 1:

In simple words , reduction of capital occurs where a company reduces the amount of its share capital. Capital reduct ion involves strategic reshaping of a company's financial structure. It's a deliberate move where a company decides to decrease its total share capital , aiming for a more efficient and streamlined financial setup.

As per Section 66(1) of the Companies Act 2013:

Subject to confirmation by the Tribunal on an applicat ion by the company , a company limited by shares or limited by guarantee and having a share capital may , by a special resolution, reduce the share capital in any manner and in particular may -

- a. extinguish or reduce the liability on any of its shares in respect of the share capital not paid-up; or

- b. either with or without extinguishing or reducing liability

on any of its shares

- cancel any paid-up share capital which is lost or is unrepresented by available assets; or

- pay off any paid-up share capital which is in excess of the wants of the company.

alter its memorandum by reducing the amount of its share capital and of its shares accordingly . It is important to note that , as per this section, no such reduction shall be made if the company is in arrears in the repayment of any deposits accepted by it , either before or after the commencement of this Act , or the interest payable thereon.

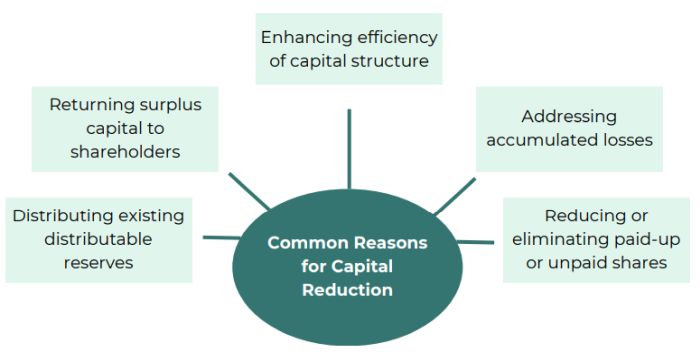

Scenarios where companies might think of Capital Reduction:

To view the full article click here

Footnote

1. The article reflects the general work of the authors and the views expressed are personal. No reader should act on any statement contained herein without seeking detailed professional advice.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.