In Crédit Agricole Corporate & Investment Bank, Singapore Branch v PPT Energy Trading Co Ltd and another appeal [2023] SGCA(I) 7, the Singapore Court of Appeal clarified the scope of the fraud exception in the context of letters of credit, and rejected an issuer's attempt to challenge the validity of a letter of credit on grounds of a fraud perpetrated by the buyer, its customer, which the beneficiary was not party to.

Notwithstanding the above, the Court of Appeal overturned the decision of the Singapore International Commercial Court (SICC) at first instance, to find that the beneficiary had breached its warranty of having marketable title to the cargo at the time property passed. The beneficiary was therefore liable, under a letter of indemnity (LOI) presented to the issuer in lieu of bills of lading for payment under the letter of credit, for losses resulting from that breach.

Our Comments

The outcome of this appeal would be welcomed by trade financiers. On the other hand, the appeal is a timely reminder to traders that the onus falls on them to exercise diligence at the time of issuing an LOI for the purposes of presentation under a letter of credit, so that they are able to ensure whether the representations and warranties contained in the LOI are accurate.

From a legal perspective, it is somewhat unfortunate that the issuer did not seize the opportunity to appeal the holding by the SICC on the fraud exception to an issuer's obligation to pay. For context, the SICC had held at first instance that a presentation "recklessly" made by the beneficiary could not vitiate the presentation.

In particular, the Court of Appeal's remarks on how the beneficiary's ignorance of the general level of market prices and its disinterest in what was going on were "remarkable", and that "the attempts at trial on the part of [the beneficiary's] witnesses to deny any knowledge of such round-tripping were unbecoming and redolent of [the beneficiary's] lack of good faith" are noteworthy, and shed light on how the apex court viewed the beneficiary's conduct.

The authors also highlight that, since this appeal was heard, the General Division of the High Court of Singapore handed down a decision in Winson Oil Trading Pte Ltd v Oversea-Chinese Banking Corporation Limited [2023] SGHC 220, declining to adopt the approach of the SICC on the fraud exception (our firm's update on this decision is available here).

While the issuer in this case succeeded in overturning the SICC's decision on appeal, its decision not to appeal the SICC's findings on fraud likely resulted in a practical difference in what it was able to recover (to the tune of US$7.15 million).

Given that the issuer only succeeded on the narrow ground of there being a breach of a warranty under the LOI, its remedy was confined to damages for the losses that it was able to prove and quantify, after deducting any losses it was able to mitigate through other avenues.

Here, as the issuer had failed to set aside the letter of credit on account of its customer's (and not the beneficiary's) fraud, it could not claim for loss that it could only have avoided if it had not entered into those documents at all. Hence, even though the issuer was ultimately successful on appeal, this legal distinction significantly reduced the amount the issuer could recover.

This update takes a look at the Court of Appeal's decision.

Background

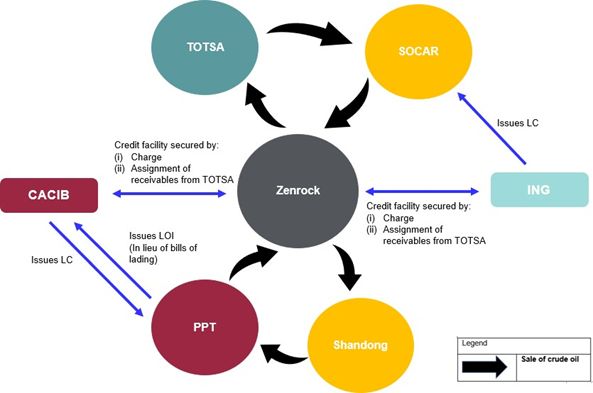

The dispute centred on the claims by an issuer of a letter of credit, Crédit Agricole Corporate & Investment Bank, Singapore Branch (CACIB), that it was induced by the fraud of its customer, Zenrock Commodities Trading Pte Ltd (Zenrock), to issue a letter of credit dated 3 April 2020 (LC). The LC was made in favour of the seller-beneficiary, PPT Energy Trading Co. Ltd. (PPT).

The LC was intended to finance Zenrock's purchase of a cargo of crude oil (Cargo) from PPT, for on- sale to Total Oil Trading SA (TOTSA). The LC was to be payable upon the presentation of, among other things, PPT's signed commercial invoice and an LOI issued to CACIB, in the absence of the original bills of lading for the Cargo.

The LOI contained, among other things, PPT's warranty of marketable title to the Cargo in these terms: "we hereby expressly warrant that at the time property passed under the contract we had marketable title to such shipment, free and clear of any lien or encumbrance".

This warranty was expressly given "[i]n consideration of [CACIB] making payment ... at the due date for payment under the terms of the [LC]" (Due Date).

In applying for the LC, Zenrock furnished CACIB both its contract to purchase the Cargo from PPT (PPT Contract) and a fabricated copy of its contract to sell the Cargo to TOTSA (Fabricated TOTSA Contract). The intention was to make it appear that Zenrock was selling TOTSA the Cargo at the Brent rate plus US$3.60 per barrel when, in reality, it was sold at a price of the Brent rate minus US$3.60 per barrel, i.e. the prices under the Fabricated TOTSA Contract were significantly inflated.

This arrangement gave the impression that the receivables under the Fabricated TOTSA Contract would cover the purchase price under the PPT Contract, which was to be financed by and paid out under the LC. Zenrock also purported to assign the receivables under the Fabricated TOTSA Contract to CACIB.

Crucially, Zenrock concealed from CACIB the fact that the PPT Contract was part of an elaborate circular trade within a lengthy chain of parties buying and selling the Cargo at prices about 50% higher than the then-prevailing market prices, that Zenrock had already sold the Cargo to TOTSA under a separate contract, and that the receivables under Zenrock's true sale contract with TOTSA were also already assigned to another lender, ING Bank NV (ING).

At around the time that PPT presented its signed commercial invoice and the LOI to CACIB for payment under the LC, CACIB learned about the double assignment of receivables and the sale terms under the Fabricated TOTSA Contract. CACIB obtained an ex parte interim injunction restraining payment under the LC. The interim injunction remained in force, until payment was made by CACIB to PPT pursuant to a negotiated accommodation reached between them.

Circular trade flow

CACIB then commenced proceedings against PPT seeking, among other things, a declaration that:

- PPT was not entitled to receive any sums under the LC as PPT had actual knowledge of, or was wilfully blind to, the fraudulent scheme to inflate the value of the Cargo and procure double financing for it; and/or

- PPT was in breach of the terms of the LOI and liable to pay damages corresponding to the sums payable by CACIB under the LC (LOI Issue).

The SICC's Decision

At first instance, the SICC found CACIB liable to pay PPT.

On the first issue, the SICC found that, while PPT was "hardly an innocent bystander", it had not acted fraudulently, despite being aware that Zenrock had purchased the Cargo from a third party within the circular trade before buying it from PPT further down the chain of sales and purchases. The SICC also found that PPT could not be said to have had actual knowledge of, or was wilfully blind to, the fraudulent scheme as PPT had, in this case, been offered a pre-structured deal similar to those done in the past, all of which had gone through successfully without any allegations of fraud.

As to the LOI Issue, the SICC found, among other things, that CACIB could not invoke a breach of warranties in the LOI as it was a unilateral contract, which never took effect because CACIB did not make payment under the LC by the Due Date. Without timely payment, there was no acceptance of the LOI and the warranties did not apply. In any event, the SICC also found there was no breach of warranties. It took the view that PPT's title was "marketable" and ownership could and did pass at the time of shipment in accordance with the terms of the PPT Contract.

CACIB appealed to the Court of Appeal against the SICC's decision. However, CACIB did not challenge the SICC's finding that PPT did not know of, or had shut its eyes to, the fraud.

The Court of Appeal's Decision

The Court of Appeal allowed CACIB's appeals, but solely on the ground that PPT had breached its warranty under the LOI that it had marketable title at the time property passed. It is crucial to note that, on appeal, CACIB did not seek to disturb the SICC's findings on the first issue concerning PPT's level of knowledge in the fraud.

Instead, CACIB argued on appeal that it was entitled to rely on Zenrock's (rather than PPT's) undoubted fraud to set aside and avoid liability to pay under the LC (LC Issue). CACIB's alternative ground of appeal was premised on the LOI Issue.

Findings on LC Issue

The Court of Appeal held that CACIB could not rely on the fraud by its customer, Zenrock, to deny payment to PPT under the LC.

It is trite law that a letter of credit creates a binding contract between the issuing bank and the seller- beneficiary, which is separate and autonomous from the underlying contract between its customer (the buyer in the underlying transaction) and the beneficiary (the seller in the underlying transaction). The Court of Appeal pointed out that the LC issued by CACIB was subject to the autonomy principle, and that the LC was separate from the underlying transactions and related contracts involving Zenrock.

The established fraud exception at common law which allows the bank to deny payment under the credit requires the seller-beneficiary to be party to the fraud. In an attempt to extend this exception to cases involving fraud by a third party, such as the customer, CACIB submitted that the bank should be entitled to impugn the validity of the credit where it had been induced by the customer's fraud to issue the letter of credit in favour of a beneficiary.

CACIB's submission was roundly rejected by the Court of Appeal for being "without precedent" and contrary to the express provisions of article 4 of the UCP 600.

Underscoring the need to uphold contracts between banks and beneficiaries, which are relied on daily and treated as binding by mercantile usage, the Court of Appeal observed that the key problem with CACIB's case was that it "significantly undermine[d] the whole system of documentary credits".

If the Court of Appeal had found in favour of CACIB on the LC Issue, no beneficiary could be assured of payment under a letter of credit, without investigating the integrity of the issuer's customer in its relationship with the bank, a "practical impossibility", or without procuring further contractual protection or insurance against the risk of the customer misleading the bank. This would be an unacceptable state of affairs, and the Court of Appeal "unhesitatingly" rejected CACIB's appeal on this ground.

Findings on LOI Issue

However, the Court of Appeal did overturn the SICC's decision on the second ground, and found that PPT had been in breach of the LOI, therefore entitling CACIB to claim damages for its losses.

The first issue before the Court of Appeal was whether the LOI was effective (and when it became effective). The Court of Appeal differed from the SICC on this point, holding that the LOI was effective from its date of issue and that CACIB's claim was not defeated simply because it did not make payment by the Due Date.

In the absence of any original bills of lading, it was already PPT's obligation to present the LOI under the LC, if it wished to be paid under the LC. In the same vein, CACIB had no option but to pay out under the LC if the LOI was duly presented and compliant with the terms of the LC. PPT could not withdraw the LOI once it had been provided, or at any rate, once CACIB had indicated that it would accept the presentation. There was no need to construe the term "at the due date for payment" as a condition precedent, and CACIB's non-payment would not operate to defeat its claim under the LOI.

The second issue was whether PPT had breached its warranty of marketable title. In its analysis, the Court of Appeal noted that the words "marketable title" must be given their own effect, and not be confused with or equated to being "free and clear of any lien or encumbrance". The Court of Appeal held that a marketable title is a title that may at all times and under all circumstances be forced on an unwilling buyer, as opposed to a title which would expose the buyer to "litigation or hazard".

The Court of Appeal found on the facts that PPT did not have "marketable title" because it was not free from "litigation or hazard".

By reason of its fraud, Zenrock had, at the time of shipment, crystallised the inconsistent charges it had granted over the same goods to CACIB and ING respectively. PPT obtained its title from a third party, Shandong Energy International (Singapore) Pte Ltd (Shandong), which in turn had obtained its title from Zenrock. However, the title held by Shandong was of uncertain value, in such circumstances where the inconsistent charges had crystallised.

Zenrock was not a seller acting in the ordinary course of business, by reason of its own fraud. Further, the Court of Appeal concluded that PPT was not a bona fide purchaser for value as PPT was aware of the round-tripping and that Zenrock was both seller and buyer. It should have been obvious to PPT that the financing arrangements were structured so as not to reveal to any individual financing bank the presence of Zenrock in more than one place in the chain. Agreeing with the SICC's observation that PPT could hardly be described as an innocent bystander, the Court of Appeal noted that there were well- founded concerns about the marketability of PPT's title from those circumstances alone.

In the circumstances, the Court of Appeal allowed the appeal and gave judgment in favour of CACIB.

Authored by Partner Tan Kai Yun with contribution from Senior Associate Andrew Pflug and Associate Hudson Wong.

Originally published 15 Nov 2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.