Not only have we seen the cash rate fall to record low levels, there has also been a rise in bank share prices along with a healthy yield along the way. This chase for yield has pushed the prices for the 'big four' banks to much higher values and has led overseas commentators to report that our banks are not only fully priced but that Commonwealth Bank is the most expensive bank in the world "on every metric".

Shareholders who accepted Commonwealth Bank's share purchase plan in 2009 at $26 would be extremely happy with the current share price growing to near $80 a share.

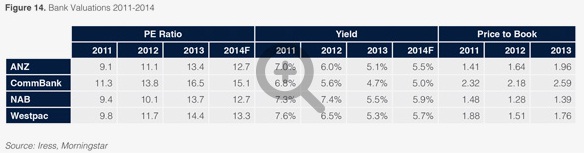

Figure 14 shows a summary of bank valuations from 2011 to demonstrate the change in yield, PE and price to book measures. Each show that banks are less attractive now than in the preceding 2 to 3 years. Notably, yields dropping from around 7% to under 5% and price to book ratios near or over 2 are not attractive for new investors.

But where do we go from here?

Most portfolios are likely to be showing an overweight position to the banks in general. Should profit be taken or should shareholders accept the risk of an overweight position? Capital gains tax is of course an issue to be considered. Generally, given the heady valuations (refer to Figure 14 above), we would suggest investors should be prudent and consider trimming an overweight position. If something should happen to the bank prices it will have a much greater impact on the overall portfolio. Of course, there is then the dilemma of where to reinvest. Where only a single bank is held, the others may be worth looking into, but it will be undertaken on the same high valuation you should be wary of. Given the still appealing yields, greater intra-sector diversification can be beneficial whilst still maintaining the attractive bank dividend.

Although it may appear that our banks are invincible, we must keep in mind that business cycles come and go and some companies have finite lifetimes. No corporation is immune to mistakes and this is why we recommend taking profits when they are available. The major risk for the future of the banks is a recession, which could lead to a rise in unemployment that leads to higher loan defaults and hence bad debts. Although banks always have provisions for bad debts, an increase will not only affect profitability but undoubtedly dividends and therefore share prices. When holding onto the banks or contemplating future purchases, you must consider why you own them.

If it is for income, then the banks offer excellent dividends in a range of around 5%-6% fully franked, which equates to around 7% including the franking credit. If you own them for growth, then they do appear to be fully priced.

Related links

- Ten best investment ideas 2014 - Focus on your own goals, not the Jones's

- Ten best investment ideas 2014 - Have a process to guide you allowing you to focus on what matters to you

- Ten best investment ideas 2014 - The innovators

- Ten best investment ideas 2014 - Servicing the demographic

- Ten best investment ideas 2014 - The new political regime

- Ten best investment ideas 2014 - Urbanisation and the growth of the middle class

- Ten best investment ideas 2014 - Where to invest offshore?

- Ten best investment ideas 2014 - Yield does not equal income

- Ten best investment ideas 2014 - Infrastructure and property – the new annuities

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.