The discussion we had in our previous year's Ten Best Investment Ideas highlighted the changes in demographics and the rise of the middle classes in the large emerging nations; think China, Brazil and India. This trend continues at large, even intensifying, specifically in China as authorities there attempt to assist the economy transition from a construction-led spend to a consumer-led spend.

The global urban population has surpassed the global rural population in recent years. In addition to ever increasing wages in emerging markets, we are witnessing an era of increasing consumption of goods and services that have been regarded as the basic/normal requirements of the developed world. As incomes in these markets improve, so too does the spread of the population able to afford goods and services they hadn't previously been able to. It also begins to change consumer spending patterns. Goods in demand include the whole spectrum from the basics such as food staples (milk, cheese, grains) to those for the more affluent (such as wine, meats and fine foods). We see demand for resources remaining strong too, as well as domestic and overseas travel, higher education and personal investment advice and services.

Some of the implications for investors can be seen in the demand not only for Australian produce, which is seen as high quality, but also in the demand for companies that control parts of the supply chain. We have witnessed the battle for the Australian-listed Warrnambool Cheese and Butter which epitomises the global trend. This is all about the rising demand from the increasingly affluent Chinese consumers and large consumer products focused businesses being aware of this opportunity – it is really the globalisation of food product.

In terms of magnitude, China is now the world's second largest economy next to the US (refer to Figure 2), and is the fastest growing economy in the G20. With more than a trillion dollars sitting in various sovereign wealth funds, the Government in China realises the burgeoning requirements of feeding and housing a growing population of substantial scale. The capital is wisely being deployed into strategic opportunities around the globe to ensure the long-term prosperity of their people.

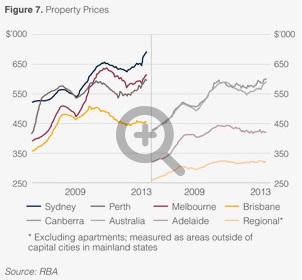

Since 2005, investments by the Chinese government and Chinese companies collectively have increased eightfold to almost $140 billion. Anecdotally, private Chinese individuals are also investing in offshore properties at a rising rate. For example, the Sydney property market has experienced the fastest national price growth in the last 12 months. A large amount of demand supporting Sydney prices has come from investors that are predominantly from mainland China, Hong Kong and Singapore seeking 'safer' markets to invest in.

China's aging population is also a factor to watch. The number of people aged 65 and above is predicted to reach almost a third of the nation's population by 2050. Chinese authorities have lifted the one child policy in an attempt to ease the burden this potential long-term demographic trend creates.

In the meantime, the Government has a huge challenge in managing the mass of aging population that may not have required family support.

From this trend, the question is what are the implications for investors?

Western multinationals are investing in the Chinese market directly in many sectors. This includes McDonalds who are aiming to increase stores in China by 50% to 2,000. Yum! Brands, who have 3,300 KFCs and 651 Pizza Hut stores in China, is looking to grow total store numbers to 20,000 inthe years ahead.

Another interesting trend is the rise of the global luxury goods shopper with the Chinese now topping the list. In 2012, 70 million Chinese travelled abroad and 47% said they bought cosmetics when overseas. China's government imposes high taxes on premium skincare, makeup and fragrances. The World Luxury Association in Beijing reported that luxury goods sales in China slumped to the lowest level in five years in January, but soared by 18% overseas as many Chinese travellers took advantage of the three-day New Year holiday.

The projected growth in this sector is highly appealing and it has led to the strategic acquisitions. Of note, one of Australia's famous brands, RM Williams, has been partpurchased by LVMH, the group that owns brands such as Louis Vuitton, Tag Heuer and Moet Champagne, in 2013.

The pick up in overseas travel by Chinese nationals is also a positive for the likes of Sydney Airport, and Westfield Group, who were awarded the contract to oversee management of food, beverage and retail operations at Los Angeles Airport. We would expect companies like these to continue to benefit from these trends.

Australia has much to offer as a producer of quality food and wine. A more affluent Chinese consumer leads to diet changes too. This places Australia's land and its output in a very attractive position.

Should the Australian dollar weaken, this could also lead to greater attraction (i.e. makes it cheaper) for overseas investors seeking long-term investment opportunities.

Take advantage of the trends by being exposed to the Australian companies with global businesses such as the health providers which stand to benefit from the growing middle class population and aging population such as CSL and Cochlear. Property companies that stand to benefit from overseas interest in our real estate include Stockland and General Property Trust (GPT) and no doubt the international interest in our assets will continue.

- Ten best investment ideas 2014 - Focus on your own goals, not the Jones's

- Ten best investment ideas 2014 - Have a process to guide you allowing you to focus on what matters to you

- Ten best investment ideas 2014 - The innovators

- Ten best investment ideas 2014 - Servicing the demographic

- Ten best investment ideas 2014 - The new political regime

- Ten best investment ideas 2014 - Where to invest offshore?

- Ten best investment ideas 2014 - Yield does not equal income

- Ten best investment ideas 2014 - Infrastructure and property – the new annuities

- Ten best investment ideas 2014 - What to do with the banks?

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.