In our first Indonesia Renewable Energy Update, we discussed how Presidential Regulation No. 112 of 2022, dated September 13, 2022, on the Acceleration of Renewable Energy Development for Electricity Supply ("RE PR"), sets in stone Indonesia's energy transition strategy. Not long after that, at a G20 event, the Government of Indonesia ("GOI") declared its participation in Just Energy Transition Partnership ("JETP") as a platform to finance the decommissioning of Coal-Fired Power Plants ("CFPPs"). In the wake of decarbonizing the electricity grid, the regulatory framework for the low carbon economy in Indonesia is starting to take shape.

The GOI concluded 2022 by issuing (i) Minister of Environment and Forestry ("MOEF") Regulation No. 21 of 2022, dated October 20, 2022, on the Implementing Governance of Carbon Pricing ("MOEF Reg 21/2022") and (ii) Minister of Energy and Mineral Resources ("MEMR") Regulation No. 16 of 2022, dated December 27, 2022, on Implementation Procedures for Carbon Pricing in the Power Plant Subsector ("MEMR Reg 16/2022"). These regulations outline the carbon market specifically for power plants.

In this second Indonesia Renewable Energy Update, we discuss the carbon trading blueprint for the power plant subsector based on a structured reading of (i) Presidential Regulation No. 98 of 2021, dated October 29, 2021, on Carbon Pricing ("PR 98/2021"), (ii) MOEF Reg 21/2022, and (iii) MEMR Reg 16/2022.

Carbon Trading for the Power Plant Subsector

PR 98/2021 specifies carbon trading as one of the carbon pricing mechanisms. 1 Carbon trading itself is defined as a market-based mechanism to reduce greenhouse gas ("GHG") emissions through the sale and purchase of carbon units, which constitute proof of ownership in the form of a certificate or technical approval stated in one ton of carbon dioxide, as recorded in the National Registry of Climate Change Control (Sistem Registri Nasional Pengendalian Perubahan Iklim – "SRN PPI").2

Carbon trading can be conducted in both domestic and international markets through (i) emissions trading and (ii) GHG emissions offset.3 PR 98/2021 also allows carbon trading to be conducted crosssector. 4 PR 98/2021 identifies six sectors for the implementation of climate change mitigation actions, namely: (i) energy, (ii) waste, (iii) industrial process and product use, (iv) agriculture, (v) forestry, and (vi) other sectors in accordance with the development of technology.5 Therefore, carbon trading for power plants can also be implemented with other sectors outside energy.

MEMR Reg 16/2022 outlines the prerequisite and subsequent procedures for carbon trading that business actors, namely, holders of an Electricity Supply Business License for Public Purpose (Izin Usaha Penyediaan Tenaga Listrik untuk Kepentingan Umum – "IUPTLU") or Electricity Supply Business License for Own-Use (Izin Usaha Pembangkit Listrik untuk Kepentingan Sendiri – "IUPTLS")6 , must take, as we elaborate in the following sections.

Outline of Carbon Trading

Figure 1 Procedures of Carbon Trading

1. Stipulation of PTBAE

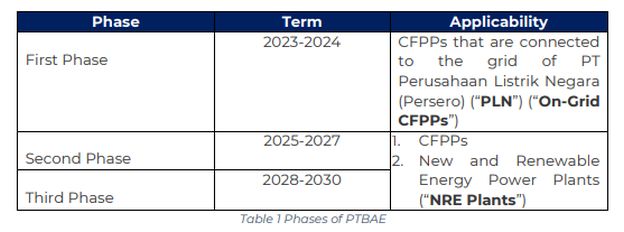

The MEMR stipulates the Emission Ceiling Technical Approval (Penetapan Batas Atas Emisi – "PTBAE") for the energy sector and power plant subsector7 based on:8 (i) the actual emissions value of GHG, which must be below the GHG emissions reduction target applicable to the energy sector and power plant subsector; and (ii) the carbon trading roadmap for the power plant subsector. MEMR Reg 16/2022 divides the PTBAE for each type of power plant into three phases, as follows:9

Following the end of the Third Phase, PTBAE for every type of power plant will be implemented in accordance with the GHG emissions target for the relevant phase. 10

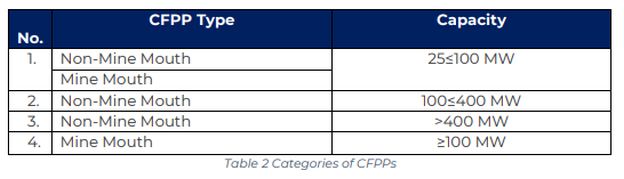

MEMR Reg 16/2022 divides the PTBAE for On-Grid CFPPs into the following categories:11

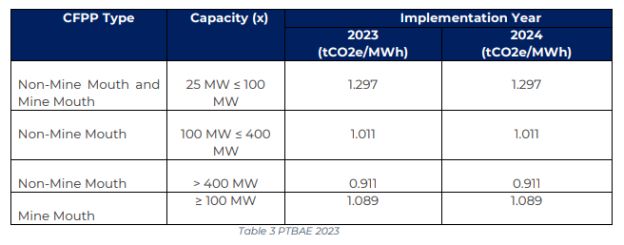

PTBAE for 2023 has been stipulated in MEMR Decree No. 14.K/TL.04/MEM.L/2023 on the Technical Approval of GHG emission Ceiling for PLN On-Grid CFPP for the First Phase, as follows:

Following the stipulation of the PTBAE and upon the application by the business actor or at its own discretion, the MEMR determines the PTBAE for business actor (PTBAE Pelaku Usaha – "PTBAE PU") by considering the prevailing PTBAE and the information obtained from the next step, which is GHG Monitoring. 12

2. GHG Monitoring Plan

MEMR Reg 16/2022 requires every business actor that participates in carbon trading to draft a monitoring plan for GHG emissions from each of their power plant units13. The monitoring plan shall consist of the monitoring of: (i) Gross Electricity Production ("GEP") completed with supporting documents in the form of an agreement that contains information on GEP; and (ii) power plant's target for GHG emissions, along with data activity and method of calculation, pursuant to the Guidelines on Calculation and Reporting of Inventory issued by the Directorate General of Electricity ("DGE")14.

The monitoring report shall be submitted to the MEMR through the Directorate General of Electricity by uploading the required documents to the Electricity Emission Calculation and Reporting Application (Aplikasi Penghitungan dan Pelaporan Emisi Ketenagalistrikan – "APPLE-Gatrik") at the latest by December 31 of the current year for the following year. If APPLEGatrik is not yet available, the report can be submitted to the Minister of Energy and Mineral Resources through the DGE.15

Business actors that do not comply with the monitoring obligations will not be allowed to participate in carbon trading.

Click here to continue reading . . .

Footnotes

1. Article 47 of PR 98/2021

2. Articles 1 points 14, 15, and 17 of PR 98/2021

3. Articles 49 (1) and (2) of PR 98/2021 jo. Article 4 (1) and Article 5 (1) of MOEF Reg 21/2022

4. Article 49 (3) of PR 98/2021

5. Article 7 (1) of PR 98/2021

6. Article 1 point 31 juncto Article 10 (5) of MEMR Reg 16/2022

7. Article 1 point 33 juncto Article 9 of MOEF Reg 21/2022

8. Article 4 (2) of MEMR Reg 16/2022

9. Article 4 (3) of MEMR Reg 16/2022

10. Article 4 (5) of MEMR Reg 16/2022

11. Article 6 of MEMR Reg 16/2022

12. Article 10 of MEMR Reg 16/2022

13. Article 7 (1) of MEMR Reg 16/2022

14. Article 7(2) to (4) of MEMR Reg 16/2022

15. Article 8 of MEMR Reg 16/2022

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.