In December 2022, the Securities and Exchange Commission (the "SEC") adopted final amendments to Rule 10b5-1 under the Securities Exchange Act of 1934 to, among other things, enhance disclosure requirements relating to insider trading. For some companies, these enhanced disclosures will be required in upcoming quarterly and annual filings. As discussed in our previous memorandum, which can be found here, the amendments require, among other things, certain quarterly and annual disclosures relating to trading arrangements, insider trading policies and procedures, and option grant policies and practices, in each case beginning with "the first filing that covers the first full fiscal period that begins on or after April 1, 2023."

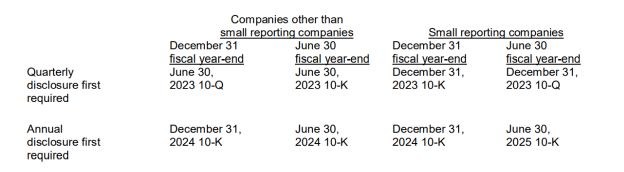

In May 2023, the SEC staff issued Compliance and Disclosure Interpretations ("C&DIs"), which can be found here (see Question 120.26), regarding the amendments, including compliance dates for the quarterly disclosures required by Item 408(a) and the annual disclosures required by Items 402(x) and 408(b), respectively, of Regulation S-K. These compliance dates are set forth in the following table.

The C&DIs (see Question 120.27) also include compliance dates for the disclosure required by the amendments to be included in proxy or information statements, as follows:

- for companies other than small reporting companies, the proxy

or information statement "for the first annual meeting for the

election of directors . . . after completion of the first full

fiscal year beginning on or after April 1, 2023" meaning:

- for December 31 fiscal year-end companies, the proxy or information statement for their first annual meeting after December 31, 2024, and

- for June 30 fiscal year-end companies, the proxy or information statement for their first annual meeting after June 30, 2024); and

- for small reporting companies, the proxy or information

statement "for the first annual meeting for the election of

directors . . . after completion of the first full fiscal year

beginning on or after October 1, 2023" meaning:

- for December 31 fiscal year-end companies, the proxy or information statement for their first annual meeting after December 31, 2024, and

- for June 30 fiscal year-end companies, the proxy or information statement for their first annual meeting after June 30, 2025).

Care should be taken by all registrants to adhere to the compliance dates for these new disclosure requirements.

To subscribe to Cahill Publications Click Here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.