This article looks at what Type "C" Reorganizations are and provides diagram examples you can download as PDFs. You will find a standard Type "C" Reorganization diagram and Rev. Rul. 67-274 that you can download as a PDF. This diagram can serve as a reference for future diagramming work. We also share tips on what to look out for to avoid any penalties or issues for your clients.

What is a Type "C" reorganization?

Under Internal Revenue Code § 368(a)(1)(C), a "C" reorganization involves the acquisition of "substantially all" of the properties of another corporation in exchange solely for all or part of the voting stock of either the acquiror or the acquiror's parent (but not a combination of both). The transferor of the property is also required to distribute all of the stock, securities, and other properties it receives, as well as its other properties, pursuant to a plan of reorganization. Rev. Proc. 77-37 sets forth a ruling safe harbor pursuant to which the "substantially all" requirement is satisfied if there is a transfer of assets representing at least 90 percent of the fair market value of the net assets and at least 70 percent of the fair market value of the gross assets held by the corporation immediately prior to the transfer.

The "solely for voting stock" requirement in a "C" reorganization is relaxed by § 368(a)(2)(B), which allows up to 20 percent of the fair market value of all of the property that is transferred to be acquired in exchange for money or other property that is not voting stock (commonly referred to as the boot relaxation rule).

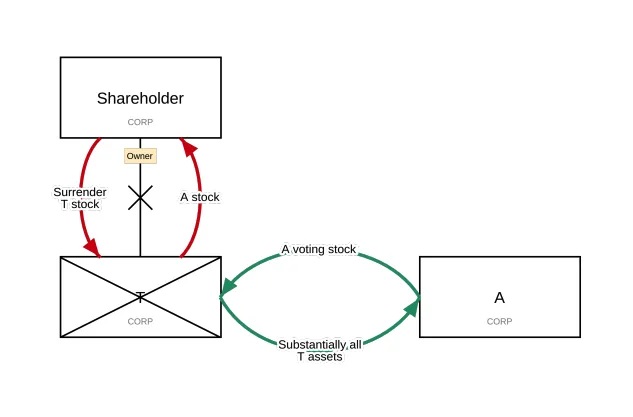

Type "C" reorganization diagram example

This diagram illustrates a basic "C" reorganization involving the acquisition of "substantially all" of the properties of a target corporation (T) in exchange solely for voting stock of the acquiror (A) (see green arrows), followed by a liquidation of T (see red arrows).

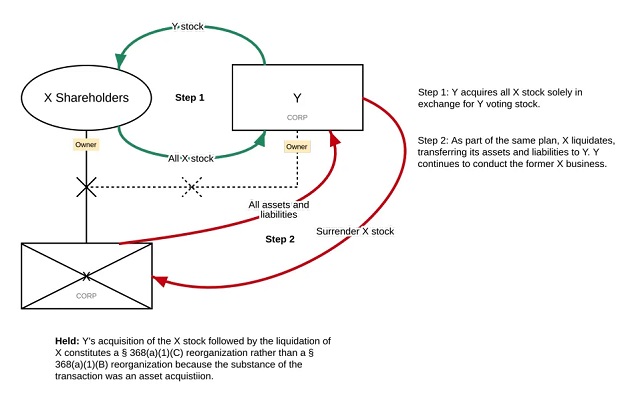

Rev. Rul. 67-274 diagram example

This example illustrates Revenue Ruling 67-274, which treats a stock-for-stock exchange followed by a liquidation (as part of a plan of reorganization) as a "C" reorganization, in conformity with the substance of the transaction as an asset acquisition.

The arrows signify the transfer of stock or assets. Easily included labels distinguish entities, relationships, and actions. The color scheme and text boxes also provide a convenient way to depict the actions and visually identify the consequences of each action.

Type "C" reorganization best practices

In structuring a type "C" reorganization, practitioners must pay close attention to ensuring that 'substantially all' of the properties of the other corporation are transferred to the acquiror. The term is not defined in the Code or Treasury Regulations, so practitioners must be familiar with case law and IRS guidance, including the ruling safe harbor set forth in Rev. Proc. 77-37. Practitioners also ought to be aware of the effect of the acquiror assuming liabilities of the target. Finally, where taxpayers engage in multi-step transactions, the transaction may be recast to combine the integrated effect of the steps, such as in the diagrammed example above, or in a situation where the acquiror's previous acquisition of the target stock could be considered as part of the asset acquisition reorganization (jeopardizing the solely for stock requirement, even with the boot relaxation rule).

Blue J's diagramming tool provides a convenient way to collaborate on a shared diagram with colleagues to visually represent any "C" reorganization, including multi-step transactions to which the step transaction doctrine may apply. We host example diagrams in our Blue J Folios, which may be easily edited to depict any transaction–or build your own. Blue J Folios provide a starting point for your research, with an outline that summarizes the topic and contains references from the Code and Treasury Regulations, common leading authorities on each topic, and a visualization of certain authorities using our Diagramming tool.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.