California has changed the State Density Bonus Law to give developers the option to incorporate significant additional density into eligible bonus projects. AB 1287, which was just signed into law by Governor Newsom, creates a new stackable density bonus (bonus on top of bonus) specifically designed to facilitate construction of middle-income housing and additional very low-income housing. Importantly, this new law provides the first opportunity to receive a density bonus for moderate income rental units.

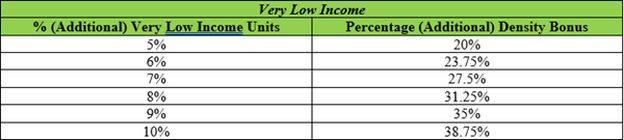

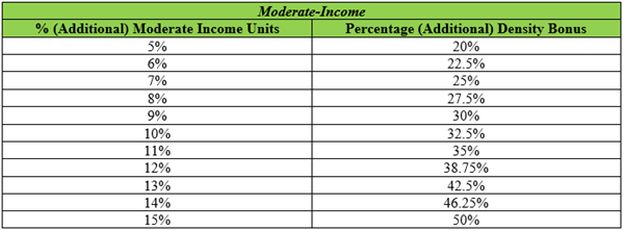

To be eligible for AB 1287's additional bonus, a project must satisfy specific criteria. First, the project must propose to construct sufficient very low-income, low-income, or moderate-income units to achieve a 50% base density bonus (i.e., 15% very low-income, or 24% low-income, or 44% moderate-income). These units are still subject to prior requirements, including that any moderate-income units used to satisfy the base bonus be for-sale. The very low and low-income units can either be for-sale or rental units. Second, after committing to the required minimum base bonus, the applicant has the option to commit to constructing additional very low-income or moderate-income units as part of the project and receive an additional density bonus at specified percentages. These additional very low-income or moderate-income units may be offered as for sale or rental units – the first time that moderate income units qualifying for a density bonus can be offered for rent. As with the base bonus, the additional bonus is calculated based on a percentage of the project's base density. Thus, this bonus is additive of the initial 50% bonus, meaning a project could obtain a 100% density bonus if providing the required percentage of affordable units. The additional bonus percentages are as follows:

To illustrate using a project with a base density of 100 units, if the project proposed to reserve 15% of the base units for very low-income households plus 15% for moderate-income households, the project would be entitled to a 100% density bonus (50% from the very low-income units and 50% from the moderate-income units). And, unlike a project that obtains a bonus through only moderate-income units, the additional moderate-income units in a stacked (bonus + bonus) project may offer the moderate-income units for rent. (Govt. Code § 65915(v) [additional "rental or for-sale affordable units to very low income households or moderate income households"].)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.