This article was originally published in the Due Diligence and Risk Management Journal. A shorter version of this article, focused only on mergers and acquisitions, was published earlier in the M&A Advisor.

It’s not just for M&A anymore. 50-year-old practices no longer meet the challenges of defining and running an organization. Due diligence methods must be revamped to serve in today’s fast-paced and perilous environment.

Introduction

Decisions are what modern business is all about. Without a good dynamic knowledge base that accommodates change and complication, decision-making is binary at best. On/off. Black/white. Good decision/ bad decision (replete with attendant risk and danger). If decisions were airplanes, many would choose not to fly.

- Dun & Bradstreet reports that a corporation fails every three minutes, a new business is formed every five minutes, a share ownership change happens every six minutes, and a company changes control every 15 minutes.

- A McKinsey study concluded approximately 60% of mergers fail financially.

- According to the US Small Business Administration, about one out of every ten small businesses fail each year.

- Financial Times studies show that 70% of acquisitions do not deliver intended value.

- Price Waterhouse Coopers says: "Real due diligence analyzes and validates all the financial, commercial, operational and strategic assumptions underpinning the decision. It looks at past trading experience and also uses this to form a view of the future. The components … are revenue and market due diligence, synergy validation, maintainable earnings, future cash flows and all operational issues, as well as decision structuring." (Emphasis added)

Why do leaders make decisions? Because they have to. As the cliché so aptly warns, "not to decide is to decide". A good decision can maximize profits, increase productivity, expand distribution channels, gain capital capacity, extend market reach, improve cost efficiency, acquire technology, make management look better, reduce risks, aid diversification, and control markets. Bad ones don’t. Generally, an organizational decision is driven by at least one leading goal, hopefully, balanced against other trade-offs. The end result is expected to justify the costs.

Alas, regardless of noble purpose, decision-making end results frequently are ignoble. There is no consensus to explain this high rate of misstep, but there is plenty of opinion. Mounting heaps of theoretical literature and empirical evidence point out that corporate decisions are often implemented for wrong reasons and often without necessary critical information.

Today’s Due Diligence Does Not Work

Due diligence has long been used to help identify and reduce risks. Maybe the term "due diligence" should go away, but right now we don’t have a better one to describe the process as it should be done. The term suffers from a narrowed perception as a necessary evil that comes with mergers and acquisitions. More on expanding that thought later. Whatever inference one attaches to the term due diligence, data indicate it isn’t working very well. Current due diligence practice is showing its age, having been in place for 50 years. Today, in most applications, traditional due diligence activities suffer from the seeming contradictory shortcomings of being both statutory and formulaic, but also irregular and inefficient. Likewise, parties get to pay premium prices for lack of accountability and vast expenditures of time.

The traditional due diligence process also is fundamentally dependent on human effort, typically provided by professionals with accounting, legal and financial backgrounds, but with no standardized procedures or specific training and little if any sense of the interdependency of their disciplines. Despite otherwise adequate professional experience, this effort always suffers from inconsistency, tunnel vision, and is characteristically consigned to a junior team.

In the traditional M&A environment, the all- too-frequent reality is that senior management has already "made the decision", but in an almost "data-free" environment. In effect, they bought the car and now that the tires are getting kicked, they don’t want to hear about the bad transmission or leaky gaskets because that would tarnish the fun of deal-making.

Going Beyond Traditional Thinking

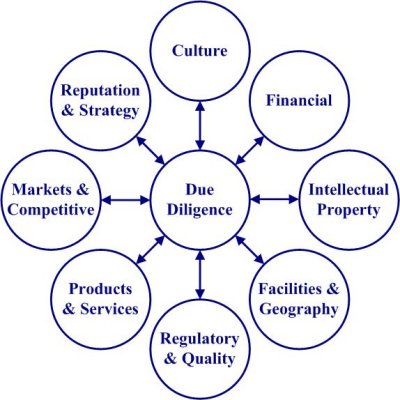

Figure 1: Due Diligence Factors Affecting Companies (Source: The Due.Com Group)

A superior due diligence system should aim well beyond traditional due diligence thinking, which is typically reactive and event-driven. Indeed, who can argue that informed decisionmaking should not move onto the broader stage of organizational leadership? Corporate failure data prove traditional due diligence systems cannot boast much success. It’s time to move from a process with roots solidly planted in the middle of the 20th century into a process that properly reflects and supports business in the 21st century. It is time for Next-Generation Due Diligence™, and, from here on, we shall use the term in its broadest sense as a tool for the discriminating decision-maker. It is very important to remember that we have now broadened our vision to include all important organizational decision-making.

Rather than just reviewing information at the detail level during a decision, an improved systematic and systemic approach should provide more robust capability in supporting these major corporate decisions (see Figure 1). Superior due diligence must be installed as a standard foundation of the corporate process – an integral, ever-present facet of business strategy and operations.

But even the best new due diligence system is doomed to failure without resolve at the top of the organization. To create and maintain a superior system, there must also be ongoing, visible commitment. Unless the board and senior executives, starting with the CEO and president, are committed to instilling belief and understanding of the need for due diligence at all levels of the corporation, it will be impossible to improve the organization with this due diligence paradigm. And once commitment is made, serious dedication must follow. Ought not leaders be judged on the quality of their decisions? Humans do what they are rewarded to do. Reward only good decisions and the process takes on new importance. This means lots of work and some resource commitment. But the returns will reflect strong attention to executive fiduciary responsibilities and create significant improvement in the organization’s capabilities, risk reduction, agility, morale and profitability.

How to Create a Superior Due Diligence System

1. Dedicated Department or Team

This will be a team effort. One head won’t do it. Alternate perspectives are impossible in such a case. In essence, you can’t fix the mind you’ve got with the mind you’ve got. Start by appointing a committed, eager, resourceful and authoritative due diligence system manager. This person has primary responsibility for implementing the due diligence system. It’s a fulltime job. This person must be a believer, because the job is more than just organizing this activity; he or she will also be its champion and must clearly represent the commitment of top management. The due diligence system manager must have the authority right from the top to make it happen. Listen to this person, even when he/she says things you don’t want to hear.

The due diligence team begins by gathering information about all corporate activities and examining all parts of the organization.

The due diligence department/team must interact with all other departments of the organization. This is the crucial point where findings are integrated to provide a valid "big picture", including the interrelations of the parts. Inter-organizational dynamics usually have positive or negative effects on the business – they are seldom neutral. Examination of one part of the organization in a vacuum will yield little of use. All other departments must support the due diligence effort. Cooperation leads to better knowledge and acceptance of the due diligence process in the organization. Corporate leaders should even consider incentives to reward this support and cooperation and success over time.

2. Due Diligence Audit

The effective due diligence system incorporates all information about processes throughout the corporation, and reflects how the pieces work together (or don’t). The first project is an initial corporate due diligence audit. To successfully complete this assignment, the new department will typically need help from outside services. The audit process traditionally comes from accounting firms, law firms, and industry specialists. While these sources are critical, they are focused on their own accepted expertise, experience, and viewpoints, and do not include all parts of a comprehensive due diligence process. Nor typically do they examine the interplay or cross-dynamics of their specialties across the organization. The view through a soda straw is pretty narrow. The team needs to ensure the corporate audit is fully inclusive and reflects operational realities and interdependencies.

Some critical aspects of a corporate due diligence audit should include:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This list is long, but far from all-inclusive and should not limit all the aspects that must be considered for a complete corporate due diligence audit. The important thing is to "think" comprehensive, integrated and interrelational.

3. Economic Analysis

The comprehensive due diligence audit is used to estimate the costs and rewards for prospective decisions, and also is the starting point to compare future improvements. Part of this system is an economic analysis that should show how such a comprehensive due diligence policy and procedures system reduces risk and increases profits for the organization. It should also confirm that the new system does not create a burden on the corporation’s core business. Elements of the economic analysis establish what additional resources are needed to support any necessary changes. The economic analysis also must include:

- how each part of the system will be integrated, along with the expected results;

- the value expected for each change;

- whether each current decision-making process produces revenue, cash flow and a profit, is revenue/cash flow/profit neutral, or has a negative financial impact for the organization.

Competent outside professional service firms should be involved to assist in determining change requirements and acceptable expenditures of budget and time. Such firms play an integral role in the overall corporate due diligence process.

The due diligence department is, in essence, an "intelligent mirror" for all corporate operations. It does not replace or displace anyone on staff or from outside services firms. This is not the fawning, sycophantic "mirror, mirror on the wall" of Snow White’s wicked witch fame. This mirror must not lie. Rather, the due diligence department should perform a "conductor" function, ensuring an harmonious orchestral function, helping everyone involved in the organization develop a more efficient, cost-effective and, most important, more comprehensive process to use with every major and minor corporate decision.

Permanent Due Diligence Team, Standardized Practices and New Economy Tools Can Improve Corporate Due Diligence

First we examined the inadequacies of 50-yearold due diligence practices and discussed the creation of a due diligence department as one method of improving the odds for success in today’s fast-paced business environment. Now we’ll examine the objectives of this new business department and its role in communications, education and implementation of a successful duly-diligent decision system. We also look at how internet based systems can both speed up and help to standardize the due diligence process.

4. Objectives

The due diligence department must coordinate with all other key operations of the organization to establish overall objectives of the due diligence system. Specific objectives are important to the success of the system, because they provide the focal points for tracking progress. Both qualitative and quantitative metrics can be used for this tracking activity. These metrics can include improvement of profitability, risk reduction, disposal of negative assets, reduction of costs, elimination of ineffective systems, elimination of inaccurate data, improvements in change processes, improvements in documentation, and improvements in reporting to outside agencies.

This kind of highly-efficient system can support all major and minor corporate events, including financings, expansions, mergers and acquisitions, technology acquisitions and licensings, product development, supply chain monitoring, strategic and tactical planning, operations, and marketing and sales. Ultimately, the system should bolster shareholder and employee satisfaction.

5. Communications and Education

A corporate-wide communication and education strategy and system are critical to a well designed due diligence system. People want to know why someone is poking around in "their" stuff. The aim is awareness and understanding about the benefits of sound due diligence practices.

One task is to overcome long-standing beliefs that "information is power that ought to be hoarded, not shared". The message is simple – "We are not seeking fault. We need information from everyone to make this organization successful."

An integrated internal communications strategy will ensure all audiences, regardless of their preferred mode of communication, hear key messages. It’s about setting expectations and then meeting them. Having a strategic communications plan in place also reinforces consistency of message. Leveraging and integrating print, audio, video, even face-to-face communication reflects stability and consistency.

Internal communications should present (among other things) case studies of corporate success to promote due diligence throughout the organization and highlight the need for every employee to support and protect this corporate activity. Highlight success and the rewards that come with it. Another influential communication method is to publish progress reports showing tangible results. Policies and procedures must also be published as reference tools, customized for each department.

6. Implementation and Monitoring

The specific components in developing and implementing a due diligence system will vary greatly depending on the status of existing systems and the corporate culture. (Corporate culture can be a huge factor, and one worth of study and attention.) Once the foundations have been established, a list can be produced targeting specific projects, resources, responsibilities, and deadlines. Some of the projects that might be incorporated include:

- due diligence audits of each department, with bi-annual performance review audits;

- financial ratios and benchmark/other metrics monitoring;

- developing diligent decision-making specifications, policies and procedures;

- identification of under-performing corporate decisions;

- review diligent decision specifications in each area of the organization, such as acquisitions, financings, research and development, geographic expansion, and hiring practices;

- define the due diligence processes required for corporate events;

- set overall corporate due diligence objectives;

- monitor due diligence objectives progress;

- inform vendors of the company’s commitment to high quality services;

- require vendors to have good due diligence practices;

- build in information on the due diligence system in the organization’s publications, including product literature, newsletters, advertising, and the annual report;

- create a risk minimization system;

- involve state and national regulatory agencies in a proactive fashion to promote goodwill and head off difficult securities problems;

- educate the company’s personnel on the needs and benefits of diligent processes;

- reward and recognition systems tied to due diligence efforts.

Next Generation Due Diligence

Figure 2: The Due Diligence "Sweet Spot"

(Source: The Due.Com Group of Companies)

With the creation of Next-Generation Due Diligence, The Due.Com Companies have developed a system that addresses traditional shortcomings of due diligence activities. Next-Generation Due Diligence has been developed over a period of more than ten years and provides a comprehensive foundation for pre- and post-decision activities and alleviates the consequences of old-style due diligence with a series of firsts:

- the first due diligence best practices and standards;

- the first consistent and fast turnaround due diligence system;

- offering affordable due diligence services through a unique web-based toolset.

The Due.Com Companies have developed the first Due Diligence Standard, including a set of minimum best practices for an effective due diligence process, with management system requirements suitable for evaluation by a third party (e.g. ISO 9000 Registrars). The Due Diligence Standard prescribes the necessary steps essential in performing and reporting the results of a due diligence process, including:

- the minimum criteria to be evaluated for an effective due diligence process;

- methods of rating the associated risks; and content requirements for reporting the conclusions of a due diligence process with recommendations.

Corporate decision makers can use Next Generation Due Diligence to help find the "Due Diligence Sweet Spot" (see Figure 2) of high performance, profitability, position, and growth. As united goals, these can make firms prosper rather than result in underperformance, divestiture, or failure.

Next Generation Due Diligence moves well beyond classical methods. This is methodology, not mythology, and focuses on the entire decision equation. The process begins with comprehensive assessment of the firm, moves to generating risk models, and then engages in the creation of a potent and dynamic pre- and post-decision strategic plan.

The key reasons to build corporate due diligence systems are to reduce risks and build shareholder value. You stack the odds in your favor when faced with a decision. For firms concerned with the time-consuming requirements necessary for building an in-house due diligence system, The Due.Com Company’s proprietary Intelligent Due Diligence system provides due diligence services that are accessible online. This diligent decision support system organizes client information for all corporate events. Features include:

- low rates;

- quick turnaround times for results;

- accurate and consistent results;

- comprehensive array of services;

- the first standardized due diligence service.

The Intelligent Due Diligence system is a marriage of the best in human knowledge and technology-enabled due diligence assessments and analyses and can assess or analyze any decision or type of business event. This includes a range of companies, from emerging growth firms to medium-stage companies to the Fortune 500.

Conclusion

A corporate due diligence system and strategy will help improve financial performance, strengthen competitive positions, expand organizations more effectively, preserve human performance and develop internal know-how.

With these improvements, companies are better able to grow through mergers and acquisitions, spin-offs, and alliances. A corporate due diligence system adds new power to the organization, adding to the existing strengths of management and staff, creating more value for a unit or division, as well as improving its abilities and success rate when acquiring or merging with new firms. In a nutshell, it also can help prevent the decision maker from looking like an idiot.

The decision to go ahead with a decision will ultimately be based on opinion. One hopes it is an informed opinion. Cable mogul Bill Daniels of Daniels Cablevision, regarded by the industry as "the father of cable television", had a sign on his desk that said it all: "A man’s opinion is no better than his information."

Charles F. Bacon is the CEO and Founder of The Due.Com Companies, headquartered in Colorado. He has performed and studied due diligence applications for more than 20 years, and has extensive experience in due diligence, risk analysis, fraud prevention, technology development, capital acquisition, and corporate and financial engineering. He is a member of the Systems Dynamics Society, the Global Association of Risk Professionals, and the American Association for Artificial Intelligence.

"Next-Generation Due Diligence™" and "Intelligent Due Diligence™" are the proprietary intellectual property of Charles F. Bacon and The Due.Com Companies.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

Next Generation Due Diligence