On August 2, 2022, the Committee on Foreign Investment in the United States ("CFIUS" or the "Committee") published its annual report for 2021. As we have noted in the past, the publication every summer of the annual report is a major event for CFIUS watchers. CFIUS's annual report is one of the only times each year that CFIUS provides information to the public about its operations. The annual report provides hard data about the number of transactions that CFIUS reviewed the previous year, the time it took to complete those reviews, and the high-level results of those reviews, among other things. The annual report is the best resource for dealmakers to use when attempting to anticipate how the CFIUS process may affect a deal.

This year's annual report shows mixed performance from the Committee. On one hand, the statistics for the declarations process are excellent. Treasury and the other member agencies are clearly making a concerted effort to make the declarations process a useful tool for transaction parties involved in benign transactions. On the other hand, the annual report shows that the Committee is struggling to process notices in an efficient manner. In particular, the Committee is still clearing a large percentage of transactions during the investigation period without imposing any mitigation, which means that the Committee is taking cases to investigation even though the transactions do not present a risk to U.S. national security. In addition, the number of withdraw/refiles skyrocketed in 2021 and, for the first time ever, the Committee has started invoking the "extraordinary circumstances" provision of the CFIUS regulations to extend certain investigation periods by 15 days. Overall, the statistics for 2021 reflect that the Committee is taking too many transactions to investigation, and when transactions go to investigation the Committee is taking too long to conclude action.

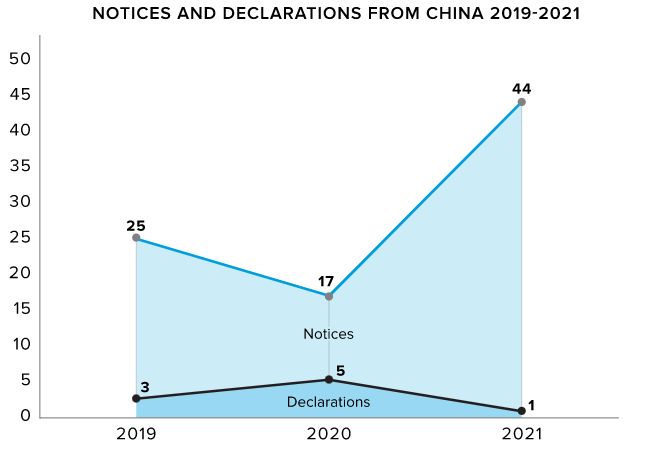

This year's annual report also shows that China transactions may be on the rise, and that the non-notified team continues to stay active. Other takeaways from the report include:

1. Transaction parties are filing more declarations

The number of declarations jumped from 126 in 2020 to 164 in 2021. This is no surprise, as awareness of CFIUS regulations grows and the benefits of a safe harbor letter become clear. We expect this trend to continue. Most parties prefer filing declarations because declarations are quicker, carry no filing fees, and there are no personally identifiable information ("PII") requirements for officers and directors. This makes declarations ideal for low-risk deals. However, for deals that parties expect will require further review or mitigation, declarations only add an extra 30 days to the process.

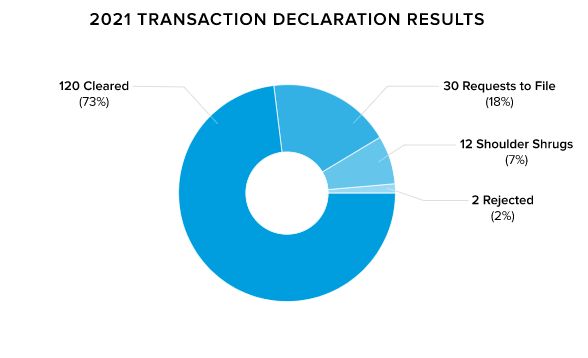

2. CFIUS continues to do an excellent job processing declarations

The Committee is putting in effort to make declarations an effective tool for transaction parties, and it shows. In 2021, transaction parties filed a total of 164 declarations. Of these, 120 cleared (73%), 30 were requested to file (18%), 12 received the proverbial "shoulder shrug" (7%), and 2 were rejected (2%). A "shoulder shrug" occurs when CFIUS does not affirmatively clear a transaction, but also does not request a filing. A clearance rate of 73% is excellent, and indicates a diligent effort by the Committee to timely review and clear these transactions. The "shoulder shrug" rate of 7% likewise shows a concerted effort from the Committee to minimize this neutral outcome. In addition to excellent work from the declarations team, the declarations statistics may also reflect that transaction parties are getting better at identifying the types of transactions suitable for the declaration process, and skipping it when the parties anticipate it would end with a request to file.

3. The country of origin statistics for declarations are not surprising

Declarations tend to correlate closely with foreign partners and allies—parties from friendly countries are likely to rely on the declaration process and expect favorable treatment, while parties from more adversarial countries expect little benefit from the declaration process and avoid it in lieu of filing a notice. To that end, Canadian parties filed the most declarations with 22 declarations filed (versus 28 covered notices). To contrast, China filed one declaration (versus 44 notices), and Russia filed one declaration (versus 7 notices).

4. There was a large increase in the number of notices filed in 2021

In 2021, transaction parties filed 272 notices—85 more than the 187 notices filed in 2020. This increase is not surprising, and likely reflects a combination of CFIUS awareness and the notoriously hot M&A market in 2021. With the significant increase in the total number of deals, it was not surprising to see a corresponding jump in CFIUS filings. It will be interesting to see how this number holds up once markets return to a more normal pace.

5. CFIUS cleared about half of the notices at the end of the review period

In 2021, the Committee cleared 52% of transactions in notice review phase (the first 45 days, before the "investigation" phase). This is a slight drop from 2020, where the Committee cleared 53% of transactions during the review phase. A transaction clears in the review phase when the Committee does not identify a risk arising from the transaction and does not believe that it will identify a risk upon further investigation. For the reasons set forth below, the Committee should be clearing a higher percentage of notices at the end of the review period.

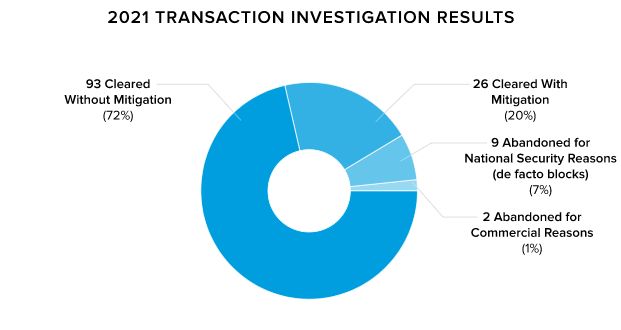

6. A total of 130 transactions (48%) were sent to investigation in 2021

Of 272 notices filed in 2021, 130 transactions (48%) were sent to the investigation phase. Of those, 93 transactions (72%) were cleared without mitigation, 26 transactions (20%) were cleared with mitigation, 9 transactions (7%) were abandoned for national security reasons (a "de facto block"), and 2 transactions (1%) were abandoned for commercial reasons. The percentage of cases clearing in investigation and without mitigation is still too high. When a case clears without mitigation, it means that the Committee did not identify a national security risk arising from the transaction. In cases that present no risk, the Committee should be able to clear the transaction within the first 45-day review period, leaving the investigation period for cases where the Committee will need to draft a risk based analysis ("RBA") and discuss potential mitigation options with the parties. There will, of course, be exceptions that require slightly more time or more information from the parties to determine that a transaction presents no national security risk, but those instances should be few and far between, not 72% of the notices that reach the investigation phase.

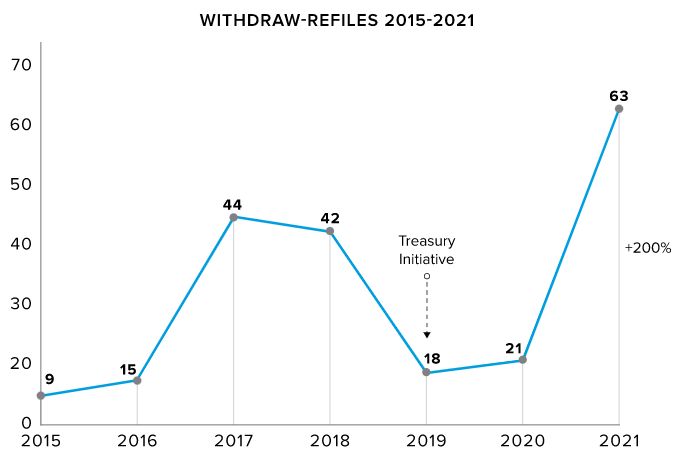

7. The biggest surprise from the annual report is the large spike in the number of withdraw/refiles

In 2021, there were 63 withdraw/refiles—triple the amount in 2020 and 50% more than the next closest year, which occurred in 2017 with 44 withdraw/refiles. In 2019, Treasury made it a priority to reduce the number of withdraw/refiles and cut the number from 42 to 18. This number was roughly maintained in 2020 with 21 withdraw/refiles. In 2021, the Biden Administration's first year in office, the number has ballooned.

There are a number of reasons why transaction parties may need to withdraw and refile a transaction. Some of these are out of the Committee's control, but the size of the spike suggests the problem is likely due to procedure. Most likely, this reflects that the Committee is having a difficult time agreeing on mitigation terms with the parties, or is experiencing delays in receiving sign-off from each agency before the statutory deadline.

Regardless of the root of the problem, dealmakers should expect delays in the CFIUS process to impact their deals, and should not bank on the standard statutory timeline.

8. The Committee has started using the "exceptional circumstances" clause to extend the statutory deadline

In line with the prevalence of the withdraw/refile spike, which indicates difficulty completing the investigation in 90 days, CFIUS has also started using the "exceptional circumstances" clause to buy itself more time to complete a review. Until 2021, the Committee had never invoked this provision. In 2021, it was invoked three times. CFIUS does not reveal sufficient information for us to determine the ultimate outcome of these transactions, for instance, whether the transactions were cleared/mitigated during the extra 15-day emergency period or whether the parties were still asked to withdraw/refile. However, the overall combination trend of more invocations of the "exceptional circumstances" clause plus the spike in withdraw/refiles suggests the Committee is having overall timing issues.

9. There was a jump in the number of China transactions

The 2021 statistics also show a significant increase in the number of transactions involving a Chinese investor. In 2020, the number of notices involving Chinese investors was 17; in 2021, this number jumped to 44, more than a 150% increase. The annual report does not identify the results for each China transaction, nor the dollar amount associated with any given transaction, so we can draw few solid inferences from this sudden increase. However, we do know that 37 transactions were either abandoned or mitigated. Even if every one of those 37 transactions was a Chinese transaction (which is highly unlikely), that would still mean seven China transactions may have been cleared without mitigation. This suggests that Chinese investors should not view CFIUS as an insurmountable hurdle—so long as a deal is structured appropriately and the national security considerations are taken into account, CFIUS may approve the transaction. Perhaps Chinese investors have already noted this and this accounts for the sudden increase in notice filings.

10. The non-notified team is still very active

Finally, it appears that the non-notified team is working overtime to find suspect transactions and call them in for review. In 2021, the non-notified team identified 135 non-notified transactions that were put forward to the Committee for consideration. When a transaction is "put forward to the Committee for consideration," that means that case officers have conducted due diligence on the transaction, concluded that the transaction likely falls within CFIUS's jurisdiction and raises significant national security issues. As a result, Treasury would then ask the Committee for agreement to reach out to the transaction parties for more information.

Of the 135 transactions identified, eight transactions resulted in a request for filing. That does not mean that the Committee cleared the other 127 transactions. If the non-notified team completes its due diligence and determines that a filing is not required at that time, the Committee does not provide the transaction parties with a safe harbor letter. The Committee can always call in the transaction at a later date.

We expect this trend to continue. Dealmakers should expect the Committee to continue to conduct due diligence on lots of non-notified transactions, but, in most cases, the Committee will likely request a filing only for the ones where the Committee believes that mitigation or divestment is the likely outcome of a filing.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.