Nissan announced it would trim its Q1 2024 production, citing dealership inventory levels and part shortages. ZF is preparing an initial public offering (IPO) for its airbag unit. Volkswagen announced plans to cut more than $11 billion in cost over the next several years, including slashing plans for a new R&D site.

In regulatory news, The International Union of United Automobile, Aerospace and Agricultural Implement Workers of America (UAW) has officially endorsed President Biden's reelection campaign. Ford announced its first significant recall of 2024 on more than 2 million Ford Explorers. The Alliance for Automotive Innovation is pushing the U.S. Treasury Department for leniency on electric vehicle (EV) tax credit requirements including mineral sourcing requirements amidst supply chain difficulties.

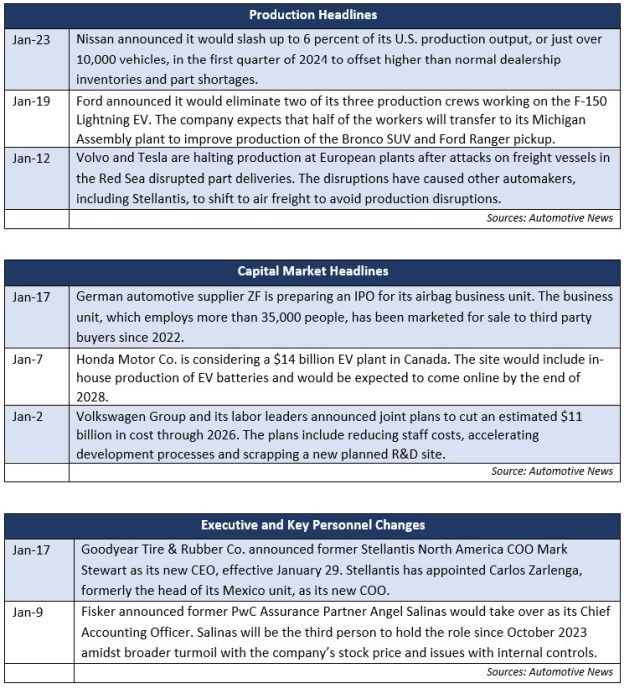

Additional January insights are included below.

Industry Focus — (Re)Focusing on Capital Deployment Post-UAW Ratification for Detroit's Big Three

As the dust begins to settle on the recent labor contract ratification process between Detroit's Big Three and the UAW, longer-term impacts of the new deal are beginning to take shape.

Cost increases for each automaker over the life of the contract are significant, and the impact is apparent in each company's messaging around cost initiatives. Capital allocation strategies are already evolving for each automaker, but the finer points within each company's messaging are split. While Detroit's Big Three are the most immediately and directly affected, the impact of the ratified UAW contracts has already extended beyond the Big Three.

Significant cost increases over the life of the contract

With the strike over and labor contracts ratified, Detroit's Big Three have already begun anticipating long-term cost impacts. Ford and GM have announced long-term cost increases of $8.8 billion and $9.3 billion respectively over the life of the contract, which is set to expire in April 2028.

For Ford, this equates to approximately $900 in incremental costs per assembled vehicle by 2028. The company has not ruled out any activity that will help them 'find productivity and efficiencies and cost reductions throughout the company.'

For GM, the impact is approximately $575 per assembled vehicle in the same time span. CEO Mary Barra indicated the company expects to "fully offset" higher labor costs in 2024 through operating efficiency and optimized capital planning and deployment.

Stellantis has not disclosed its estimate on the longer-term impact of the UAW strike, but indicated it cost the company $3.2 billion in lost revenue and just shy of $800 million in net income in 2023.

Capital deployment strategies get (re)focused

With significant capital outlays related to the broader transition to EVs planned for each of Detroit's Big Three through the end of the decade, the ratified UAW contract has already contributed to significant shifts in capital deployment strategies for each automaker. While Stellantis has remained relatively quiet on its longer-term capital planning changes, Ford and GM have been upfront with strong messaging about cost efficiencies.

While pullbacks related to EV production are a recurring theme, diverging strategies around near- and mid-term activity are separating the automakers. Near-term capital deployments specific to EV development were among the first dollars announced to be pulled back:

- GM indicated its 2023 full-year capital spending would be cut by at least $500 million, driven by delays to product launches and production ramp-ups specific to EVs. The company also announced its support for significant cuts to its Cruise autonomous taxi division's workforce amidst technology concerns and leadership turnover. The automaker has previously committed to significant cost cuts for the business unit, which lost more than $700 million in the third quarter of 2023.

- Ford announced it would be cutting two-thirds of the production team for the F-150 Lightning amidst a production slowdown driven by weakening consumer demand. Ford also previously announced it would reduce its planned investment in a battery factory in Marshall, Michigan by more than $1 billion.

Messaging around longer-term capital planning for each automaker has emphasized similar points around longer-term cost focus and rebuilding investor confidence.

Ford announced the postponement of nearly $12 billion in spend related to expanding EV manufacturing capacity, citing slowing demand and the company's broader plan to optimize its capital outlays relative to its competitors'. The company is not cutting back on its total planned spending for EVs but has promised investors it will be more mindful about the timing and targeted nature of its investments.

GM has pitched a more directly investor-friendly capital strategy since ratification of the new UAW contract. Plans to increase its quarterly dividend by 33 percent and accelerate a $10 billion share buyback plan sent a strong message of confidence in the company's ability to fully offset increased labor costs. The company has maintained its plan to offer EVs exclusively by 2035 and is aiming for profitability of its EV unit by 2025.

Impact of the UAW strike beyond the Big Three

While the longer-term impact of the increased labor costs Detroit's Big Three face through 2028 remains to be seen, the impact has already rippled through the broader automotive industry.

While suppliers are expected to face continued long-term difficulties with lost volumes and labor challenges resulting from the UAW's strike, the broader slowdown in EV production for the automakers puts suppliers in a particularly precarious position. With efforts to ramp up dual-track programs for internal combustion engine and EV models already causing financial strain for suppliers, the slower ramp-up of manufacturer volumes and the lack of predictability places suppliers in a challenging operating environment.

Suppliers are not the only automotive industry players reacting to the recently ratified contracts between the UAW and the Big Three. Non-unionized auto manufacturers have recently announced a string of pay increases for factory employees. Tesla is the most recent original equipment manufacturer to announce a 'market adjustment pay increase' to remain competitive in the labor market as the UAW ramps up its own efforts to unionize other automakers — such as Toyota, Volkswagen and Nissan — in the United States.

Regulatory Landscape

UAW Endorses President Joe Biden's Reelection Campaign: UAW president Shawn Fain announced the union would formally endorse President Joe Biden's 2024 reelection campaign. Fain cited Biden's support for the UAW and states the union should back the candidate that will give the UAW 'the best shot at winning.' In September 2023, Biden became the first sitting U.S. president in history to join a picket line on strike with GM workers at a parts depot.

Ford Explorer Recall: Ford is recalling more than 2 million Ford Explorer crossovers in the U.S. due to risks the exterior trim near the windshield could detach while driving. The recall covers model years 2011 to 2019. The recall comes after Ford had the most recalls of any U.S. automaker in 2023, issuing 58 recalls across 6.2 million vehicles.

Push for EV Tax Credit Leniency: The Alliance for Automotive Innovation urged the U.S. Treasury Department to make certain flexibilities permanent to ease compliance standards with the Inflation Reduction Act provisions that block tax credits for new EVs based on mineral sourcing requirements. The requirements have reduced the number of qualifying models available in the U.S. from 34 to 20.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.