The below text on the arbitrability of Concession Agreements in the Telecom Sector was used in the speech given at DAV Turkey's International Arbitration – Focus on Practices Symposium held at Rezan Has Museum in Istanbul on May 16th, 2013

In 1999, Article 125 was inserted into the Constitution. The referred provision states that "...the disputes arising from concession specifications and agreements may be settled by national or international arbitration..." In line with such amendment in the Constitution, the relevant provisions of the Law on the Council of State (No. 2575) and the Law on Administrative Judicial Procedure (No. 2577) were revised. Article 24 of the Law on the Council of State excludes the jurisdiction of the Council of State for disputes arising from concession agreements containing an arbitration clause. As a result, the Council of State "...may decide the actions for the annulment or compensation against the administration resulting from the concession covenants and contracts for which arbitration has not been provided..." Article 2 of the Law on Administrative Judicial Procedure is amended in order to limit the power of administrative justice – in disputes arising from concessions and for which arbitration is suggested – to the verification of the conformity of the actions and acts. Hence, the administrative courts cannot review the appropriateness of an act and action in this respect.

In addition, the Law on the Application of International Arbitration in Concession Agreements (No.4501) was also enacted in 2000. The Law governs the rules and principles to be followed during the execution of the concession agreements by the parties. Under Article 3 of the referred law, disputes with a "foreign element" as defined under Article 2 are to be settled through international arbitration1. Afterwards, the Law on International Arbitration No. 4686 which was enacted in 2001 included arbitration proceedings for the resolution of disputes with a foreign element as defined under Law No. 4501 (those arising from public service concession contracts) under its scope. The Law on International Arbitration sets forth the rules applicable to international arbitration. Under Article 2 of the said law, "foreign element" is defined widely in a manner extending the scope of the referred legislation2.

Furthermore, as per Article 8 of the Law on International Arbitration, the parties may freely agree on the procedural laws to be applied by the arbitrator(s).

Finally arbitration clauses were inserted into the renewed Concession Agreements regarding the operation of GSM services in 2001. With the arbitration clause of "[t]he Parties agree to resolve the disputes pertaining to the scope, implementation and termination of this agreement... pursuant to the Rules of Arbitration of the International Chamber of Commerce ("ICC Rules") by 3 arbitrators appointed in accordance with the same rules.". The parties further agreed that Turkish shall be the language of the arbitration proceedings with Turkish Law being the applicable law and Istanbul being the place of arbitration.

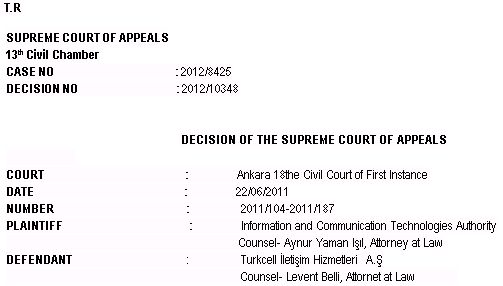

Exemplary Decision of the Supreme Court of Appeals

The exemplary decision from which the aforementioned quotations are taken from concern a Concession Agreement signed by and between Information and Communication Technologies Authority and a GSM Operator. According to this agreement, the GSM Operator was obliged to pay a certain percentage of its monthly gross sales as treasury share and a certain percentage thereof as Contribution to Authority Expenditures. The reason of the dispute between the said parties was the discounts applied to distributors for sales at wholesale and whether such discounts are to be included in gross sales and hence taken into consideration in the payment of treasury share and contribution to authority expenditures. The GSM Operator argued that gross sales mean the total value attained in return for the goods and services sold and that the discounts are applied prior to such sales and are not included in the invoices whereas the Information and Communication Technologies Authority argued in the contrary. The GSM Operator applied to the ICC for the determination of the non-obligation to pay Treasury Share and Contribution to Authority Expenditures on the discounts applied to distributors for sales at the wholesale level. ICC rendered a decision in favour of the GSM Operator and held that the GSM Operator was not obliged to pay the Treasury Share and Contribution to Authority Expenditures. Thereafter, the Information and Communication Technologies Authority filed a lawsuit for the setting aside of such arbitral award with reference to Article 15 of the Law on International Arbitration, which is provided herein below:

Please kindly find below significant quotations from the decision of the 13th Civil Chamber of the Supreme Court of Appeals with Case no of 2012/8425 and Decision No of 2012/10348

"As can be perceived, the grounds for cancellation are enumerated in two parts and the grounds for cancellation under Part 1 are said to be taken into account upon proof by the parties whereas the grounds under Part 2 are understood to be taken into account by the courts on their own. Under such circumstances, in case the dispute that is subject to the arbitral award is not arbitrable or the award is contradictory to public order, a judgment for the setting-aside of the arbitral award can be rendered...the public order is generally defined in the doctrine as "the entirety of the institutions and rules which determine the fundamental structure of a society at a given time in political, social, economic, ethical and legal aspects..."

"The fundamental principles that the States cannot abandon are the rules that concern public order and, in general, any contradiction to the mandatory provisions aiming to protect public interest and order and any contradiction to ethics and fundamental rights and liberties are issues that require the intervention of public order...For instance, given that customs laws and tax legislation are of concern to public order, an arbitral award resolving receivables that are contrary to tax legislation shall be confronted with the intervention of public order due to being incompatible with the fundamental principles deemed as indispensable under the Turkish law.... Under national law, public order means the entirety of the rules protecting the fundamental structure and fundamental interests of the Turkish society..."

" If the parties selected the law to which the arbitration shall be subject – in the arbitration agreement; the arbitrator(s) are obliged to accept that the parties have thereby selected the public order of the applicable law... In our concrete case, since it is set forth in the arbitration agreement between the parties that the dispute shall be settled by predicating upon the "Turkish Legal Rules"; the notion of public order under the Turkish Legal Rules - which is the applicable law - should also be based upon - in terms of the determination of the contradiction to public order. It should forthwith be stated that in order for the evaluation of the objections as to the violation of public order, the examination of the case merits may be necessary. Otherwise, it is not possible for the evaluation of the objections as to the contravention of public order. The examination of the issues related with the merits of the work as a requirement in such situations does not purport the reviewing of the case merits in a technical sense..."

"In fact, it is perceived that these provisions of the agreement are exactly carried over from the Supplemental Clause 36 of the Law numbered 5398 which makes additions to the Telephone and Telegraph Law numbered 406. In such case, it is not possible for the contractual provisions to be construed independently from the provisions of the law from which they are exactly quoted and the development process necessitating the introduction of such legal provision and the objective thereof cannot be ignored...The fact that the decisions rendered in contradiction with the fundamental principles which the States cannot abandon, mandatory legal provisions which have the objective of protecting public interest and order as well as legislation regarding the economic structure of the society would be confronted with the intervention of public order was mentioned above."

"Even though the Treasury Share and Contribution to Public Expenditure which were determined to be paid in the concession agreement do not constitute taxation; they are significant and continuous income elements which result from the transfer by the State of the public service. In our concrete case, as a result of the exclusion of the discounts applied to distributors in sales at wholesale from the basis for assessment of the gross sales upon which the payment of the Treasury Share is based – in contradiction with the objective of the regulation of the Supplemental Clause 36 of the Telegraph and Telephone Law numbered 406, the wording of the said provision and Article 8 of the Concession Agreement; it is apparent that the Treasury Share from which the State intends to attain a continuous income shall decrease, the budget balances shall be disrupted and consequently the economic balances and public order shall deteriorate...."

"Yet, the decisions taken by the GSM operators as per their commercial policies cannot affect the Treasury Shares. The acceptance of the contrary shall enable the evasion of the payment of the Treasury Share by increasing the discounts applied to the distributors. As a matter of fact, the plaintiff authority has even asserted that the defendant company implemented the discounts made to the distributors by 100% and written off the Treasury Share to be paid...The relinquishing in this manner to the GSM operator's initiative of the most important element of a concession agreement – the obligation to pay the Treasury Share – which was executed for the public benefit and with the intention to obtain more or less a certain amount of and continuous income – is contrary to the mandatory legal provisions and public interest by reason of the rendering of an award by the Arbitral Tribunal - with the objective interpretation method - against the actual intentions of the parties, the rules of the Turkish Law and the objective of the introduction of these rules and in a manner decreasing the Treasury Share; the consequences of the said award are contrary to the nature of the concession agreement, the objective of the State to obtain a continuous income, mandatory legal provisions and public interest and accordingly Turkish public order."

According to the Supreme Court of Appeals, the notion of public order is narrower in an international sense and that the notion itself should be considered within the terms of the chosen law. As per the Turkish law, public order is stated to mean the entirety of the rules protecting the fundamental structure and fundamental interests of the Turkish society. In its judgement, it is alleged that even though the Treasury Share does not constitute taxation; the decrease in the payment of such share shall damage the budget and hence economic balances and adversely affect public order. It is further asserted that in order for the evaluation of the objections as tot the violation of public order, the examination of the merits of the case may be necessary and, otherwise, that is not possible for the evaluation of the objections as to the violation of public order.

Turkish Courts cannot review the substance of an award and the correctness of the arbitrator's decision and cannot go into the merits of the case with the excuse of the notion of "public order" Therefore, the decision is not only violating the Law, but it also makes referral to arbitration actually ineffective. It shall definitely have negative effect both legally and in terms of the business of foreign investors with Turkey. Considering that international investors and businessmen want to have the absolute trust referring their disputes in Turkey to international arbitration and the awards of the arbitral tribunals being final and binding; it is clear that such awards by the Turkish courts on the ground of "public order" shall reduce such trust in the Turkish legal system and hence the business environment. Therefore, the decision discussed in this present article –together with many others in the same direction- shall have adverse effects on the trust on the foreign businessmen in the Turkish legal system and hence may –indeed affect the "economic balances" so highly protected by the Supreme Court so much more negatively than the decrease in the payment of the Treasury Share.

Upon the appeal – with hearing- by the counsel for the plaintiff of the decision for the dismissal of the lawsuit on the grounds set forth in the decision at the end of the adjudication that was carried out in the action for annulment between the parties, a subpoena was served on the related parties. The hearing commenced the upon the arrival of the counsel for plaintiff, Aynur Yaman Isik –Attorney at Law- and Atilla Ozturk –Attorney at Law- and the counsels for the defendant, Murat Karkin –Attorney at Law- and Umit Akin –Attorney at Law- on the stated date and was postponed to another date for a judgement to be rendered –pursuant to the hearing of the oral statements of the counsels who were present at the hearing. This time, it is ascertained that the petition for appeal is due in tine and the file is examined and it is discussed and held as follows:

DECISION

The plaintiff put forth that the "Concession Agreement on the Licensing for the Establishment and Operation of the GSM-PAN Europe mobile Telephone System" as executed with the defendant company on 27.4.1998 was renewed on 13.2.2022 and, finally, 3.7.2005 – following certain amendments thereon as per the Law numbered 5398 and that in accordance with Article8 of the agreement, 15% of the gross sales attained by the operator are required to be paid to Treasury on a monthly basis, and that an action was brought – against the Authority- before the (ICC) International Court of Arbitration with the Reference number of 15321/JHN/GZ with the certain claim that the defendant "is not obliged to pay the Treasury Share on the discounts made to the distributors in sales as wholesale" and that the Arbitral tribunal held –majority of votes- " that (1) the defendant is not obligated to pay the Treasury Share – on the discounts effected prior to the realization of the sales and the issuing of the invoices- in sales to distributors at wholesale- as per Article8 of the Concession Agreement dated 10 March 2006, (2) the allocation of the arbitration , costs amounting to 710.000 USD equally between the plaintiff and the defendant, covering by each party of their legal and other costs, (3) the rejection of all others claims" and that Clauses (1) and (2) of the said award should be annulled as per the relevant provisions of Article15 of The International Arbitration Law numbered 4686, in particular " public order" and "ultra vires" and sought the cancellation of the Clauses (1) and (2) of the ICC (International Court of Arbitration) arbitral award with the date of 24.01.2011 and the Reference number of 15321/JHN/GZ.

The defendant argued that the conditions requiring the setting-aside of the award rendered by the Arbitral Tribunal are not present and the law selected by the parties has not been exceeded by any ultra vires act and that there are not any points in the award which is in conflict with public order and that the members of Arbitral Tribunal are experts in their fields and that the defendant cannot subject a resolved dispute to re-adjudication since the parties have chosen international arbitration in the settlement of disputes instead of a state judgement and sought the refusal of the claim for the cancellation of the Arbitral Award of the International Court of Arbitration.

The Court ruled that the award rendered by the Arbitral Tribunal is binding on the parties by basing on the expert report and decided for the rejection of the lawsuit by indicating that there are not any conditions as stipulated under Article15 of the "International Arbitration Law" numbered 4686 for setting-aside of the award and such decision was appealed by the plaintiff.

The lawsuit involves the claim for the cancellation of Clauses (1) and (2) of the Arbitral Award of the ICC (International Court of Arbitration) with the date of 24.1.2011 and the Reference number of 15321/JHN/GZ.

As is known, the International Arbitration Law numbered 4686(IAL) was enacted on 21.6.2001 and entered into force by its publication on 5.7.2011. As per Article 1 of the referred law –which governs the rules to be implemented in the arbitration proceedings- with the heading of "objective and scope"; the application of (IAL) in disputes incorporating foreign elements and the place of arbitration is determined as Turkey or the referred law is chosen by the party arbitrator / arbitral tribunal is mandatory. Hence, the IAL shall be applied as – 5.7.2001- in disputes falling under the scope of this legislation ("The Foreign Element Concept and ICC Arbitration "Prof. Dr. Ziya Akinci, 6.4.2004 International Arbitration Seminar, Ankara, 6.4.2004, p.39). Accordingly, it is evident that the agreement which constitutes the subject matter of the lawsuit and which contains an arbitration clause and in which the place of arbitration is set as "Istanbul" comes under the scope of the aforementioned legislation – owing to its execution after the entry into force of IAL (Decision of the 15th Civil Chamber – Case No: 2002/4900, Decision No: 2002/5118, Date: 13.11.2002; Decision of the 15th Civil Chamber – Case No: 2002/4007, Decision No: 2003/876, Date: 25.2.2003; Decision of the 15th Civil Chamber - Case No 2002/2760, Decision No: 2002/4528, Date: 10.10.2002). Article 12/C of the Arbitration Law numbered 4686 states that "the arbitrator or the arbitral tribunal shall render a decision according to the laws- selected by the parties – to be applied to the contractual provisions and the disputes thereof. In the interpretation and the performance of the contractual provisions, commercial customs and practices pertaining the such laws shall be taken into consideration. Unless otherwise indicated, the selection of a certain law shall be construed as the direct selection of the substantive law are not the conflict of the laws or the procedural rules of such state "and in the event of the selection of law by the parties in the arbitration clause, the selected law is deemed to have been chosen in order to be applied to the merits. Again, in case of the selection of the law to be applied to the merits, it is perceived that the substantive law and commercial usages of such law and not the conflict of laws thereof shall be taken into consideration.

It is accepted in the Decision for the Unification of case-law with the date of 28.1.1994 and number of 1994/4-1 thst if it is prescribed in the arbitration clause by the parties that the substamtive law should be applied in the settlement of the disputes-in an arbitration within the scope of the Code of Civil Procedure , the arbitrators should decide according to such rules ; in the application of the substamtive law , the rules concerning the public order, and primarily the Constitution as well as the scientific opinions in the doctrine and the practices of the Supreme Court of Appeals in that matter should also be taken into consideration and that the parties may appeal upon the non-compliance by the srbitrators to these substamtive laws as prescribed and that such appeal should be examined -similar to court decisions- by the Supreme Court of Appeals on appeal prescribed (Journal of the Decisions of the Supreme Court of Appeals, vol.20, no.4, april 1994, pp. 519-543)

In the event of the cases in which IAL should be applied; appeal of the arbitral awards is not possinle ( solely the appeal of yhe decision remdered at the end of the annulment decision can be appealed) as can be co prehended clearly from Article 15 referred law, yet since cancellation can be sought, the examination of the arbitral decision on merits is out of question (Ziya Akinci, International Arbitration, Ankara 2003, p.185). In fact, the only legal action against arbitral awards is the action for setting-aside and the grounds for cancellation which are enumurated in Article 15 referred law are as follows:

"1. If the applicant party proves that:

a) A party to the arbitration agreement was incapacitated or the arbitration agreement is invalid under the laws to which the parties have subjected or under the Turkish law –in case of any non-selection thereof,

b) The selection of the arbitrator or the arbitral tribunal was not in compliance with the agreement of the parties or the procedure prescribed under this Law,

c) The arbitral award was not rendered within the time limit,

d) The arbitrator or the arbitral tribunal decided on its competence or non-competence in a manner contrary to law,

e) The arbitrator or the arbitral tribunal rendered a decision on a matter outside the arbitration agreement or did not decide on the entirety of the claim or exceeded its competence,

f) The arbitration was not conducted in accordance with the procedure set forth in the agreement of the parties or failing any agreement thereon, with the provisions of this Law and this situation affects the merits of the decision,

g) The principle of equality of the parties was not abided by; or

2. If the Court establishes that, a) the matter that is subject to the award of the arbitrator or arbitral tribunal is not arbitrable under Turkish Law, b) the award is in conflict with public order." [Emphasis added]

As can be perceived, the grounds for cancellation are enumerated

in two parts and the grounds for cancellation under Part 1 are said

to be taken into account upon proof by the parties whereas the

grounds under Part 2 are understood to be taken into account by the

courts on their own. Under such circumstances, in case the dispute

that is subject to arbitral award is not arbitrable or the award is

contradictory to public order, a judgment for the setting-aside of

the arbitral award can be rendered.

With respect to the examinations of the "award being contrary

to public order" as a ground for cancellation which shall be

taken into account by the court ex officio; the public

order is generally defined in the doctrine as " the entirely

of the institutions and rules which determine the fundamental

structure of a society at a given time in political, social,

economic, ethical and legal aspects " ( Suha Tanriver,

"The Role of Public Order in the Recognition and Enforcement

of Foreign Arbitral Awards in Turkey, Gift to Prof.

Dr.Ali Bozer", "Public Order", Ankara, 1998,

p.152).

The fundamental principles that the States cannot abandon are the

rules that concern public order and, in general, any contradiction

to the mandatory provisions aiming to protect public interest and

order and any contradiction to ethics and fundamental rights and

liberties are issues that require the intervention of public order.

For instance, given that customs laws and tax legislation are of

concern to public order, an arbitral award resolving receivables

that are contrary to tax legislation shall be confronted with the

intervention if public order due to being incompatible with the

fundamental principles deemed as indispensable under the Turkish

law. Similarly, the awards rendered, incongruous with the economic

structure of the society may also be considered as contrary to

public order. (Kemal Dayindarli, "National- International

Public Order and its Effects on

Arbitration",Ankara1994,p.36)

The notion public order differs under national and international

private law. Under national law, public order means the entirety of

the rules protecting the fundamental structure and fundamental

interests of Turkish society. These rules comprise of the rules

comprise of the rules -pertaining to legislation and private law-

with which the parties should comply. On the other hand, the notion

of international public order is narrower and restricted. Hence, a

case which is considered as a violation of public order under the

national law may not be considered as a violation of public order

in terms of international law. If the parties selected the law to

which the arbitration shall be subject - in the arbitration

agreement; the arbitrator(s) are obliged to accept that the parties

have thereby selected the public order of the applicable law

(Dayindarli, ibid. p.77). In other words, public order

should be evaluated by adhering to the chosen law. In our concrete

case, since it is set forth in the arbitration agreement between

the parties that the dispute shall be settled by predicating upon

the "Turkish Legal Rules"; the notion of public order

under the Turkish Legal Rules - which is the applicable law-,

should also be based upon- in terms of determination of the

contradiction to public order.

It should forthwith be stated that in order for the evaluation of

the objections as to the violation of public order, the examination

of the case merits may be necessary. Otherwise, it is not possible

for the evaluation of the objections as to the contravention of

public order. The examination of the issues related with the merits

of the work as a requirement in such situations does not purport

the reviewing of the case merits in a technical sense (Prof Dr.

Cemal Sanli, "Drafting of International Commercial Contracts

and Remedies of Disputes", 3rd Ed.

Istanbul,July,2005,p.209)

The dispute between the parties which constitutes the subject-matter of the arbitration proceedings stems from the Concession Agreement regarding GSM operation which was signed on 27.4.1998 and renewed on 13.2.2002 according to the Provisional Article 2 of the Law numbered 4673 and dated 12.5.2001 and thereafter amended on 10.3.2006 as per the Law numbered 5398.

Public concession agreements concern the granting -for a certain period- of the operation of public services to private persons that are determined by the administration and under the supervision thereof. The main objective of execution of such agreements is public interest. Concession agreements are subject to the written form and are founded on the specifications previously drawn up. The specifications and the contractual documentation are – in essence- defined unilaterally by the administration. The concessionaires are entitled to entirely accept or reject the terms and condition prepared by the administration. Therefore, concession agreements are akin to adhesion agreements .These agreements are of a mixed nature; whilst the provisions regarding the term of concession granted and the financial balance are contractual, the provisions on the organization and performance of the public service are regulatory. The contracting administration possesses certain paramount rights and powers in comparison with the other contracting party (concessionaire). These rights and powers are; authority to inspect and apply sanctions, authority to amend the agreement unilaterally and authority to revoke concession. It is recognized that the administration possesses such powers in its capacity as the principal owner and the party in charge of the public services. Albeit the administration possesses the right to modify the terms and conditions of the upon the emergence of new circumstances. As per the principle of unforseeability (imprevision), the concessionaire is entitled to demand –from the administration- the rectification of the financial balance of the agreement which has deteriorated. The rationale for granting of such a right to the concessionaire is the public interest regarding the continuation of the public service operated by such concessionaire.

Following such explanations on the definition and nature of the concession agreements, when the occurrence at issue is examined; in the concession agreement regarding the electronic communication which constitutes the subject-matter at issue; certain financial obligations – one of which is the "Treasury Share" and the other is "Contribution to Public Expenditure" (KMKP) –were stipulated on the operator.

It is inferred from the contend of the file that the treasury share in the concession agreement executed previously by the parties on 13.2.2002 was determined as 15% of the gross revenue attained over the number of all subscribers; however, pursuant to the lawsuits filed by the GSM operators –including the defendant- as to the payment of such shares over vat, opening-closing, SIM cards, cancellation, improvements, interconnecting fees, default interest, special communication tax; it was held in the cases pursued through international arbitration and before the Council of State that the treasury share shall also be paid over vat, opening-closing, SIM cards, cancellations, improvements, interconnecting fees, default interest, special communication tax, yet than in order for the settlement of the dispute in an amicable manner and by means of the acceptance of the GSM operators for the narrowing of the basis for assessment, a protocol was executed by and between the parties on 22.11.2004; that the basis of gross revenue from which treasury share is to be paid was re-set as "gross sales" by means of the removal of the items such as default interest and indirect taxes; that the operators were also granted the right to execute agreements in this respect as per Article 12 of the same legislation ; that the concession agreement dated 10.3.2006 was signed between the parties after such process; that prior to this agreement , negotiations were held and written communications were exchanged as to the keeping of the taxes and similar revenues –which are collected in respect of being a taxpayer- outside the scope of the basis for assessment from which the treasury share is to be paid; that the discounts applied to distributors in sales at wholesale- which is subjected to arbitration by the defendant company- is not among the contested income brackets; that the referred discounts were included in the gross revenue which constituted the basis for assessment for approximately 8 years during the period before the amendment of the agreement; that they were charged to gross sales constituting the basis for assessment and the treasury share was paid even after the amendment of the agreement in 2005 which is subjected to arbitration and that pursuant to the continuation of the same application for nine months, the dispute referred to the arbitral tribunal was commenced upon the warning of the financial advisor of the defendant company.

The provision for "the payment by the Operator to the Treasury of 15% of the monthly gross sales excluding default interest applied to subscribers for the amounts which were not paid in due time and fiscal obligations such as indirect taxes, charges and duties and amounts accrued for accounting for reporting purposes " was prescribed in article 8 of the Concession Agreement between the parties with date of 10.2.2006 – under the heading "Share(s) to be Paid to Treasury" and again gross sales were defined under Article 5/n as "Gross Sale: Amounts which comprised of the total amounts attained or accrued in return for the goods or services sold within the framework of the activities of the operators and which are passed from the income statement accounts to (60 Gross Sales) account". In fact, it is perceived that these provisions of the agreement are exactly carried over from Supplemental Clause 36 of the Law numbered 5398 which makes additions to the Telephone and Telegraph Law numbered 406.In such case, it is not possible for the contractual provisions to be construed independently from the provisions of the law from which they are exactly quoted and the development process necessitating the introduction of such legal provision and the objective thereof cannot be ignored. In fact , it is observed that whilst the " gross revenue" was changed with " gross sales" ; the legislator –taking into account of the disputes and all developments regarding the basis for assessment of the treasury share – did not contend solely with the indication of the value for the payment of the treasury share like the previous arrangement and specified that the basis for assessment of the treasury share shall be ascertained over the gross sales and enumerated each of the values not to be included in the basis for assessment albeit being within the scope of gross sales and intend to eliminate the disputes and uncertainties previously experienced and did not list the discounts applied to distributors – as subjected to arbitration- within the scope of exceptions. Indeed, the main starting point of the provision introduced with the Supplemental Clause 36 of the Law numbered 5398 is to remove the dispute experienced in the prior process by and between the GSM operators and the authority and to slightly narrow the basis for assessment of the Treasury Share and Contribution to Public Expenditures and Additional Provisional Article 12 which grants the GSM operators the right to re-execute agreements in this respect was also introduced for this purpose.

The fact that the decisions rendered in contradiction with the fundamental principle which States cannot abandon, mandatory legal provisions which have the objective of protecting public interest and order4 as well as legislation regarding the economic structures of the society would be confronted with the intervention of public order was mentioned above. Even though the Treasury Share and Contribution to Public Expenditure which were determined to be paid in the concession agreement do not constitute taxation; they are significant and continuous income elements which result from the transfer by the State of the public service. In our concrete case, as a result of the exclusion of the discounts applied to distributors in sales at wholesale from the basis for assessment of the gross sales upon which the payment of the Treasury Share is based –in contradiction with the objective of regulation of the Supplemental Clause 36 of the Telegraph and Telephone Law numbered 406, the wording of the said provision and Article 8 of the concession Agreement ; it is apparent that the Treasury Share from which the State intends to attain a continuous income shall decrease, the budget balances shall be disrupted and consequently the arbitration proceeding; the GSM operators choose – as a marketing and distribution strategy- to effect sales to its distributors below the fixed tariffs and such situation shall not alter the GSM service charges reflected on to their subscribers; in other words, shall not make a difference in the gross sales finally attained in consequence of the GSM service. However, while the gross sales figures and the GSM service subscription fees have not changed, the inadequate calculation of the Treasury Share due to the discounts applied by the operator shall be at stake. Yet, the decisions taken by the GSM operators as per their commercial policies cannot affect the Treasury Share by increasing the discounts applied to distributors. As a matter of fact, the plaintiff authority has even asserted that the defendant company implemented the discounts made o the distributors by 100% and written off the Treasury Share to be paid. Such a situation would constitute fraud against the Concession Agreement and the legislation on which the referred agreement is based and income shifting in terms of fiscal law and cannot legally accepted. The relinquishing in this manner to GSM operator's initiative of the most important element of a concession agreement –the obligation to pay the Treasury Share- which was executed for the public benefit and with the intention to obtain more or less a certain amount of and continuous income – is contrary to the mandatory legal provisions and public interest.

In conclusion, in the case before the court, it set forth in the Concession Agreement which was amended as per the Supplemental Clause 36 of the Law numbered 5398 that the Treasury Share should be paid over the gross sales and even though the items which are excluded from the basis for assessment being enumerated in restricted manner, the discounts applied to the distributors were not counted within the scope of the exceptions. At the date of the agreement and a long period before such date and thereafter, the accounting practice of the defendant was to charge the discounts to "60 gross sales" account and hence the Treasury Share over the discounts were paid undisputedly and no disputes in this matter either before or during the protocol and agreement stages did not take place. In this case, despite the non-existence of any disputes in this matter between the parties for approximately 8 years, the payment of the Treasury Share by the inclusion of the discounts in taxation basis, the continuation of the practice in this manner for a period of 9 months following the amendment of the agreement in 2005 and it being established that the said dispute started upon the warning of the financial auditor of the defendant company and by reason of the rendering of an award by the Arbitral Tribunal – with the objective interpretation method- against the actual intentions of the parties , the rules of the Turkish Law and the objective of the introduction of these rules and in a manner decreasing the Treasury Share ; the consequences of the said award are contrary to the nature of the concession agreement, the objective of the State to obtain continuous income, mandatory legal provisions and public interests and (2) of the Arbitral Award – the consequences of which shall render results contrary to Turkish public order – should have been cancelled, are against the procedure and the laws and necessitates the reversal thereof.

RESULT: Due to reasons explained hereinabove, it is unanimously decided –on 17.04.2011- for the REVERSAL of the appealed award in favour of the appellant/plaintiff, the receipt of TRY 900.00 hearing attorney fees from the defendant and the payment thereof to the plaintiff, the repayment – if so demanded- of the appeal fee of TRY 18.40 which was taken in advance

Footnotes

1.Definition of "foreign element"

The Law No. 4501 Article 2 (c) - Foreign element shall refer to circumstances under which [i] at least one of the parties, be it established or to be established, to a [concession] contract is to be considered foreign in accordance with the regulations on the encouragement of foreign capital, or [ii] the realization of the contract shall necessitate foreign capital, or conclusion of foreign loan or security agreements.

Foreign Direct Investments Law No. 4875 (enacted in 2003)

Foreign investor: real persons with the citizenship of foreign countries and Turkish citizens residing abroad as well as legal entities established according to the laws of foreign countries and international organizations – that invest in Turkey

2.The Law No. 4686 Article 2 - The 'foreign element' is deemed to exist when one of the following situations occur and accordingly the arbitration will be considered as international:

- The domiciles, habitual residences or places of business of the parties to the arbitration agreement are in different states;

- The domiciles, habitual residences or places of business of the parties are in a state different than

- The place of arbitration determined by the arbitration agreement itself or by the interpretation thereof,

- The place where a significant part of the obligations arising out of the main agreement will be performed or the place with which the dispute is most closely connected with;

- At least one of the shareholders of the company which is a party to the main agreement contributed foreign investment in accordance with the foreign investment promotion legislation or it is necessary to enter into credit and/or warranty agreements in order to provide foreign investment for the validity of the main agreement;

The main agreement or legal relationship realizes the transfer of capital or goods from one state to the other.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.