In the bustling sphere of Vietnam's business investments, a prevalent practice emerges: the creation of multi-tiered subsidiaries. This structural strategy is geared towards establishing an entity that can potentially benefit from being treated as a domestic company under Vietnamese law, an advantage built upon the foundation of the Law on Investment No. 61/2020/QH14.

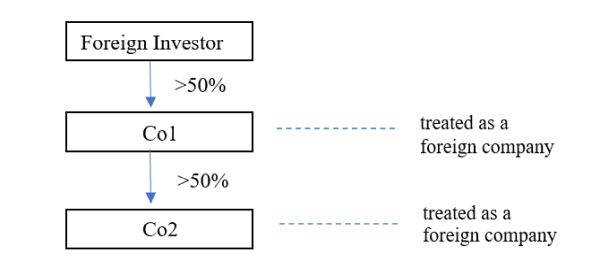

Central to this approach are the provisions within Article 23.1 and 23.2 of the law. These sections present an interesting dynamic where a company primarily owned by foreign investors (Company 1) and its direct subsidiary (Company 2) are akin to foreign entities under Vietnamese law, while companies not within these stipulations are viewed as domestic entities.

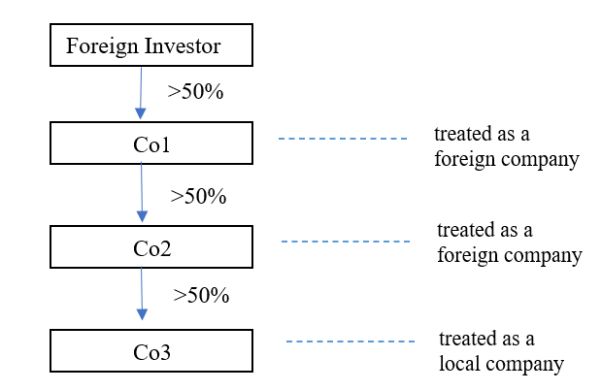

The intricacies of these provisions are further unveiled in the interpretation related to the subsidiaries of Company 2 (Company 3). A predominant school of thought among legal experts suggests that Company 3 does not fall under Article 23.1, and as per Article 23.2, should be treated like a domestic entity.

However, it's essential to recognize that this interpretation, despite its popularity, is not explicitly affirmed by the authorities. The silence from the relevant bodies introduces an element of uncertainty. There remains the possibility of a more conservative interpretation that could classify Company 3 as a foreign entity, given that its majority owner, Company 2, is also classified as such.

This prevailing ambiguity has led many firms to adopt a cautious approach. The establishment of additional subsidiary layers (Company 4 and Company 5) serves as a widely used defensive tactic, providing a level of 'insurance' against potential future restrictive interpretations of the law.

In conclusion, while the multi-tiered subsidiary structure is a common practice in navigating the Law on Investment in Vietnam, its acceptability remains an open question due to the lack of explicit regulatory affirmation. This uncertainty highlights the dynamic interaction between strategic business planning and legal interpretation in the context of Vietnam's intricate legal landscape.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.