The figure below gives an overview of the main hidden payments flowing between the participants. In the following analyses, all non-disclosed payments are in red, both in graphics and tables.

Figure 8: The main generally undisclosed payments flowing

For the first time, we see the fund producer as a participant. The fund producer is generally intransparent to the Client1.

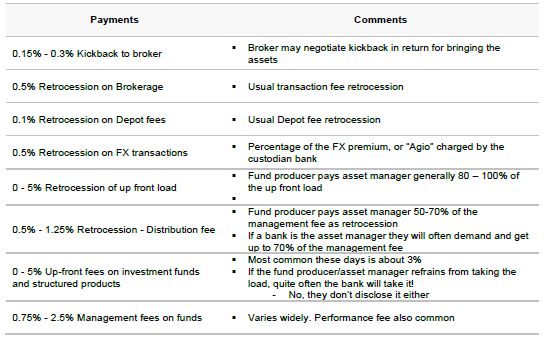

Table 2: Main Non-Disclosed payments

Footnote

1 Disclosure vs. Non-Disclosure of fund fees are debatable. Yes, the fees do appear in the fund prospect. However the Client is highly unlikely to read the prospect. The asset manager places the funds in the Clients portfolio without asking the Client. The fees associated with funds are not disclosed on Client statements, neither the up front load nor the management fee. The Client has no idea if the funds in his portfolio charge 0% or 5% up front load, or for that matter a 0.2% or 2% management fee. We treat these payments as undisclosed.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.