Davies has submitted a comprehensive comment letter to the Capital Markets Modernization Taskforce (Taskforce) in response to the consultation report published by the Taskforce on July 9, 2020 (Report). The Taskforce was formed by the Ontario government in February 2020 with a mandate to review and modernize Ontario's capital markets. The Report, which followed consultations with market participants (including Davies), set out several proposals that would, if implemented, represent fundamental changes to Ontario's securities laws. Although we support some of the proposals in the Report, many others would not be beneficial for Ontario – and some would be disastrous. These "bad" proposals would ultimately have an adverse impact on issuers, investors and other market participants, eroding confidence in Ontario's capital markets and rendering them less attractive and competitive than other advanced capital markets.

We strongly support initiatives to modernize Ontario's capital markets and reduce regulatory burden. However, any significant changes to securities regulation should be considered only after thorough cost-benefit analyses and, if pursued, should be implemented on a national rather than a provincial scale to promote harmonization and minimize the growing overlap and fragmentation among corporate and securities laws and stock exchange requirements. Regulators should also be mindful of the importance of aligning Ontario's rules with those of other advanced capital markets, and particularly the United States, in circumstances where alignment is appropriate.

The Taskforce intends to deliver its final report to the Minister of Finance by the end of 2020.

Some of the more significant (and problematic) proposals outlined in the Report include the following:

- Expanding the mandate of the Ontario Securities Commission (OSC) to include fostering capital formation and competition.

- Removing any "hold" period on securities privately placed with accredited investors.

- Introducing an "alternative offering" model that would allow reporting issuers to sell freely tradeable securities to the public without a prospectus.

- Allowing exempt market dealers to participate as sponsors of reverse takeover transactions.

- Decreasing the ownership threshold for early warning reporting disclosure from 10% to 5%.

- Adopting quarterly filing requirements for institutional investors of Canadian companies.

- Mandating enhanced disclosure of material environmental, social and governance information, including forward-looking information.

- Eliminating the "objecting beneficial owner" and "non-objecting beneficial owner" shareholder statuses to enable issuers to access the list of all beneficial securityholders.

- Creating a prohibition to deter and prosecute misleading or untrue statements about public companies, divorced from the traditional market impact test.

- Enhancing the availability of pre-enforcement hearing seizure powers and extending them to assets unconnected with an alleged breach of securities laws.

- Strengthening investigative tools by empowering OSC staff to obtain production orders and enhancing compulsion powers.

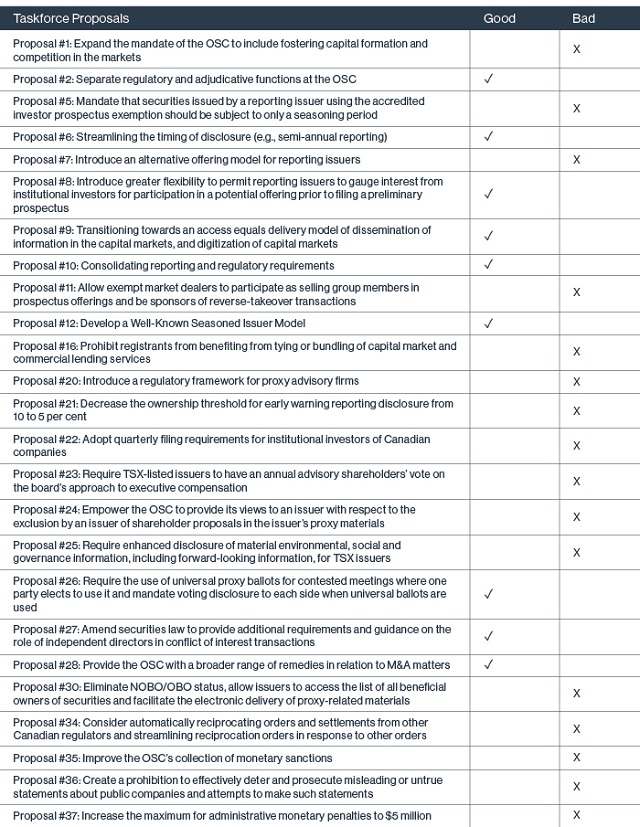

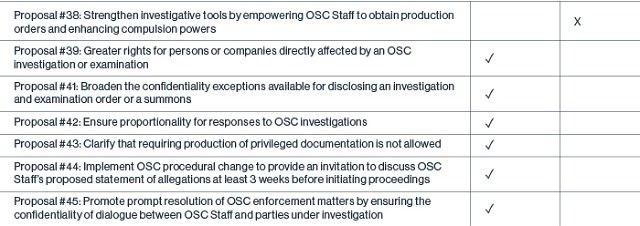

Our "report card" below identifies each proposal on which we have provided comments and whether we believe that the proposal would be good or bad for Ontario's capital markets. For complete details, including our arguments and analysis, please refer to our comment letter.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.