Overview

- Each year there are amendments to legislation and case law decisions that impact your obligations, rights, and powers as an employer

- The purpose of today's webinar is to review a sampling of key legislative amendments and case law developments

- This webinar acts as a compliment to the issue specific seminars and webinars that we hold throughout the year

- This webinar touches on issues that impact all employers (unionized or not), for unionized employers, please note we hold a labour law update webinar in March each year

- This webinar should not be relied on in lieu of legal advice and you should always consult with your employment lawyer to understand your legal options and obligations

1)i) Legislative Amendments: Employment Standards Act – Mass Terminations

- On March 13, 2023, the Ministry of Labour announced that proposed amendments will be introduced relating to the Mass Termination rules under the Employment Standards Act ("ESA")

- The ESA currently provides that employees are entitled to increased notice of termination under the ESA if the employment of fifty or more employees is terminated at an employer's "establishment" within a four-week period

- To date, it had been unclear how remote workers were impacted by the Mass Termination provisions of the ESA

- Under the ESA, an "establishment" is defined as a location at which an employer carries on business. If the employer carries on business at more than one location, separate locations can constitute one "establishment" if:

-

- The separate locations are located within the same municipality; or

- One or more employees at the location have seniority rights that extend to the other location under a written Employment Contract

- The home offices where remote employees work were not clearly included the definition of establishment

- If the proposed amendments to the ESA are passed, the definition of "establishment" will explicitly include employees who work remotely from home offices

- This will mean that in the event of a Mass Termination, remote workers would become eligible to receive the Mass Termination notice provided for in the ESA, which is greater than the regular termination notice provision in the ESA

1)ii) Legislative Amendments: Canada Labour Code – July Amendments

- Two amendments to the Canada Labour Code (the "Code") came into effect as of July 9, 2023

- With the first amendment, the Code now requires employers to provide each employee with a written "Statement of Employment Conditions"

- For existing employees, the Statement must be provided by October 7, 2023 (90 days after the requirement came into force)

- For new employees, it must be provided within the first 30 days of employment

- For all employees, a new Statement of Employment Conditions must be provided within 30 days of any changes

- Employers are also required to retain the written Employment Statement for 36 months after the employment ends

- The Regulations to the Code outlines what information must be included in the Statements

- This includes, amongst other things, the employee's job title and rate of wages, a description of the duties and responsibilities, the names of the parties to the employment relationship, the term of employment (whether indefinite or fixed-term), a description of the necessary qualifications for the position and the hours of work for the employee

- The second amendment which came into effect July 9, 2023 now requires employers to reimburse reasonable work-related out-of-pocket expenses incurred by employees within 30 days after an employee submits their expense claim to the employer, unless the employer and employee have agreed to another timeline either in writing or a collective agreement

- Failure to comply with the above two amendments can lead to fines being imposed against an employer

1)iii) Legislative Amendments: Occupational Health and Safety Act – Fines and Heat Stress

OHSA Fines

- Over the last number of years OHSA has been amended a number of times to increase the fines which can be imposed on both corporations and individuals convicted of an offense under OHSA

- In 2022, the Provincial Government increased the maximum fine for individuals convicted of an offense under OHSA to $500,000.00 and for corporate directors the maximum fine was increased to $1,500,000.00

- Further proposed amendments which are currently at the Third Reading stage would increase the maximum fine for corporations convicted of an offense under OHSA from $1,500,000.00 to $2,000,000.00

- Also, in the Fall of 2022, the fines which the Ministry of Labour can impose for ticketed offenses (which are less serious than prosecutions) also increased from $250.00 to $350.00 for workers, from $450.00 to $550.00 for supervisors and from $550.00 to $650.00 for employers

Heat Stress

- Based on statistics provided by the Workplace Safety and Insurance Board, there were 350 lost time claims for heat exhaustion just from construction workers between 2006 and 2015

- In order to address these matters, amendments to OHSA are being proposed which would create Regulations which specifically address heat stress

- The new Regulations being considered would introduce heat stress exposure limits, require companies to conduct heat stress risk assessments and would also require employers to identify and implement control measures and procedures to control heat exposure

1)iv) Legislative Amendments: Competition Act – Wage Fixing and No-Poaching

- As of June 23rd, 2023, the Canadian Competition Act has been amended to prohibit employers from entering into non-poaching agreements and wage- fixing agreements with their competitors

- As such, it is now a criminal offence in Canada to enter into an agreement with an unaffiliated employer not to solicit or hire each other's employees

- In addition, it is now a criminal offence in Canada to enter into an agreement with an unaffiliated employer to fix, maintain, or decrease employee compensation (i.e. wage fixing)

- This ban extends to agreements entered into before June 23rd, if either party looks to enforce them post-June 23rd

- This ban on wage fixing and no poaching agreements does not apply where the companies are affiliated (e.g. subsidiaries)

- The ban also does not apply where the wage fixing or no poaching agreement is established by a collective agreement

- Under the Competition Act, there is an exception to the ban on wage fixing and no poaching agreements known as the Ancillary Restrained Defence or ARD

- The Ancillary Restraint Defence exists if the companies can establish that a wage fixing agreement or no poaching agreement was necessary further to a desirable business transaction to make the transaction possible or to achieve efficiency

- For example, companies may be able to successfully raise the defence if they enter into a no poaching agreement if it is a term of litigation settlement

- Despite this ban, employers remain able to enter into certain restrictive agreements with their employees

- For example, employers can still use both non-solicitation agreements (i.e. you can work for a competitor, but cannot solicit our clients/employees) and non-competition agreements (i.e. you cannot work for certain competitors)

- However, in Ontario a non-competition agreement is only enforceable if: i) it was in place before October 25, 2021; ii) it is in regards to a member of the executive team (e.g. the CEO, CFO, etc.); OR iii) it is entered into further a purchase and sale, where the seller is becoming an employee of the purchaser

- For further details on the ban on wage fixing and no-poaching agreements, the Competition Bureau of Canada has published enforcement guidelines

1)v) Legislative Amendments: Pay Transparency

- Various jurisdiction in Canada are passing legislation that establishes obligations and restrictions further to pay transparency

- Pursuant to the Pay Transparency Act, once proclaimed, Ontario employers are:

-

- Required to include a salary rate or range with all job advertisements

- Required to track compensation to ensure pay equity in regards to gender and other diversity characteristics (only applies if the company has 100+ employees)

- Required to file an annual pay transparency report with the Ministry of Labour and post it in the workplace (only applies if the company has 100+ employees)

- Prohibited from asking job candidates about their past compensation

- Prohibited from disciplining or firing employees for talking about their compensation with colleagues

- For federally regulated employers (e.g. trucking companies that cross provincial lines, financial institutions, etc.) with 100+ employees, they are currently required to include gender-based wage equity data with their annual employment equity report, pursuant to the Employment Equity Act

- In May 2023, the British Columbia government passed the 2023 Pay Transparency Act

- Under the Act, as of May 11, 2023, British Columbia employers are:

-

- Required to include a salary rate or range with all job advertisements

- Required to track compensation to ensure pay equity in regards to gender and other diversity characteristics (applies as of Nov 2024 to employers with 1000+ employees; applies as of Nov 2025 to employers with 300+ employees; and applies as of Nov 2026 to employers with 50+ employees)

- Required to file an annual pay transparency report with the Ministry of Labour and post it in the workplace or on the company's intranet (applies as of Nov 2024 to employers with 1000+ employees; applies as of Nov 2025 to employers with 300+ employees; and applies as of Nov 2026 to employers with 50+ employees)

- Prohibited from asking job candidates about their past compensation

- Prohibited from disciplining or firing employees for talking about their compensation with colleagues

1)vi) Legislative Amendments: Employment Standards Act – Placement Agency and Recruiter Licence

- As a result of amendments to the Employment Standards Act, all staffing companies and recruiters who provide staffing services in Ontario will need to be formally licensed as of January 1, 2024

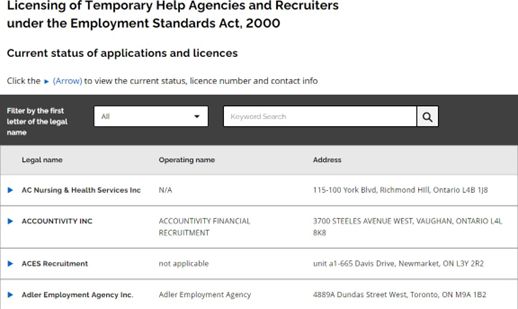

- Temporary help agencies and recruiters are currently able to apply for their licence via the Ontario Ministry of Labour's online portal

- The application must include specific information regarding the business, including the names and addresses of all officers, directors, and partners, criminal record details for all officers, directors, and partners, and the address of each location of the business inside and outside of Canada

- The application must also be accompanied by an electronic irrevocable letter of credit of $25,000, as issued by a Canadian bank or credit union

- There is also an application fee of $750

- For businesses that are both a staffing company and a recruiter, they must submit two applications

- If your business uses placement agencies or recruiters, you can confirm that they are licenced on the Ministry of Labour's new application and licence status webpage

To read this article in full, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.