Overview

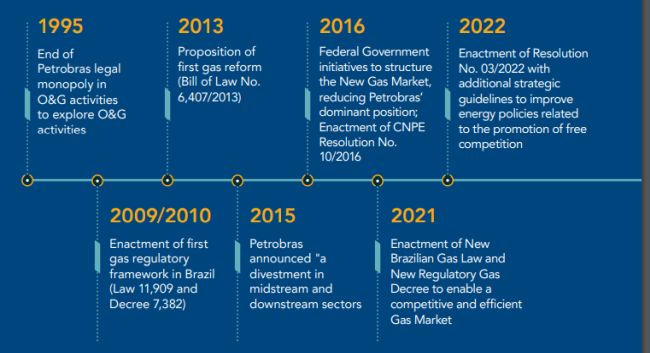

The first regulatory framework specifically targeting the natural gas market in Brazil was created more than 10 years ago, through the enactment of the Federal Law No. 11,909/2009, followed by the Federal Decree No. 7,382/2010. However, less than five years later, in 2013, the first regulatory reform was proposed, Bill of Law No. 6,407 of 2013, as the original legislation did not seem sufficient to promote competitiveness and expansion of gas transportation infrastructure in Brazil at the time. This is because, despite the end of its legal monopoly to oil and gas exploration in 1995, Petrobras continued to exercise a dominant position in the entire gas value chain.

Discussions on the structuring of a new regulatory scenario for natural gas in Brazil have dragged on for years and only intensified in 2015, when Petrobras announced a divestment process to reduce its position in oil and gas midstream and downstream sectors in Brazil. Soon afterwards, the Federal Government launched the Gas to Growth (Gás para Crescer) initiative to guide the gas regulatory reform by establishing the guidelines for an open and competitive gas market, considering the expected reduction of Petrobras' role in this sector.

The National Energy Policy Council ("CNPE") stepped in during the structuring work of the new Brazilian Gas Market and published CNPE Resolution No. 10/2016, which set forth strategic guidelines for the design of a new gas market in Brazil, focused on the promotion of competition.

Other programs and initiatives followed, including an agreement between Petrobras and the Administrative Council for Economic Defense (CADE), the Brazilian Antitrust Authority with which Petrobras has agreed to several commercial commitments to support its voluntary divestment of the Brazilian gas market, to enable the diversification of players and the attraction of new investments to expand the sector's infrastructure.

After many years of debates among Federal and State governments, industry agents and Brazilian society, Law No. 14,134/2021 ("New Brazilian Gas Law") and Decree No. 10,712/2021 ("New Regulatory Gas Decree") were finally published to create the necessary basis for the new Brazilian gas market, based on efficiency, competition and best international regulatory practices.

On April 04, 2022, the CNPE published Resolution No. 03/2022, which established additional strategic guidelines to improve energy policies related to the promotion of free competition and created the basis for the transitional period to a competitive market.

Inside the New Brazilian Gas Regulatory Framework

To understand the relevance of the rules created by the New Brazilian Gas Law and New Regulatory Gas Decree and their potential impacts on the Brazilian gas scenario in the next few years, take a look at the main changes promoted by the new Brazilian gas regulatory framework:

1 Authorization Regime for Gas Transportation and Storage

Under previous gas legislation, gas transportation activities were subject to the concession regime, preceded by a public tender process. The New Brazilian Gas Law defines authorization as the exclusive granting regime for gas transportation activities in Brazil, which include the construction, expansion, operation and maintenance of gas transportation facilities. The authorization regime also applies to gas storage activities, which were also subject to the concession regime.

2 Transportation Unbundling Rules

The New Brazilian Gas Law establishes corporate restrictions among the gas industry agents, preventing transporters from having (i) indirect or direct corporate control or (ii) an affiliation1 relationship with companies or consortiums performing activities of exploration, development, production (E&P), importation, shipment and commercialization of natural gas.

3 Entry-Exit Model for Gas Transportation Capacity

Under the previous gas legislation, shippers had to contract the gas transportation capacity of each "piece" of the gas pipeline infrastructure, considering the physical flow of the molecule within the transportation system, "congesting" the transportation capacity and promoting inefficient use of the infrastructure. The New Brazilian Gas Law allows shippers to book capacity rights independently at the so-called "entry" and "exit" points, creating gas transportation through zones supported by virtual trading points (virtual hubs).

4 Negotiated Third-Party Access to Essential Facilities

The New Brazilian Gas Law grants thirdparty access not only to gas transportation pipelines, but also to essential facilities (gas offloading systems, gas processing facilities and LNG terminals), which shall be negotiated in good faith and in a non-discriminatory manner by the facilities' owners, who will retain a preference for using its facilities. The third-party access to gas transportation pipelines will be further regulated by National Agency of Petroleum, Natural Gas, and Biofuels ("ANP").

Gas Commercialization

The Brazilian Constitution (art. 25, §2) establishes the monopoly of the States to explore "local piped gas services", also known as gas distribution activity. Gas distribution and gas commercialization activities have always been confused in several Brazilian States, whose local regulation on local piped gas services unconstitutionally incorporated gas commercialization activities into the scope of the State monopoly for gas distribution.

In many States, the rights of local consumers related to gas distribution is limited to the producers and importers, considering the obstacle imposed by the distributors by restricting competition for the molecule in the captive distribution market. Thus, specific regulatory frameworks reach the inconsistency of forcing the producer to sell its gas to the distributor in order to enforce its right of access to distribution, even in cases where the producer is the final consumer of its own product.

Other States, despite admitting the figure of the "free consumer", impose extensive classification requirements and regulations for such an agent, increasing the regulatory cost of these market transactions.

To enable a competitive market for gas commercialization in Brazil with the reduction of gas prices and an increased offering, it is necessary to: (i) end competitive limitations on gas commercialization in the States; and (ii) secure the regulatory separation of gas distribution and gas commercialization in States regulations.

Among other aspects, the CNPE Resolution No. 03/2022 established that:

- Reinforcing the separation among competitive activities (such as production and commercialization of gas) from monopolistic activities (such as transportation and distribution) is a strategic guideline for the design of the new gas market in Brazil;

- The transition to a competitive gas market has the purpose to restrict the transactions among gas traders and gas distributors that are related parties;

- Implementation of gas release programs and stimulation of gas commercialization by producers shall be a policy for the opening of the gas market;

- The active participation of gas suppliers and buyers in the short term commercialization market to enable a higher liquidity and transparence of the gas market is in the best interest of the National Energy Policy.

To view the full article click here

Visit us at Tauil & Chequer

Founded in 2001, Tauil & Chequer Advogados is a full service law firm with approximately 90 lawyers and offices in Rio de Janeiro, São Paulo and Vitória. T&C represents local and international businesses on their domestic and cross-border activities and offers clients the full range of legal services including: corporate and M&A; debt and equity capital markets; banking and finance; employment and benefits; environmental; intellectual property; litigation and dispute resolution; restructuring, bankruptcy and insolvency; tax; and real estate. The firm has a particularly strong and longstanding presence in the energy, oil and gas and infrastructure industries as well as with pension and investment funds. In December 2009, T&C entered into an agreement to operate in association with Mayer Brown LLP and become "Tauil & Chequer Advogados in association with Mayer Brown LLP."

© Copyright 2020. Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. All rights reserved.

This article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.