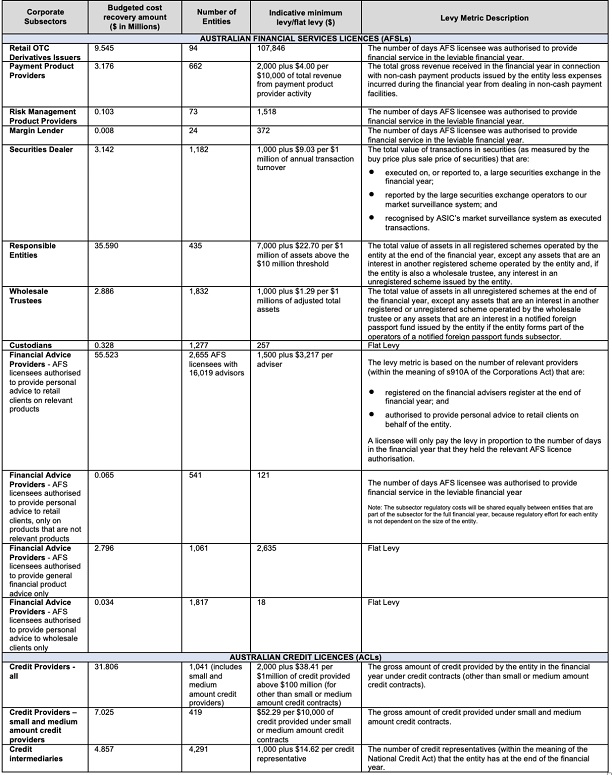

ASIC has released the indicative levy amounts for the 2022-23 financial year. The Cost Recovery Implementation Statement (CRIS) details ASIC's costs and how these costs are allocated to participants in the financial services and credit industries. We encourage all AFSL and Australian Credit Licence holders to:

- Review the CRIS for their estimated levy; and

- Update their cash flow projections and budgets in anticipation of the invoice from ASIC in January 2024.

How much are you likely to pay?

What do the levies pay for?

ASIC's budget is set by the Australian Government. ASIC is required to outline how it intends to recover its costs from various regulated subsectors using industry funding levies and fees for service based on transaction-based activities.

The CRIS includes the following components:

- An explanation of how ASIC implements the industry funding model (IFM), which describes how ASIC assigns costs to calculate the levies and fees for service;

- A summary of ASIC's estimated levies, categorised by industry subsector; and

- A detailed breakdown of ASIC's estimated costs and the areas of focus in their work, classified by sector and subsector.

ASIC expects that $352.0 million of its total budgeted resources will be recovered by the cost recovery levies and statutory industry levies for 2022-23. To address recommendations outlined in the Australian Government's ASIC Industry Funding Model (IFM) review report, ASIC and Treasury will establish a five-yearly consultation process with the industry. This process will examine the policy settings of the IFM, replacing the previously released annual consultation CRIS that ASIC used to release prior to the final CRIS.

What next?

ASIC regulated entities were required to submit business activity metrics via the Regulatory Portal prior to 27 September 2023 to allow ASIC to appropriately calculate the levy. Those entities who do not submit their details by the due date will nonetheless receive an invoice with an estimated levy. AFSL holders should also remember that the levy will be calculated on the basis of all authorisations included on the AFSL, including any authorisations that are not utilised throughout the 2022-23 financial year. Where an entity falls into more than one subsector, the invoice will include the relevant levies for all applicable subsectors.

ASIC expects that the figures released in the CRIS will allow industry participants to ensure they budget appropriately for the levy which will be invoiced in January 2024. AFSL holders should make sure to include the levy in cash flow projections moving forward to avoid any inadvertent breaches of their financial requirements in RG166.

Further Reading

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.