A $70,000 penalty has been imposed on National Advice Solutions Pty Ltd under the anti-hawking provisions which commenced in 2021.

National Advice Solutions made unsolicited calls to consumers, encouraging them to roll over their superannuation into different superannuation products. Initial and ongoing fees for the rollover were charged by National Advice Solutions.

What does this mean for licensees?

ASIC stated that the reforms to the anti-hawking regime were made "in response to clear consumer harm when it came to the unsolicited calls involving financial products..." and that it will continue to pursue court action where it sees licensees disregarding the prohibition on hawking financial products.

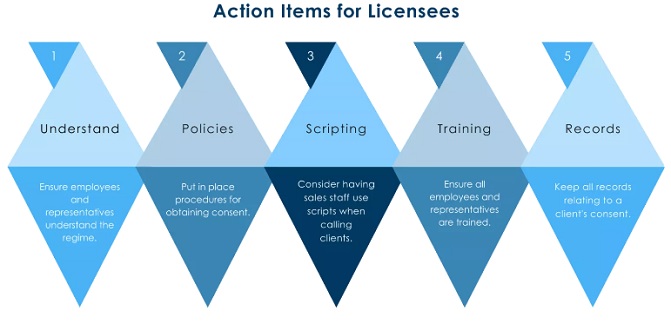

This means licensees must be proactive in ensuring that its employees and representatives do not engage in hawking activities. Licensees should:

- Ensure employees and representatives understand the offers that are and are not permitted under the anti-hawking regime;

- Put in place procedures for obtaining consent from clients to contact them;

- Consider scripting telephone calls for sales employees;

- Conduct internal training in relation to the anti-hawking regime with all employees and representatives who have contact with consumers;

- Keep proper records, including:

- the date consent was obtained

- the methods of contact permitted

- the range of products within the scope of consent

- any variations to or withdrawal of the consumer's consent

- any communications with the client prior to consent being obtained

The prohibition on hawking

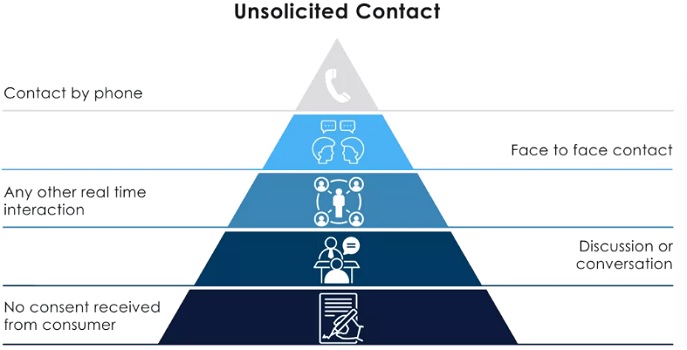

The prohibition on hawking states that a person must not offer financial products for issue or sale to a retail client if the offer is made in the course of, or because of, unsolicited contact. Unsolicited contact is:

- contact by phone

- face-to-face

- any other real time interaction in the nature of a discussion or conversation to which the consumer did not consent.

The prohibition on hawking applies to offers made to retail clients only and does not apply where the offer, request or invitation is made in the course of giving personal advice to the consumer, where the advice provider is required to act in the best interests of the consumer.

The prohibition is not limited to the provider of the financial product but extends to the actions of all employees, agents and representatives of a licensee.

Background

In December 2022, ASIC cancelled the AFSL of National Advice Solutions and banned two of its Responsible Managers from providing financial services. On 20 February 2023, National Advice Solutions appeared in the Southport Magistrates Court and pleaded guilty to one charge of breaching the anti-hawking laws.

The anti-hawking reforms commenced on 5 October 2021 and were designed to address consumer harms arising from consumers being approached with unwanted financial products via cold-calls or other unsolicited contact.

Further Reading

- 23-034MR National Advice Solutions convicted of hawking in relation to superannuation roll over calls

- 22-366MR ASIC bans two Gold Coast based financial service providers and cancels the AFS licence of National Advice Solutions

- ASIC Regulatory Guide 38

- Anti-hawking Prohibition Reforms for Financial Products

- AFSL Anti-Hawking Policy Template