Overview

The mining boom that fuelled growth over the last decade and cushioned the economy from the worst of the Global Financial Crisis has well and truly ended.

Increasing global supply coupled with a sharp slowdown in demand from China has seen the iron ore price fall by over 50% to US$63/tonne, its lowest level since 2009. Coal has also fallen sharply and oil is 35% lower. The terms of trade are now expected to fall by 13.5% in 2014/15, the largest decline since records began in 1959.

Unfortunately lower prices are likely to stay this way for some time. This is because China's residential construction boom, the single largest consumer of steel, is beginning to unravel. Property prices have begun to fall on the back of rampant oversupply. As property developers fail, non-performing loans will escalate, weighing on the banking system. A more pronounced slowdown in China appears inevitable.

Of course much lower commodity prices have wider ramifications. Only the lowest cost producers can survive should prices stabilise at or around current levels for any prolonged period of time. If this happens then higher cost producers will collapse and/or production will be curtailed. Jobs will be lost and incomes will fall, both of which will detract from growth. While the fall in the oil price is widely a positive for a net importer such as Australia, it is a negative for our LNG industry, which is forecast to become our second largest export in coming years.

As a result of the much lower terms of trade and lower wages growth, tax receipts have been revised down by over $31.6 billion. The underlying budget deficit is now expected to exceed $40 billion this financial year. While the incumbent Government continues to blame its predecessor for the budgetary woes, the reality is that this is simply the inevitable outcome from short sighted political pork-barrelling during the boom times. It is easy to cut personal tax rates, lift tax-free thresholds and abolish tax on superannuation pensions when times are good, but these choices were never going to be sustainable. By definition, any boom will always end.

Nevertheless, there are benefits from the plunging terms of trade. The Australian dollar is expected to continue to fall which will enhance the competitiveness of our exports and import competing industries. In addition, interest rates are likely to stay lower for longer. This should continue to provide support for asset prices (property and shares) and non-mining investment, which in turn should assist consumer spending.

Conclusion

The outlook for the Australian economy has deteriorated with the sharp fall in commodity prices. The stimulative impact of low interest rates coupled with positive momentum in residential construction should remain broadly supportive of growth over the next 12 months, albeit at below trend levels (about 2.5% p.a.).

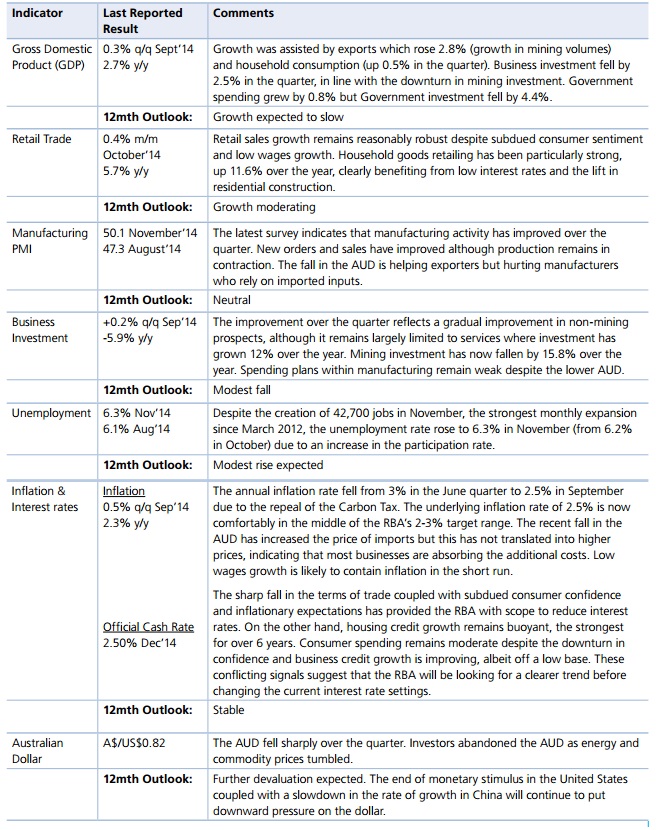

Key Economic Indicators

This publication is issued by Moore Stephens Australia Pty Limited ACN 062 181 846 (Moore Stephens Australia) exclusively for the general information of clients and staff of Moore Stephens Australia and the clients and staff of all affiliated independent accounting firms (and their related service entities) licensed to operate under the name Moore Stephens within Australia (Australian Member). The material contained in this publication is in the nature of general comment and information only and is not advice. The material should not be relied upon. Moore Stephens Australia, any Australian Member, any related entity of those persons, or any of their officers employees or representatives, will not be liable for any loss or damage arising out of or in connection with the material contained in this publication. Copyright © 2014 Moore Stephens Australia Pty Limited. All rights reserved.