We conducted an informal, small-scale survey during March to May 2023 to gather insights from prominent non-bank lenders on their activity over the past twelve months in the net asset value (NAV) lending market. In this report, we share our findings. Please note that given the small scale of the survey, these findings do not necessarily reflect the broader market, and the visuals below may reflect a heavier weight of parameters which would be more subdued in a larger pool of data.

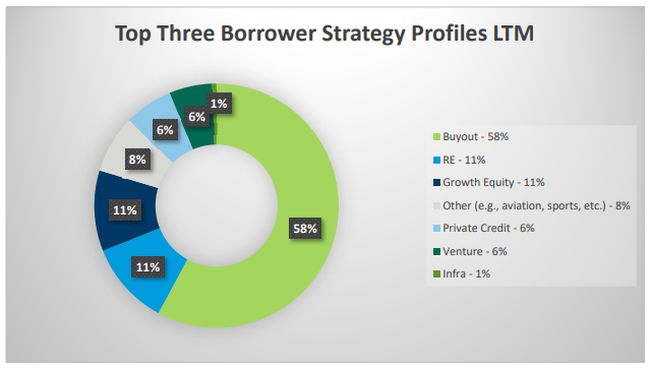

Top Three Borrower Strategy Profiles LTM

Buyout was the most prevalent borrower strategy profile in the last 12 months (LTM) among survey participants, followed by an equal representation of Real Estate and Growth Equity.

Commitment Sizes

Commitment sizes in the $100mm – $250mm range were most common among survey participants. Smaller commitment sizes of up to $25mm, however, remain a signficant part of the market. While certain respondents may have participated in the notable $1,000mm+ NAV financing earlier this year, individual commitment sizes in that facility may have been significantly lower.

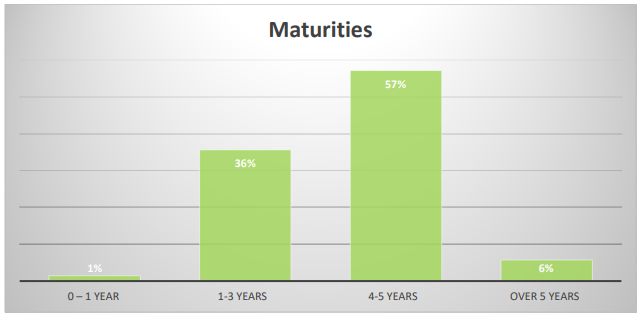

Maturities

Maturities in the 4-5 years range were the most common, with 57% of maturities being in that range.

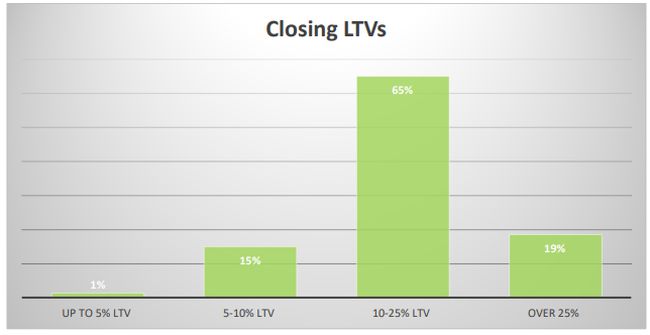

Closing LTVs

65% of closing LTVs (Loan-to-Value) were in the 10-25% range. We note with interest that the second most common response was closing LTVs of over 25%.

To view the full article click here

Insights On The NAV Lending Market

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.