Malta's fiscal unity regime stands as an innovative measure of tax efficiency, offering a host of benefits to groups of companies. From simplified tax management to enhanced cash flow, this regime provides a strategic advantage for businesses operating within its framework. Within this article, we delve into what makes Malta's fiscal unity regime a game-changer for businesses looking to optimise their tax strategies.

Understanding Malta's Fiscal Unity Regime

Introduced through the Consolidated Group (Income Tax) Rules in 2019, Malta's fiscal unity regime allows related companies within a group to elect to be treated as a single taxpayer for income tax purposes. This consolidation streamlines tax calculations and reporting, fostering efficiency and clarity in tax management.

Opting for the Fiscal Unity Regime

A company incorporated in Malta is taxed at 35% on its profits. Upon a distribution of profits to a foreign shareholder by a company registered in Malta, these shareholders may claim a partial tax refund. The most common tax refund is of 6/7ths, i.e. 30% (6/7ths of 35%) of the taxable profits.

If no application for a Fiscal Unit is made, then the Maltese tax return is to be submitted normally at a rate of 35%. Further to this submission, the shareholder will then be able to claim the 30% refund of this tax back. Therefore, the tax rate following this whole process is effectively 5% (scenario 1 below).

However, shareholders of Malta companies must wait some time to get the above-mentioned tax refund. On average, this could take between 6 and 9 months and therefore, could lead to certain liquidity issues.

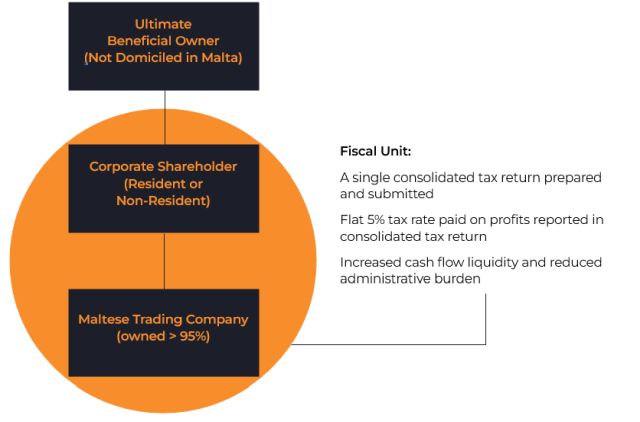

Therefore, to counter such issues, the Fiscal Unity Regime was introduced. Through this regime, the accounts of the distributing subsidiary and receiving shareholder are consolidated and therefore, only the effective tax rate of 5% will be charged (scenario 2 below).

Scenario 1:

Scenario 2:

Forming a Fiscal Unit

Under the rules, companies within a group can consolidate their income tax returns by electing to form a fiscal unit. A parent company holding at least 95% shareholding in its subsidiaries can initiate this process, treating subsidiaries as transparent entities for tax purposes. This ensures alignment with eligibility criteria outlined in the rules.

Registration Process and Obligations

Registration involves ensuring accounting periods coincide among group members and resolving any pending tax liabilities with authorities. Facilitated through the electronic portal of the Commissioner for Revenue, registration must occur within a specific timeframe. Upon successful registration, the parent company assumes the role of 'principal taxpayer', bearing responsibilities under Maltese tax law.

Financial Reporting and Tax Treatment

The regime mandates the preparation of audited consolidated financial statements annually. Transactions between members of the fiscal unit are generally disregarded for tax purposes, simplifying the tax assessment process. Notably, Malta's fiscal unity regime offers an efficient tax refund mechanism, allowing shareholders to offset tax refunds against the income tax due by the fiscal unit.

Benefits and Disadvantages

The advantages of Malta's fiscal unity regime are clear: simplified tax management, enhanced efficiency, improved cash flow, transparency, and flexibility for group structures. However, challenges exist, including joint and several liability for tax payments, potential complexities in registration, and increased regulatory compliance burdens.

Conclusion

For businesses seeking to optimise their tax strategies, Malta's fiscal unity regime presents a compelling solution. At CSB Group, we specialise in guiding businesses through the process of forming a Fiscal Unit in Malta. From evaluating eligibility to navigating registration procedures and beyond, our team of leading tax and corporate specialists ensure comprehensive support every step of the way. As a leading Corporate Services Provider, CSB Group strives to remain abreast current developments and emerging solutions to assist clients and efficiently guide them through the various corporate structuring options available both in Malta and in other countries.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.