On Tuesday, 27 February 2024, President Bola Ahmed Tinubu, GCFR, launched the Expatriate Employment Levy (EEL). The EEL is a government-mandated contribution imposed on organizations which engage expatriate workers in Nigeria, subject to certain exemptions. Its objectives are to promote skills transfer and knowledge sharing, balance economic growth and social welfare, enhance collaboration between public and private sectors and address demographic shifts. The EEL will serve as a mandatory document like passport. Every eligible expatriate will be required to present the EEL card at the time of exit and entry into Nigeria. Several countries, especially in the middle east, have implemented expatriate levies or similar measures to grow their revenue base or control the influx of expatriates. So, Nigeria is not alone in this regard.

The levy will be computed at $15,000 for every expatriate on director level and $10,000 for those on other levels. Interestingly, the handbook, in paragraph 8.11, specifies that the EEL will be based 'mostly on the offshore earnings of expatriates working in Nigeria'. This suggests an ad valorem rate, which is different from the fixed amounts specified in the handbook. The EEL, which is payable annually, should qualify for tax deduction as a validly incurred business expense.

The handbook, which contains the guidelines for implementation of the levy, 'the Project', was also launched by the President. According to the government, the Project will be operated on a Public Private Partnership (PPP) model between the Federal Government of Nigeria (FGN) represented by the Federal Ministry of Interior (FMI) as the guarantor while the Nigeria Immigration Service (NIS) will serve as the implementing agency. In this regard, the NIS will carry out periodic audit with a view to ascertaining the level of compliance with the EEL. However, the handbook does not specify how any disputes arising from the audit may be resolved. Please click here. to access the handbook.

According to the handbook, employers are required to register their expatriate employees through an online reporting portal that will be set up for this purpose.

The effective date of implementation of the EEL has subsequently been defined as 15th March 2024 and employers have until 15th April 2024 to comply. Expatriates that are on quota or are in Nigeria for at least 183 days in any 12-month period will be liable to pay the EEL. However, accredited staff of diplomatic missions and government officials are exempt from the levy.

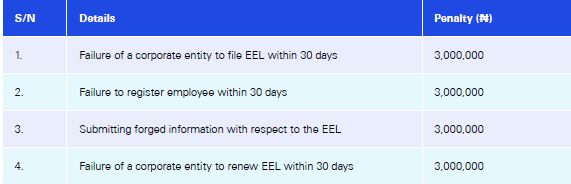

The handbook also specifies penalties for non-compliance with the guidelines. Inaccurate or incomplete reporting by any employer can lead to imprisonment for a term of 5 years or a fine of ₦1,000,000 or both. The other offences and related penalties are as follows:

The intention of the government to promote and protect the interests of the local workforce is welcome. The introduction of the levy may also result in organisations showing preference for Nigerians in diaspora that possess the requisite skills and knowledge. This may, therefore, serve as an avenue to promote back to roots immigration and potentially offset the impact of the 'japa' syndrome. However, a critical question that government needs to address is whether the potential benefits of introducing the EEL to achieve its objectives outweigh the costs. There is also the issue of whether a thorough impact assessment was carried out before the introduction of the levy. Such assessment will provide the relevant information on the revenue potential of such levy, the related cost, and the impact on businesses. Meanwhile, there are a handful of grey areas that need to be clarified to enable stakeholders to make informed decisions.

Undoubtedly, Nigeria has a revenue challenge. It is, therefore, understandable that government will explore every avenue to enhance its revenue sources. However, it is always important to find the right equilibrium between revenue generation and economic growth. Otherwise, the country will not achieve sustainable growth. In the light of the prevailing myriad of taxes and levies, the government, through the Presidential Committee on Fiscal Policy and Tax Reforms, has given the assurance that it will not introduce new taxes but streamline existing taxes and levies. The question, therefore, is what has changed?

There is the question of whether the government can introduce such levy without the appropriate legal and regulatory framework. It is always important that such significant policy change is supported by an enactment of the National Assembly. Also, the timing of reforms is extremely important. Given the headwinds facing businesses now, this may not be the best time to introduce such a levy. Otherwise, the current challenges will be exacerbated and may result in disruptions to business operations.

Currently, Nigeria is trying to attract the desired foreign investment. For this to happen, the right enabling environment for business must be created. The EEL may do more harm than good by significantly impacting the expatriate population in Nigeria and discouraging the inflow of the much-needed foreign direct investment required to drive the growth of the Nigerian economy. This may also force businesses to relocate their operations to other neighbouring countries which may be more accommodating.

The EEL may potentially impact many organisations negatively, especially as it is already challenging to sustain the payment of the $2,000 statutory fee to obtain residence permits (CERPAC forms) for non-ECOWAS nationals annually, given the current foreign exchange challenges in the country. It is interesting to note that payment for a residence permit is made in its naira equivalent. As of the time of this publication, a CERPAC form costs ₦3,196,000 (exclusive of bank commission of N5,000). The annual naira equivalents of the EEL are ₦16,000,000 and ₦23,000,000 per non director and director level expatriate respectively, based on the prevailing exchange rate.

Of course, there is the question of why a government levy is fixed in foreign currency and not in the Nigerian Naira. It appears that this is designed to guard against regular adjustment of the levy amount in view of the current high inflation rate and the depreciation of the local currency against the US dollar. However, the issue of 'dollarizing' the economy has often been the subject of discourse. It is, therefore, difficult to understand that the same issue that is being kicked against by one agency of government is being promoted by another. Payment of the EEL in US dollars will put unnecessary pressure on the exchange rate. It is, however, possible that government may fix the levy in US dollar but direct for the payment to be made in Naira to address this issue in the same manner as the CERPAC.

Perhaps, the FMI should have focused on publishing a Critical Skills List, as contained in the Expatriate Quota Administration Handbook 2022 (please access here) to define the roles/professions that expatriates are permitted to undertake in Nigeria and encourage the growth of the local workforce. Enforcement of such list should also be a priority.

Certainly, balancing the need for increased revenue with the imperative of fostering economic development is a delicate task that needs a holistic approach. It requires streamlining regulations, aligning fiscal policies, and defining the legal framework to create a conducive business environment. While stakeholders await more clarity on the implementation of the EEL, organizations with expatriates who meet the eligibility requirements need to urgently take proactive action to review the impact of this development on their businesses and take appropriate action to avoid penalties that may arise from non-compliance. KPMG is well placed to provide the required guidance and support.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.