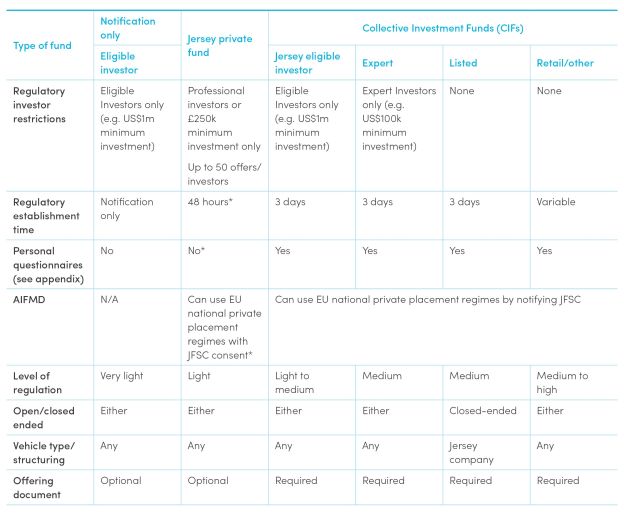

The following table summarises the main points of fund regulation in Jersey.

* For a Jersey Private Fund with a Jersey manager which is "marketed" into EU/EEA (as defined in the AIFMD): (a) an AIF Certificate is required (10 days); and (b) if the AIFM is not sub-threshold, the AIFM (or the fund, if self-managed) must obtain an AIF Services Business licence (10 days). These processing times run concurrently with the fund application.

All funds are subject to Jersey's internationally compliant laws and regulations in respect of the prevention and detection of money laundering and the financing of terrorism.

Non-Jersey domiciled funds generally do not require a separate authorisation in Jersey (although consent may be required for some activities, such as keeping the register in or marketing into Jersey). Jersey entities can be established to act as service providers to such funds.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.