BACKGROUND

Countries worldwide have been progressively pivoting towards the implementation of international agreements relating to climate change, such as the Kyoto Protocol (1997), Paris Agreement (2015), and Glasgow Climate Pact (2021) that were initiated within the framework of the United Nations Framework Convention on Climate Change ("UNFCCC"), with the objective of mitigating the impact of climate change. As climate change continues to accelerate, driven primarily by the increasing levels of Greenhouse Gases ("GHG")1 in the atmosphere, the global community recognizes the urgent need to mitigate the negative effect of climate change through GHG reduction.

Indonesia, as a participant in the UNFCCC, has endorsed both the Kyoto Protocol and Paris Agreement. These international commitments were formalized through Law Number 17 of 2004 and Law Number 16 of 2016, respectively. In line with these ratifications, Indonesia is committed to contribute to achieving the international goal to limit the rise in global average temperature to below 20C above pre-industrial levels and continuing efforts to suppress the temperature rise within 1.50C above pre-industrial levels (called the Nationally Determined Contribution or "NDC"). This NDC of Indonesia outlines its target to reduce GHG emissions by 29% independently and 41% with international collaboration by the year 2030.2

CARBON PRICING

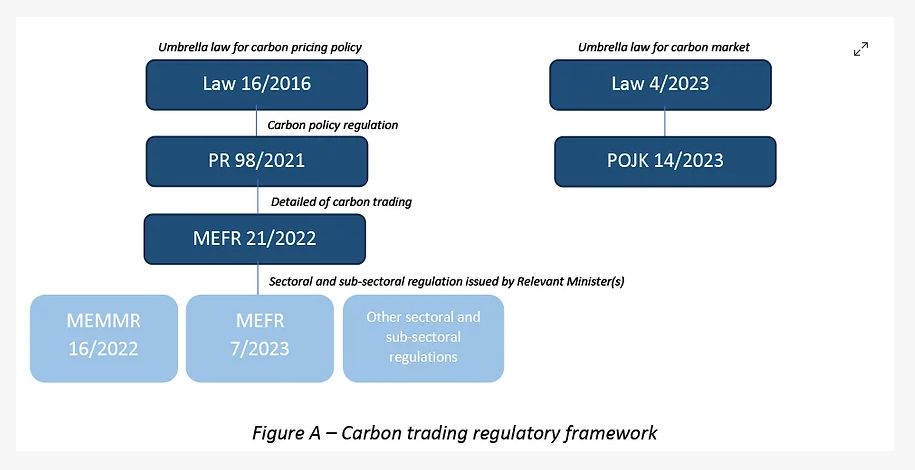

In the light of achieving the NDC target, the government of Indonesia ("GOI") has drawn inspiration from the carbon pricing initiatives adopted by other countries. In the past two years, the GOI has introduced a series of regulations related to carbon pricing which include Presidential Regulation Number 98 of 2021 on the Implementation of Carbon Pricing to Achieve NDC Targets and Control Over GHG Emissions in Relation to Nation Development ("PR 98/2021") and Minister of Environment and Forestry Regulation Number 21 of 2022 on Guidelines for the Implementation of Carbon Pricing ("MEFR21/2022"). Earlier this year, the GOI also issued Law Number 4 of 2023 on the Development and Strengthening of the Financial Sector ("Law4/2023") which governs, among other matters, the implementation of Indonesia's domestic carbon market. Law 4/2023 has been further regulated through the issuance of Indonesian Financial Services Authority ("OJK") Regulation Number 14 of 2023 on Carbon Trading through the Carbon Exchange ("POJK 14/2023").

The purpose of these regulations is to restrict the generation of carbon within certain thresholds and to utilize its limited availability to establish the economic value of carbon. Employing a market-based strategy establishes a direct correlation between the carbon emissions generated by an entity and the corresponding rise in cost associated with carbon. Therefore, in essence, the carbon pricing policy aims to encourage entities to reduce carbon emission by adopting cleaner technologies or facilitating the shift toward a more environmentally sustainable strategy.

This economic approach is commonly implemented through mechanisms such as carbon taxes and cap-and-trade systems. In Indonesia, PR 98/2021 establishes carbon pricing methods in the form of (i) carbon trading; (ii) result-based payment; and (iii) carbon levy.3 This article will primarily delve into the carbon trading policy in Indonesia.

CARBON TRADING

Coverage Sectors and Subsectors

Participation in carbon trading is mandatory for all individuals and corporate entities within the sectors and sub-sectors highlighted in PR 98/2021.4 The carbon trading policy currently covers five (5) main sectors: (i) energy; (ii) waste; (iii) industrial process and product use; (iv) agriculture; and/or (v) forestry. The subsectors comprise: (i) power generation; (ii) transportation; (iii) buildings; (iv) solid waste; (v) liquid waste; (vi) garbage; (vii) industry; (viii) rice fields; (ix) livestock; (x) plantation; (xi) forestry; and/or (xii) peat and mangrove management.5 PR 98/2021 provides that these sectors and subsectors can be occasionally expanded (collectively referred to as the "Relevant Sectors/Subsectors").6

In addition to PR 98/2021 and MEFR 21/2022 as the general and implementing regulations of carbon pricing, each relevant minister7 regulating the Relevant Sectors/Subsectors (a "Relevant Minister") is authorized to issue their sectoral regulations, particular to the matter of carbon trading.8 Only one sector and one subsector now have sectoral regulations in place, namely the forestry sector (through Minister of Environment and Forestry Regulation Number 7 of 2023 on Procedure for Carbon Trading in the Forestry Sector ("MEFR 7/ 2023"))9 and the power generation subsector (through Minister of Energy and Mineral Resources Regulation Number 16 of 2022 on Procedures for the Implementation of Carbon Economic Value within the Power Generation Subsector ("MEMMR 16/2022")).

Please refer to Figure A below which sets out Indonesia's legal framework for carbon pricing and trading.

Understanding the Concept of Carbon Trading

Carbon trading constitutes a market-driven mechanism aimed at decreasing GHG emissions by engaging in the buying and selling of carbon units, through a carbon exchange platform or through a direct buy and sell transaction.10 Carbon trading is carried out on the basis that a business entity is required to emit GHG emissions within a certain limit or is required to comply with emission reduction obligations set out by the GOI. The exchange of carbon units involves quantities measured in CO2-equivalent tons and can be carried out within domestic and international markets. The revenue generated from carbon trading and the cost associated with exceeding the limits are intended to motivate entities to engage in carbon reduction efforts and promote environmental sustainability. In an ideal scenario, the expense associated with acquiring carbon from the market should exceed the cost of implementing innovative technologies and processes to curtail emissions. Therefore, a company would be more committed to taking reasonable measure to decrease their costs through emissions reduction.

PR 98/2021 established two distinct carbon trading methods, comprising emission trading and emission crediting/offsetting.11 Despite their common trait of involving the trade of carbon units, these methods differ in their concept and execution. Emission trading pertains to businesses or activities within Relevant Sectors/Subsectors that are subject to a predetermined cap or limit on emissions.12 Emission offsetting, on the other hand, relates to businesses or activities outside the Relevant Sectors/Subsectors that voluntarily engage in carbon trading.13

Further details regarding emission trading and emission offset is set out below:

A. Emission Trading

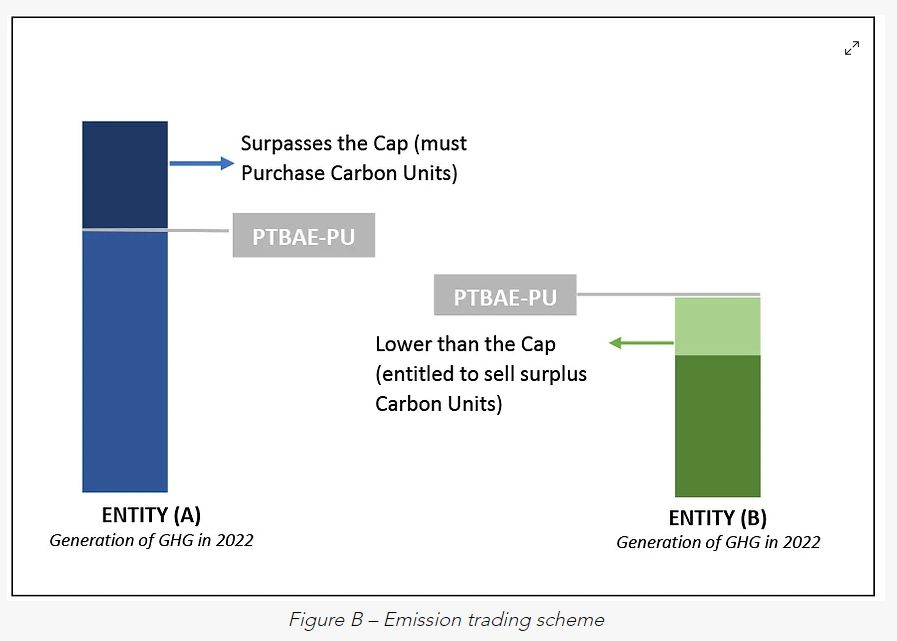

Under MEFR 21/2022, the GOI is required to determine: (i) a certain GHG emission cap for the Relevant Sector/ Subsectors; and (ii) a certain GHG emission cap for each business entity operating within the Relevant Sectors/ Subsectors.14 The term used to indicate the cap for each Relevant Sector/Subsector is PTBAE (Persetujuan Teknis Batas Atas Emisi).15 Whilst the term used for the cap applicable to a business entity is PTBAE-PU (Persetujuan Teknis Batas Atas Emisi bagi Pelaku Usaha).16 Both PTBAE and PTBAE-PU are determined by the Relevant Minister.17

PTBAE-PU signifies the maximum allowable level of GHG emissions generated by a specific business entity within a designated timeframe.18 The total accumulation of PTBAE-PU across all business entity within a sub-sector must not exceed the PTBAE set for that sub-sector.19 Should the emissions generated by a business entity surpass its determined PTBAE-PU, the said business entity is obliged to procure carbon units from the market in quantities that are equivalent to the quantity of emissions that had surpassed the entity's PTBAE-PU. This transaction can occur either through a direct dealing or on a carbon exchange platform, if available.20 Conversely, if a business entity's emissions fall below its allocated PTBAE-PU, it is entitled to sell its excess emission quota on the market. This potential transaction is illustrated in Figure B below.

As highlighted in Figure B above each business entity have a different level of PTBAE-PU, since the PTBAE-PU is not a mere equal distribution of the PTBAE for the sector, but also based on the actual or historical emission levels produced by each business entity.21 When a period of compliance22 concludes, it is determined that Entity (A) has exceeded its designated PTBAE-PU. Consequently, Entity (A) will be required to replace the excess emissions produced by purchasing carbon units from other entities, like Entity (B), which are selling their surplus carbon units because the emissions generated by Entity (B) is below its PTBAE-PU.

The calculation of a business entity's carbon emissions at the end of a period of compliance is carried out through a procedure referred to as measuring, reporting and verification ("MRV").23 This MRV process involves a Verifier who is an independent third party certified by a verification agency accredited by a national accreditation committee.24 The appointed Verifier is responsible for reviewing and verifying the business entity's emission report and assessing whether the business entity had exceeded its PTBAE-PU limit or not.25

As a result of this MRV process, business entities with surplus emissions will be granted carbon certificate(s).26 These carbon certificates then serve as tradeable units in the carbon trading market.27

B. Emission Crediting/Offsetting

Emission offsetting applies to businesses and/or activities that are not subject to PTBAE and/or PTBAE-PU limits.28 If a company intends to offset its carbon unit deficit or would like to voluntarily participate in selling and purchasing carbon units, it would need to engage in emission-reduction activities and obtain a GHG Emissions Baseline29 from the Relevant Minister.30

The company concerned shall express their intention to engage in emission reduction activities by submitting a DRAM (Dokumen Rancangan Aksi Mitigasi) or a project design document detailing a climate change mitigation action plan prepared by the business entity.31 This DRAM must be validated by a Validator, an independent third party certified by the national accreditation committee.32 This validation process is designed to assess if the proposal for the mitigation action plan prepared by the business entity is feasible and meet the requirements set out in Minister of Environment and Forestry Regulation Number P.72/MENLHK/SETJEN/KUM.1/12/2017 of 2017 on Guidelines for the Implementation of Measurement, Reporting and Verification of Climate Change Control Actions and Resources ("MEFR 72/2017").33 Once validated, the DRAM shall be reported to the National Registry System for Climate Change Control ("SRN PPI" or Sistem Registri Nasional Perubahan Pengendalian Iklim). This SRN PPI is a register system that collects, manages and provides data and information pertaining to various emission reduction activities and the cumulative of national results within the framework of Indonesia's carbon price policy.34

The business entity then proceeds to implement GHG emission reduction activities as outlined in the DRAM. After completing these emissions reduction measures, they report the emissions reduction achieved at the end of a period of compliance, which are then verified by the Verifier.35 Similar to the verification under the emissions trading scheme above, this verification is intended to assess the emission reduction activities conducted by the company and to determine whether the activities have resulted in the reduction of emissions. The report by the Verifier will also be submitted to the SRN PPI. The Directorate General of Climate Change Control36 will carry out the final determination of the MRV process by considering the report of the emission reduction activities carried out by the business entity, verification report issued by the Verifier, the DRAM, and the validation report issued by the Validator and submitted to the SRN PPI.37

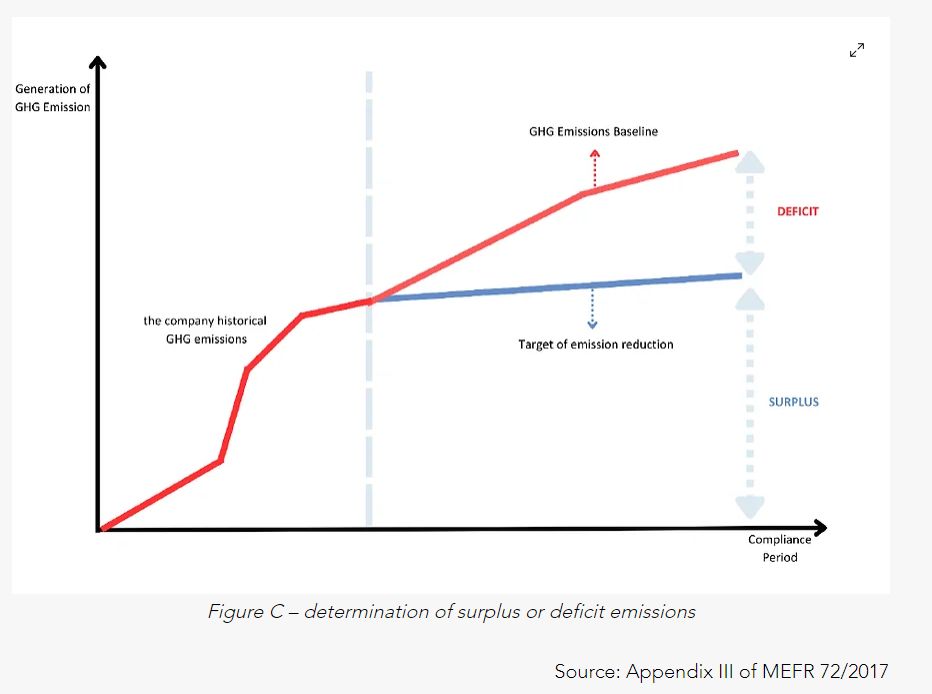

In the emission offsetting scheme, the cap is established based on the GHG Emission Baseline and the determined emissions reduction target. The GHG Emissions Baseline represents the estimated level of GHG emissions in a specified sector or activity within a certain period of time without involving any emission-reduction activities.38 On the other hand, the determined emissions reduction target represents the estimated level of GHG emissions after taking into account the emission-reduction activities.39 See the illustration in Figure C below to understand the emission offsetting scheme.

The company is considered to have surplus emissions when the reduction of GHG emissions resulting from its activities falls below the determined GHG Emissions Baseline and target.40 Conversely, the company is considered to generate deficit emissions when the generation of emission from its activities exceeds the determined target yet remains below target GHG Emissions Baseline.41 Furthermore, if the company generates surplus emissions as evidenced by an assessment, carbon certificate(s) or SPE-GRK will be issued.42 In any case, if the company generates deficit emissions, the company must offset emissions to cover this deficit by purchasing from other entities that have surplus emissions.43 This certificate can be used by the company to participate in carbon trading, either directly or through the carbon exchange.

Footnotes

1. GHG hereunder includes carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), hydro-fluorocarbons (HFCs), per-flourocarbons (PFCs), and sulphur hexafluoride (SF6).

2. Article 2 paragraph (3) of PR 98/2021.

3. Article 47 paragraph (1) of PR 98/2021.

4. Article 46 paragraph (1) of PR 98/2021.

5. Article 7 paragraph (2) and paragraph (3) of PR 98/2021.

6. Article 7 paragraph (4) of PR 98/2021.

7. Relevant Minister refers to any minister(s) who is positioned as a coordinator in a Relevant Sectors and/or Sub-sectors in the implementation of carbon pricing policy.

8. Article 48 paragraph (4) of PR 98/2021 Article 8 of MEFR 21/2022.

9. MEFR 21/22 has addressed the subsectors of forestry, peat and mangrove management.

10. Art. 48 paragraph (1) of PR 98/2021.

11. Art. 49 paragraph (2) of PR 98/2021.

12. Art. 1 point (17) junto Art. 50 paragraph (2) of PR 98/2021.

13. Art. 52 of PR 98/2021.

14. Art. 9 and Art. 10 of MEFR 21/2022.

15. Art. 1 point (33) of MEFR 21/2022.

Art. 1 point (34) of MEFR 21/2022.

16. Art. 9 and Art. 10 of MEFR 21/2022.

17. Art. 1 point (34) of MEFR 21/2022.

18. Art. 10 paragraph (5) of MEFR 21/2022.

19. Carbon Exchange is currently being prepared by the GOI. In August 2023, the OJK has issued a regulation related to Carbon Exchange through OJK Regulation Number 14 Of 2023 on Carbon Trading Through Carbon Exchange.

20. Art. 10 paragraph (6) of MEFR 21/2022.

21. Period of Compliance refers to a period determined by the Relevant Minister to measure the Business Actor's compliance in decreasing GHG emissions based on the determined Emissions Upper Limit or target.

22. Art. 12 of MEFR 21/2022.

23. Art. 1 point (37) of MEFR 21/2022.

24. Art. 12 of MEFR 21/2022.

25. Art. 13 paragraph (4) of MEFR 21/2022.

26. Art. 13 paragraph (5) of MEFR 21/2022.

27. Art. 14 paragraph (1) of MEFR 21/2022.

28. GHG emission baseline is the estimated level of GHG emission and projection in identified sectors or activities within certain period of time which has been

29. Baseline emissions are determined by reviewing the entity's historical emissions in the absence of mitigation policy interventions.

30. Art. 15 paragraph (1) of MEFR 21/2022

31. Art. 15 paragraph (3) of MEFR 21/2022

32. Art. 61 paragraph (3) of PR 98/2021.

33. Art. 15 of MEFR 21/2022.

34. Art. 16 of MEFR 21/2022.

35. The Directorate General of Climate Change Control is a division within the Ministry of Environment and Forestry responsible for managing climate change-related matters.

36. Art. 17 of MEFR 21/2022.

37. Art. 1 point (15) of MEFR 21/2022.

38. Appendix I of MEFR 72/2017.

39. Art. 14 paragraph (1) letter b of MEFR 21/2022.

40. Art. 14 paragraph (1) letter c of MEFR 21/2022.

41. Art. 61 paragraph (3) of MEFR 21/2022.

42. Art. 14 paragraph (5) of MEFR 21/2022

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.