Summary

On 20 March 2024, the Federal Court of Australia (FCA) found in favour of the taxpayer in Mylan Australia Holding Pty Ltd (MAHPL) v Commissioner of Taxation (Commissioner) (No 2) [2024] FCA 2531.

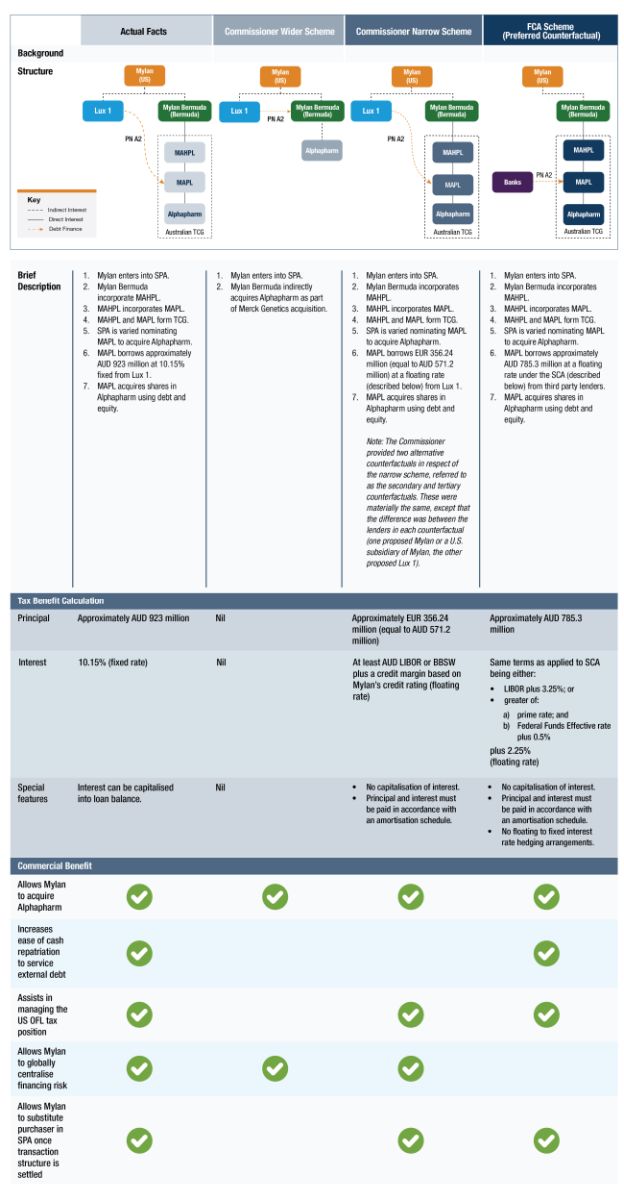

The FCA determined that the general anti-avoidance provisions in Part IVA of the Income Tax Assessment Act 1936 (ITAA 1936) did not apply to a financing structure implemented as part of Mylan Inc's (Mylan) 2007 acquisition of Merck's global genetics business, which included Merck's Australian operations held within Alphapharm Pty Ltd (Alphapharm).

Executive Summary

- The FCA rejected the Commissioner's argument that if a "scheme" had not entered into (where MAHPL ultimately acquired Alphapharm) and instead an alternative "scheme" was effected (including one where another member of the Mylan group acquired Alphapharm), MAHPL would not have had any debt and would therefore not claim any Australian debt deductions.

- The FCA noted that MAHPL appears to have obtained a tax benefit, having regard to an objective analysis of purpose using the eight factors in section 177D(b), the FCA was not satisfied that the dominant purpose of the scheme was to obtain an Australian tax benefit.

- There were key commercial factors which supported the use of related party debt as opposed to equity funding. This included evidence where regard was given to the interest rate on the intra-group financing being determined by taking into account comparable market rates and the Mylan US Overall Foreign Loss (OFL)2 position (whereby Mylan's ability to credit foreign tax credits against US income is limited). Notably, the FCA did not view the management of the OFL position as avoiding Australian tax.

- The decision follows that of the recent Full FCA decision earlier this month in Minerva Financial Group Pty Ltd v Commissioner of Taxation [2024] FCAFC 28 (Minerva)2 which highlighted the importance of the need to weigh all eight factors objectively and that the mere presence of a tax benefit is not sufficient to attract the application of Part IVA.

- The decision also explored several areas of interest which may have relevance to transactions and recapitalisations more generally. This included flexibility being incorporated into transaction documentation (to allow for changes in relation to how the Merck business and any subsidiaries were acquired) and the use of an Australian "HoldCo/BidCo" acquisition structure, which has long been a common business practice.

- Taxpayers should still be mindful of other tax rules that could apply to inbound related party debt funding, particularly having regard to the new thin capitalisation measures which will commence on 1 July 2023 (and the debt creation rules which will commence on 1 July 2024) which could apply to deny debt deductions associated with intra-group transactions as well as transfer pricing considerations associated with the quantum of debt.

Case Facts and Timeline

The facts from this case are broadly as follows:

Mylan and Merck Enter into Share Purchase Agreement (SPA)

- In May 2007, Mylan entered into a Share Purchase Agreement (SPA) with Merck where it would acquire the Merck Genetics business for a cash purchase price of EUR 4.9 billion. Importantly, the SPA contained provisions which allowed for Mylan to put forward a different transaction structure at a later point in time as Mylan had not settled on a final transaction structure at the time. Specifically, the SPA allowed for Mylan to nominate any of its affiliates to either complete the transaction or to acquire interests in any Merck Genetics subsidiary.

- Over the following months, Mylan engaged with its advisors in determining its acquisition structure. Ultimately, MAHPL and a subsidiary of MAHPL, Mylan Australia Pty Limited (MAPL) were incorporated. On 20 September 2007, these entities formed an Australian tax consolidated group (TCG).

Alphapharm Becomes Target Entity. MAPL Becomes Purchaser

- On 1 October 2007, the SPA was amended (resulting in the Amended SPA) such that Alphapharm was designated as an Additional Target Company, MAPL was designated as an Additional Purchaser and the Closing Date for the Amended SPA was 2 October 2007. The broad effect of this was that Alphapharm became a target entity and MAPL became a purchaser, as opposed to Alphapharm being acquired as part of the broader transaction.

- On 2 October 2007, the Amended SPA closed and MAPL acquired Alphapharm. MAPL partially funded its acquisition of Alphapharm with 25 percent equity and 75 percent debt. The debt was an AUD denominated intercompany loan borrowed from Mylan Luxembourg 1 S.a.r.l. (Lux 1) at a fixed interest rate of 10.15 percent which was determined and set on a later date but with retrospective effect from the date of acquisition (Promissory Note A2).

Equity Raising Undertaken; Mylan's Debt Reduced

- The broader transaction was highly leveraged, with the level of Mylan's debt (as a percentage of its total capitalisation) pre-acquisition of approximately 50 percent increasing to approximately 98 percent post-acquisition. An equity raising was undertaken in the months subsequent to the acquisition which resulted in a reduction in Mylan's level of debt.

- In April 2021, the Commissioner issued amended assessments to MAHPL for the income years ended 31 December 2007 to 31 December 2017 to cancel the deductions for MAHPL's deductions on Promissory Note A2.

How was the case argued and what was the court's decision?

Button J ultimately found that the Commissioner's primary counterfactual did not represent a prediction of the events which might reasonably have taken place had Mylan not effected the transaction in the form that it did. Notably, it was considered that there would be a mixture of debt and equity financing the acquisition of Alphapharm.

The FCA put forward an alternative "Preferred Counterfactual" which included the following:

- MAPL would borrow the original amount of Promissory Note A2 (of approximately AUD 785 million) on seven-year terms from third-party financiers under the external financing arrangement entered into by Mylan for the transaction (being the Senior Credit Agreement (SCA).

- Any borrowing of MAPL under the SCA would be at floating rates consistent with the rates specified in the SCA. No hedges would be taken out by MAPL to fix its interest rate exposure, however, MAPL would have taken out cross-currency swaps to hedge any foreign denominated borrowings into AUD at an annual cost of 3.81 percent per annum over AUD three-month BBSW.

- MAPL would have been equity funded in a manner to fund the balance of the purchase price of Alphapharm and to also ensure that MAHPL was within the Australian thin capitalisation safe harbour threshold.

- Interest on the borrowings would not have been capitalised and MAPL would be required to repay principal in a manner consistent with the terms of the SCA. If MAPL's cashflow was insufficient to meet any interest or principal obligations, Mylan would have another group company loan the amounts required to avoid defaulting on its obligations, resulting in MAPL owing those amounts to that related party under an intercompany loan bearing an arm's length interest rate.

Having regard to this Preferred Counterfactual, Button J concluded that it appeared that MAHPL obtained a tax benefit. Notwithstanding that no calculations were undertaken, her Honour was satisfied that a tax benefit would arise because the deductions actually claimed appeared to be higher than the deductions which would otherwise arise under the Preferred Counterfactual.

The reasoning for this decision draws upon the following:

- Given the reduction in interest rates in the years that proceeded 2007, the fixed interest rates applied to MAPL's Promissory Note A2 would be higher than a floating rate borrowing.

- The Preferred Counterfactual did not allow interest to be capitalised (which was increasing the quantum of the borrowings and by extension, the interest). It also required principal to be amortised over time through repayments of principal.

- The Preferred Counterfactual did not involve costs incurred for floating to fixed hedges.

While the FCA identified this tax benefit, the FCA ultimately concluded that Part IVA did not apply to the Promissory Note A2. This is on the basis that notwithstanding the tax benefit which was obtained, the FCA had, on an objective assessment, determined that the arrangement was not entered into for the dominant purpose of obtaining that tax benefit which it had identified. Button J's reasons for this conclusion are comprehensive and there was emphasis placed upon the importance that the tax benefit must be the most influential purpose in order for Part IVA to apply.

Notably, the only factor that the FCA identified as being indicative of a dominant purpose to obtain a tax benefit was the failure to refinance Promissory Note A2 as interest rates fell over the years proceeding 2007. Additional factors indicated that there was a prevailing non-tax purpose included:

- It is common for international businesses to manage liquidity, interest rate and cross-currency risk in a centralised manner for the wider group. This means that fixed rate intercompany financing arrangements with foreign subsidiaries (like that for Promissory Note A2) is common to ensure that risk is managed consistently across a group.

- The 10.15 percent interest rate set at the time the financing was first entered into did not appear to be excessive. There was no evidence that this rate was not determined as at the time at which the loan was first entered.

- While MAPL's level of debt was set at Australia's thin capitalisation limit, this was not indicative of a dominant tax purpose. This was particularly the case as the impact of Mylan's OFL position supported a commercial decision for MAPL to take on more, rather than less, debt.

A&M's key observations

- The principles adopted by the FCA in Mylan and by the Full FCA in Minerva are consistent. Both cases heavily focused on the importance of weighing all eight factors within Part IVA and the necessity for any tax benefit to be the dominant driver for that scheme, as opposed to any tax benefits being secondary to any key commercial or financial objectives. Tax benefits may be obtained as part of a transaction, so long as obtaining that benefit is not the most influential motivation of the parties involved. Again, it is not sufficient to simply identify a tax benefit.

- As part of his primary counterfactual, the Commissioner made submissions in relation to the incorporation of MAHPL, incorporation of MAPL, subsequent formation of a tax consolidated group and use of that group to acquire Alphapharm. However, Button J highlighted that the "incorporation of a local holding company structure is an entirely unremarkable step to be taken in the context of a large, multinational corporate acquisition ... nor is there anything suggestive of the requisite dominant purpose in the election to have recourse to Australia's taxation provisions allowing the establishment of consolidated groups." The description of a consolidated HoldCo/BidCo acquisition structure as being "entirely unremarkable" is welcome given that it is widely adopted in the market.

- The case may also serve as an example of how new debt creation rules may not apply to all "debt push-down" transactions. This is because it is not uncommon for a taxpayer (as they did in this case) to borrow within their global group to acquire assets (including shares in a company) from a third party. The debt creation rules will typically apply where an intra-group financial arrangement is used to fund the acquisition of an asset from within that group. In addition, given that this transaction involved intra-group debt (which should not necessarily contravene the debt creation rules), this would demonstrate that there will be increased complexity associated with managing the debt creation rules as the rules will necessitate tracing the sources and uses of intragroup debt to understand whether there are amounts of intragroup debt that are subject to the debt creation rules.

- There were several references made in the decision to how the parties who were involved in the transaction and the ultimate implementation of Promissory Note A2 were no longer employed by Mylan or its subsidiaries. It is noteworthy that the judgment frequently relies upon the contemporaneous documents available to understand Mylan's intentions at the time of the transaction while also referencing instances where there was a lack of contemporaneous analysis. Given that the outcome which was in favour of the taxpayer relies on this analysis, it highlights the critical importance of contemporaneous evidence and documentation being maintained at the time transactions are undertaken.

- One of the reasons used to justify obtaining an Australian tax benefit was that there was a U.S. tax benefit in optimising Mylan's OFL position. While there were reasons for the transaction being undertaken to optimise Mylan's US tax outcomes, this does not, for the purposes of Part IVA, constitute an Australian tax benefit. We note that the Federal Government in its May 2023-24 Budget highlighted its intention to expand the scope of the Australian general anti-avoidance rule to include schemes that aim to reduce foreign income tax. However, in any case, this emphasises the importance of taking a holistic view of transaction structuring and highlights the necessity of balancing multiple transaction considerations (which in this case includes tax in multiple jurisdictions, but can also include other key debt, accounting and legal considerations).

Footnotes

1. Mylan Australia Holding Pty Ltd v Commissioner of Taxation (No 2) [2024] FCA 253 (fedcourt.gov.au)

3. Minerva Financial Group Pty Ltd v Commissioner of Taxation [2024] FCAFC 28 (fedcourt.gov.au)

Originally published 17 April 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.